SoundHound AI Inc CFO Nitesh Sharan Sells 23,212 Shares

Nitesh Sharan, Chief Financial Officer of SoundHound AI Inc (NASDAQ:SOUN), sold 23,212 shares of the company on March 19, 2024, according to a recent SEC Filing. The transaction was executed at an average price of $8.37 per share, resulting in a total value of $194,364.44.

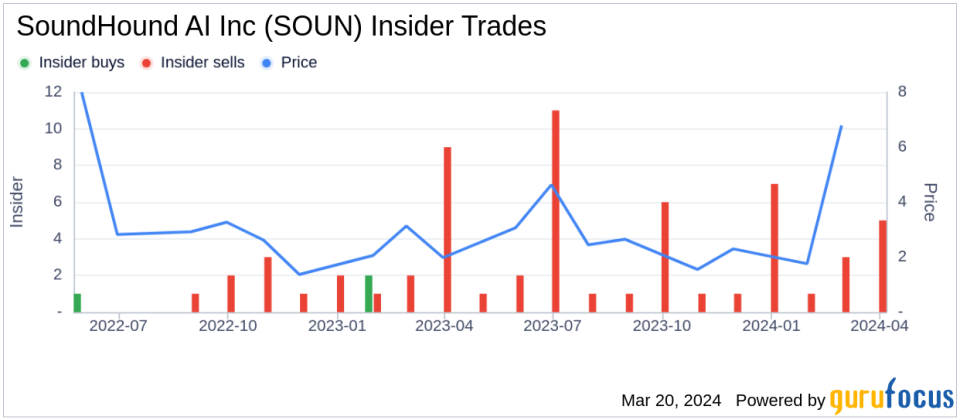

Over the past year, Nitesh Sharan has sold a total of 85,029 shares of SoundHound AI Inc and has not made any purchases of the stock. The insider transaction history for the company reveals a pattern of 43 insider sells and no insider buys over the same timeframe.

SoundHound AI Inc is a company specializing in voice-enabled AI and conversational intelligence technologies. The company's solutions are designed to enable customers to interact with products using natural language voice commands. SoundHound AI Inc's technology is integrated into various products and services across multiple industries, providing users with a seamless and intuitive way to engage with technology through voice.

On the date of the insider's recent sell, shares of SoundHound AI Inc were trading at $8.37, giving the company a market capitalization of $2.574 billion.

The insider's recent sell is part of a broader trend observed within the company's insider trading activities, which have been characterized by a greater number of sells than buys over the past year. This trend is reflected in the insider transaction history and may be of interest to shareholders and potential investors as they consider the stock's performance and insider confidence.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.