SoundHound AI Inc CEO and 10% Owner Keyvan Mohajer Sells 31,665 Shares

Keyvan Mohajer, CEO and 10% Owner of SoundHound AI Inc (NASDAQ:SOUN), has sold 31,665 shares of the company on March 22, 2024, according to a recent SEC filing. The transaction was executed at an average price of $6.08 per share, for a total value of $192,543.20.

SoundHound AI Inc (NASDAQ:SOUN) is a company that specializes in voice-enabled AI and conversational intelligence technologies. The company's solutions are designed to enable businesses and consumers to interact with products and services through intuitive voice commands, providing a more natural and efficient user experience.

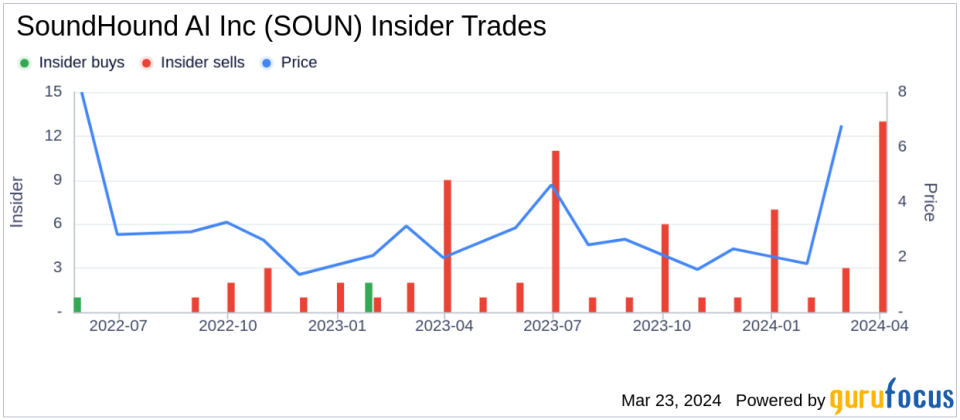

Over the past year, Keyvan Mohajer has sold a total of 537,169 shares of SoundHound AI Inc and has not made any purchases of the stock. This latest transaction continues a pattern of insider sales by Mohajer, with no insider buys reported over the same period.

The insider transaction history for SoundHound AI Inc shows a total of 49 insider sells and no insider buys over the past year. This trend suggests that insiders may perceive the stock as fully valued or are taking profits off the table.

On the day of the insider's recent sale, shares of SoundHound AI Inc were trading at $6.08, giving the company a market capitalization of $1.897 billion.

Investors often monitor insider sales as they can provide insights into how corporate executives, directors, and major shareholders view the stock's current valuation and future prospects. While insider selling is not always indicative of a stock's future performance, it can provide context for potential investors when considered alongside other financial data and market analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.