Sonoco (SON) Raises Q2 View on Stellar Demand & Price Recovery

Sonoco Products Company SON raised its second-quarter 2022 earnings guidance on the back of the company’s strong quarter-to-date results and the current prediction for the remaining period of the second quarter. It now expects adjusted earnings per share (EPS) between $1.60 and $1.70 for the June-end quarter, indicating year-over-year growth of 70% at the mid-point. The updated guidance is also higher than the earlier guidance of $1.20-$1.30 per share. In second-quarter 2021, the company reported an adjusted EPS of 93 cents. Following the management’s raised outlook, the company’s shares moved up 5% in the last trading session.

Including one-time items, earnings for the April-June quarter are expected in the band of $1.27-$1.37 per share against the loss per share of $3.34 in the prior-year quarter.

Robust customer demand in the company’s Consumer Packaging and All Other segments, strong recovery in price and cost across most of its businesses are likely to deliver better-than-expected operating results in the second quarter. Sonoco’s consumer packaging businesses is expected to gain from the Metal Packaging acquisition.

The segment’s flexible packaging business is gaining from strong demand for confectionery, food service and other food products. Plastic food packaging reflects higher demand in the fresh and prepared food markets. Demand for Industrial Paper Packaging products has returned to pre-pandemic levels in most global markets. SON’s industrial-served markets will gain from strong demand for global tubes, cores and cones. Due to supply chain challenges, the company has decided to delay the conversion of its Hartsville paper machine to the third quarter. This delay is expected to result in less downtime and will provide favorable results in the Industrial Paper Packaging segment in the second quarter.

Sonoco is focused on driving profitable growth, margin expansion and generating solid free cash flow. Its balance sheet strength and availability of substantial liquidity in the form of cash and revolving credit facilities will continue to drive growth. Operating cash flow for the year is expected in the range of $690-$740 million and free cash flow is expected between $365 million and $415 million. Both are significantly above the 2021 results.

SON’s focus on optimizing businesses through productivity improvement, standardization and cost control will also boost results. It is implementing several synergy opportunities, including optimizing raw material purchases, leveraging indirect expenses, and coordinating supply chain logistics. These factors will help meet Sonoco’s cost savings target of $20 million by 2024. Nevertheless, Sonoco will continue to bear the brunt of raw material, energy and freight cost pressures and the impact of the COVID-19 pandemic on global supply chains.

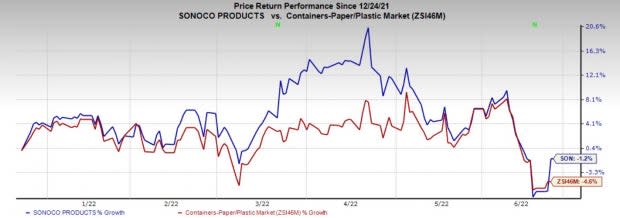

Price Performance

Shares of Sonoco have lost 1.2% in the past six months compared with the industry's decline of 4.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sonoco currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Graphic Packaging Holding Company GPK, Myers Industries MYE and Packaging Corporation of America PKG, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Graphic Packaging has an estimated earnings growth rate of 86.8% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 7.6%.

Graphic Packaging pulled off a trailing four-quarter earnings surprise of 7.2%, on average. The company’s shares have appreciated 8% in the past six months.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 27% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Myers Industries’ shares have risen 25% over the last six months.

Packaging Corporation has an expected earnings growth rate of 16.2% for 2022. The Zacks Consensus Estimate for the current year’s earnings rose 4.2% in the past 60 days.

PKG has a trailing four-quarter earnings surprise of 19.6%, on average. Packaging Corporation’s shares have risen 16% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research