SoundHound AI Inc (SOUN) Reports Significant Q4 Revenue Growth and Improved Adjusted EBITDA

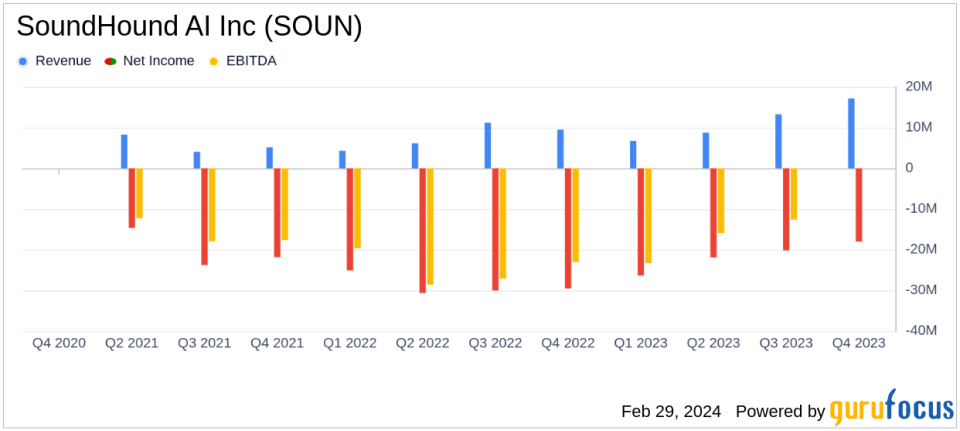

Revenue Growth: Q4 revenue surged by 80% to $17.1 million.

Adjusted EBITDA: Improved by 80% year-over-year in Q4.

Bookings Backlog: Combined cumulative subscriptions & bookings backlog reached $661 million, doubling year-over-year.

Net Loss: Decreased by 42% to $18.003 million in Q4 and by 24% to $88.937 million for the full year.

Liquidity: Total cash balance exceeded $200 million.

Outlook: 2024 revenue projected between $63 to $77 million, with a 2025 target exceeding $100 million.

On February 29, 2024, SoundHound AI Inc (NASDAQ:SOUN) released its 8-K filing, announcing a record quarter with an 80% increase in Q4 revenue to $17.1 million and a significant improvement in adjusted EBITDA by 80% year-over-year. The company, a pioneer in conversational intelligence, has demonstrated robust financial growth and operational achievements, signaling a strong market position in the voice AI industry.

SoundHound AI Inc is renowned for its independent Voice AI platform, which empowers businesses across various sectors to provide superior conversational experiences. The company's integration of new generative AI capabilities and the acquisition of SYNQ3, which positions SoundHound as the largest voice AI provider for restaurants, have been pivotal in driving consumer engagement and expanding market penetration.

Financial Performance and Challenges

Despite the impressive revenue growth, SoundHound AI Inc faced challenges, as reflected in its net loss figures. The Q4 net loss decreased by 42% to $18.003 million, and the full-year net loss saw a 24% reduction to $88.937 million. These losses highlight the company's ongoing investments in research and development, as well as sales and marketing efforts to capture a larger share of the rapidly evolving AI market.

Operating expenses for Q4 were reduced by 23% to $29.540 million, with significant cuts in sales and marketing (-34%) and research and development (-41%). This strategic reduction in expenses, alongside revenue growth, contributed to the improved bottom line.

SoundHound AI Inc's financial achievements, particularly the doubling of its bookings backlog to $661 million, underscore the company's potential for sustained revenue growth and market expansion. This backlog, combined with a strong liquidity positionwith a total cash balance exceeding $200 millionpositions the company to capitalize on the increasing demand for AI solutions.

Key Financial Metrics

Important metrics from the financial statements include:

- Revenue: Q4 saw a leap to $17.147 million, a significant increase from the previous year's $9.501 million.

- Operating Expenses: Total operating expenses for the year were reduced by 16% to $114.481 million.

- Net Loss Per Share: Decreased from $0.15 in Q4 of the previous year to $0.07 in the current year.

- Adjusted EBITDA: Improved to $(3.676 million) in Q4, a substantial increase from $(18.821 million) in the prior year.

These metrics are crucial as they provide insights into the company's operational efficiency, cost management, and overall financial health.

Looking Ahead

Looking forward, SoundHound AI Inc anticipates continued growth, projecting full-year 2024 revenue to be in the range of $63 to $77 million, with a midpoint target of $70 million. The company also sets an ambitious 2025 outlook, expecting to accelerate growth with revenue exceeding $100 million and achieving positive adjusted EBITDA.

CEO Keyvan Mohajer expressed confidence in the company's trajectory, stating,

Our pace and agility amid this AI revolution has put us ahead of the field when it comes to delivering real commercial value."

CFO Nitesh Sharan also emphasized the company's strong finish to the year and its readiness to meet the surging customer demand for AI solutions.

For a more detailed analysis and additional information, investors and stakeholders are encouraged to review SoundHound AI Inc's SEC filings, which will be available on the company's website and included in the upcoming 10-K filing.

Investors and media can access more details through the contact information provided, with Scott Smith handling investor relations and Fiona McEvoy managing media inquiries.

Explore the complete 8-K earnings release (here) from SoundHound AI Inc for further details.

This article first appeared on GuruFocus.