Sonoco Products Co (SON) Reports Solid 2023 Financial Results Amidst Macroeconomic Challenges

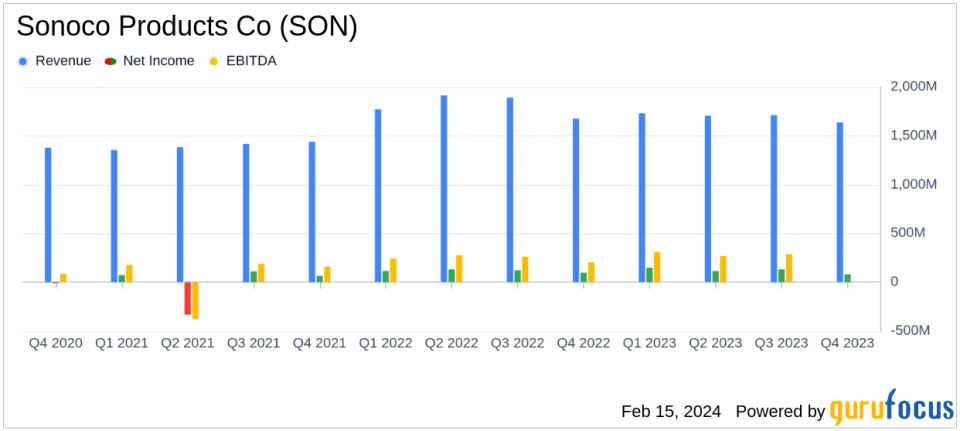

Net Sales: Decreased by 6% year-over-year to $6.8 billion.

Operating Profit: Increased by 6% to $716 million for the full year.

Net Income: Slightly increased by 2% to $475 million for the full year.

Adjusted EPS: Decreased by 19% to $5.26 for the full year.

Operating Cash Flow: Achieved a record $883 million for the full year.

Free Cash Flow: Reached a record $600 million for the full year.

Dividends: Increased annual dividend for the 40th consecutive year.

On February 15, 2024, Sonoco Products Co (NYSE:SON) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year ended December 31, 2023. The company, with a history spanning over 125 years, has established itself as a major player in the sustainable global packaging industry, offering a diverse range of products including flexible and rigid plastics, reels and spools, pallets, and composite cans. SON continues to serve a broad spectrum of consumer and industrial markets primarily in North America and has a commendable track record of increasing its dividend annually for more than three decades.

2023 Performance Highlights and Challenges

Sonoco's 2023 performance was marked by significant achievements despite facing a challenging macroeconomic environment. The company reported its second-best full-year results for Adjusted EPS in its history and generated a record operating cash flow of $883 million and free cash flow of $600 million. These financial achievements are particularly noteworthy for a company in the Packaging & Containers industry, where cash flow is critical for sustaining capital-intensive operations and funding growth initiatives.

SON invested at record levels in its business for future growth and productivity, achieved record results in Operating Profit and Adjusted EBITDA in its flexible packaging segment, and saw record net sales in rigid paper containers within the Consumer Packaging segment. The Industrial Paper Packaging segment also produced record Operating Profit margins and Adjusted EBITDA margins despite a low volume environment.

However, the company faced challenges, including a 6% decrease in net sales year-over-year, driven by lower volumes across the portfolio, partially offset by revenue from acquisitions. Adjusted operating profit and Adjusted EBITDA also saw declines due to lower volumes, unfavorable price/cost in Industrial, higher employee expenses, and higher accounts receivable reserve.

Financial Tables and Commentary

SON's financial statements reflect the resilience of its business model. The company's net income attributable to Sonoco increased slightly to $475 million, while diluted EPS remained stable at $4.80. Despite a decrease in net sales, the company managed to improve its operating profit by 6% to $716 million, showcasing effective cost management and productivity gains.

"In 2023, Sonoco made further progress on our strategic initiatives and delivered solid financial results in a challenging macroeconomic environment," said Howard Coker, President and Chief Executive Officer. "We achieved the second-best year of financial results in our 125-year history. Our multi-year focus on improving and leveraging the operating model combined with our capital allocation strategy resulted in record productivity."

SON's balance sheet remained strong with cash and cash equivalents of $152 million and a decrease in total debt by $139 million from the previous year. The company also reported a robust liquidity position with available liquidity of $1.1 billion.

Looking Forward

Looking ahead to 2024, SON expects to face volume declines and negative price/cost impacts. However, the company plans to aggressively manage costs, generate positive productivity, and execute strategic initiatives to simplify its portfolio and capture synergies from recent acquisitions. SON's guidance for the first quarter of 2024 projects an Adjusted EPS of $1.05 to $1.15, and for the full year, an Adjusted EPS of $5.10 to $5.40.

SON's commitment to strategic growth and operational efficiency, combined with its strong financial position, positions the company to navigate through uncertainties and continue delivering value to its stakeholders. For more detailed information and financial data, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sonoco Products Co for further details.

This article first appeared on GuruFocus.