SoundThinking Inc (SSTI) Achieves Record Quarterly Revenues, Sets Positive Outlook for FY 2024

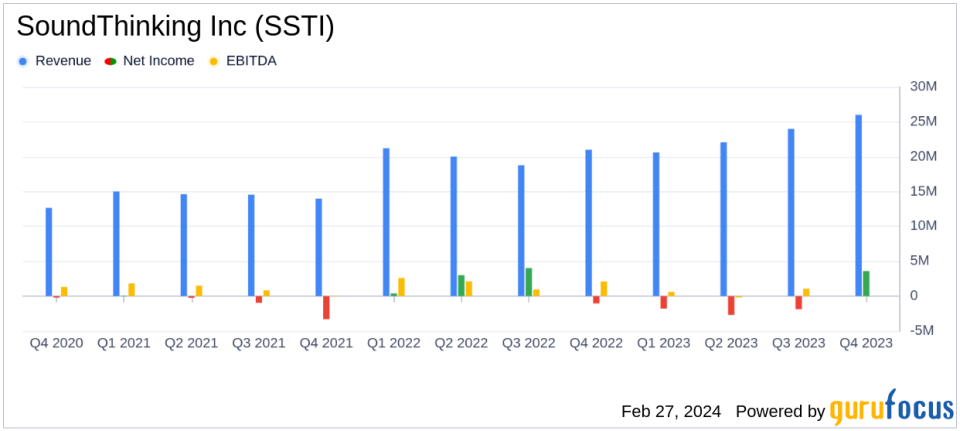

Revenue Growth: Q4 revenues surged 24% year-over-year to $26.0 million, marking the highest in SSTI's history.

Profitability Turnaround: Transitioned from a GAAP net loss in Q4 2022 to a GAAP net income of $3.6 million in Q4 2023.

Full-Year Performance: Full-year revenues climbed 14% to a record $92.7 million despite a GAAP net loss of $2.7 million for 2023.

Adjusted EBITDA: Q4 Adjusted EBITDA improved to $4.8 million, while full-year Adjusted EBITDA reached $14.3 million.

Strategic Expansion: SSTI expanded its customer base domestically and internationally, including a significant $13.5 million CaseBuilder contract.

Guidance for FY 2024: SSTI projects revenue growth of 13% at the midpoint and Adjusted EBITDA margins of 18% to 20% for FY 2024.

On February 27, 2024, SoundThinking Inc (NASDAQ:SSTI), a trailblazer in public safety technology, unveiled its financial results for the fourth quarter and full year of 2023. The company announced a remarkable 24% increase in Q4 revenues, reaching a record $26.0 million, the highest quarterly revenues in its history. This performance underscores the company's successful expansion and the growing adoption of its SafetySmart platform. SSTI also introduced its FY 2024 revenue guidance, projecting continued growth. For a detailed view of SSTI's financials, please refer to their 8-K filing.

Financial Highlights and Operational Achievements

SoundThinking Inc's fourth quarter was marked by significant achievements, including a 26% increase in gross profit to $15.0 million and a complete turnaround to a GAAP net income of $3.6 million, compared to a net loss in the same quarter of the previous year. The full year also saw a 14% increase in revenues, although it recorded a GAAP net loss of $2.7 million for 2023. Adjusted EBITDA for the year was $14.3 million, a slight decrease from the previous year, reflecting the company's strategic investments and expansion efforts.

The company's operational highlights include the launch of its services in six new cities, expansion in existing markets, and securing a significant contract with the New York City Department of Corrections. SSTI's international presence also grew with its third international deployment in Montevideo, Uruguay.

Strategic Acquisitions and Market Expansion

SoundThinking Inc's strategic acquisitions, such as SafePointe, LLC, have expanded its SafetySmart platform and increased the company's total addressable market. These moves, coupled with a strong sales and marketing strategy, have positioned SSTI for continued growth and market penetration.

President and CEO Ralph Clark commented on the company's performance, stating, "Our record quarterly revenue in the fourth quarter capped a successful year for SoundThinking. We added eight new cities under contract in the fourth quarter and deployed 155 new go-live miles in 2023, which demonstrates the robust expansion of our customer base across both the domestic and international markets."

"Our customers continue to recognize the force multiplier effect SoundThinkings platform provides, reflected by our 107% revenue retention rate and world-class net promoter score above the 60% level. Furthermore, we are pleased to have reached an $8.6 million extension agreement with the City of Chicago to keep ShotSpotter operational in Chicago through November 2024," Clark added.

Looking Ahead: FY 2024 Outlook

For the upcoming fiscal year 2024, SoundThinking Inc has set a revenue guidance range of $104.0 million to $106.0 million, indicating a 13% year-over-year growth at the midpoint. The company also anticipates Adjusted EBITDA margins to be between 18% and 20%. This guidance reflects SSTI's confidence in its operational strategy and the value proposition of its SafetySmart platform.

As SoundThinking Inc continues to innovate and expand its reach, the company remains committed to delivering value to its stakeholders and contributing to safer communities through its advanced public safety technology solutions.

For more information on SoundThinking Inc's financial performance and strategic initiatives, investors and interested parties are encouraged to attend the company's conference call or access the webcast on SSTI's investor relations website.

For value investors seeking to understand the potential of SSTI's stock, the company's solid revenue growth, strategic acquisitions, and positive outlook for FY 2024 offer compelling reasons to consider SoundThinking Inc as a part of their investment portfolio.

Explore the complete 8-K earnings release (here) from SoundThinking Inc for further details.

This article first appeared on GuruFocus.