South32 Ltd (SOUHY): A Comprehensive Analysis of Its Dividend Performance and Sustainability

Exploring the past, present, and future of South32 Ltd's dividend strategy

South32 Ltd (SOUHY) recently announced a dividend of $0.16 per share, payable on 2023-10-12, with the ex-dividend date set for 2023-09-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into South32 Ltd's dividend performance and assess its sustainability.

A Brief Overview of South32 Ltd

Warning! GuruFocus has detected 7 Warning Signs with ARCC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

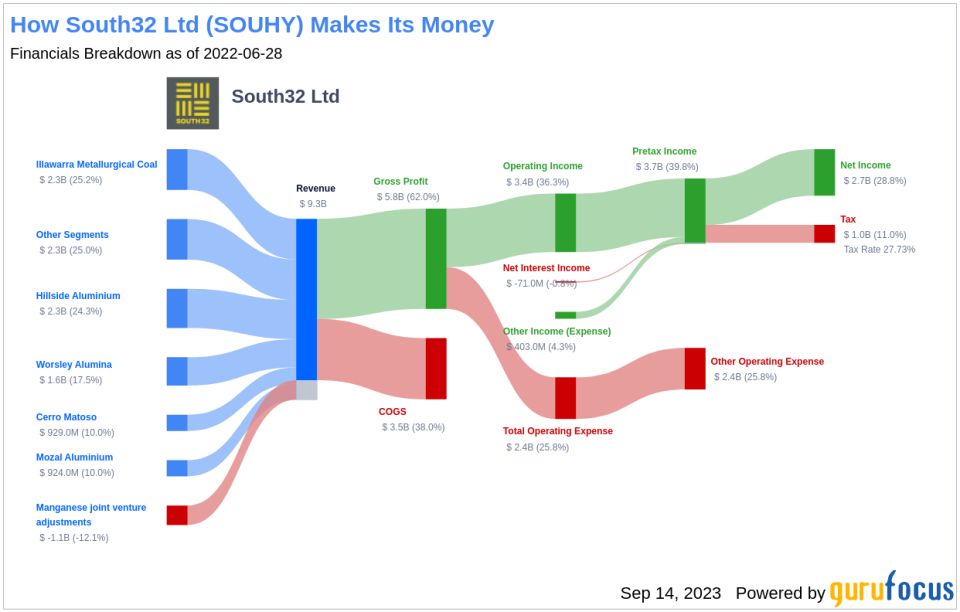

South32 Ltd was born out of the demerger of noncore assets from BHP in 2015. The company operates major alumina businesses in Australia and Brazil, aluminium in Brazil, South Africa, and Mozambique, manganese businesses in Australia and South Africa, the Cannington silver/lead/zinc mine in northwest Queensland, and the Cerro Matoso nickel mine in Colombia. In addition, South32 Ltd acquired Arizona Mining, which brings with it the high-grade and likely low-cost Taylor deposit in the U.S., and also entered the copper business in 2022 via the purchase of a 45% stake in the Sierra Gorda mine in Chile.

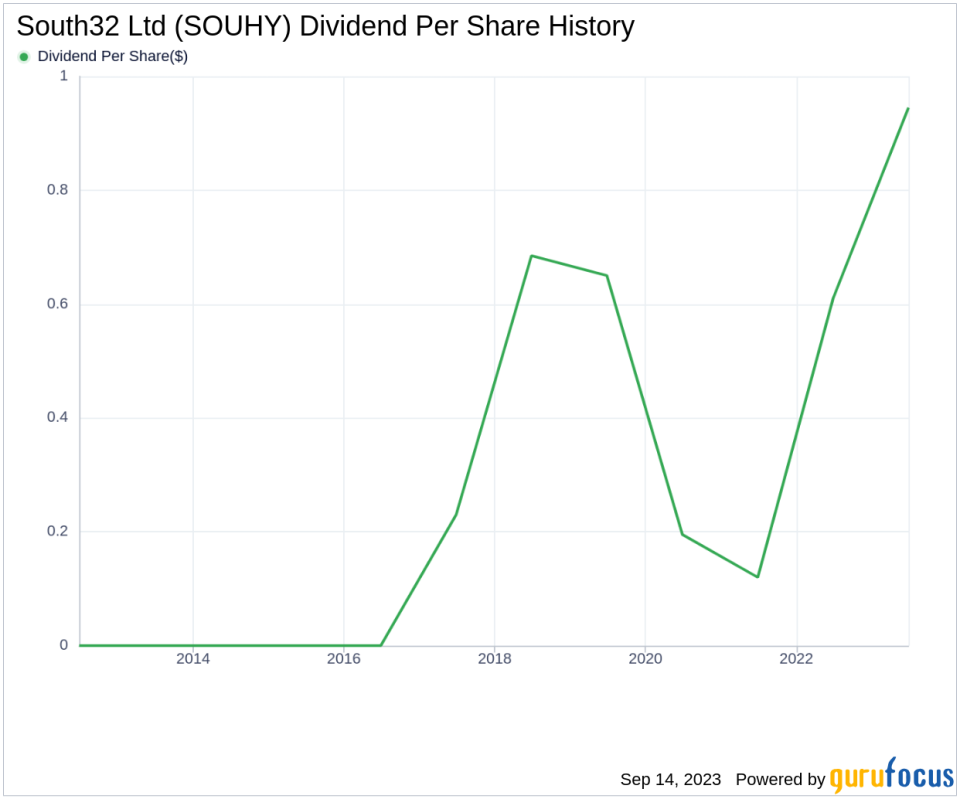

Tracking South32 Ltd's Dividend History

South32 Ltd has maintained a consistent dividend payment record since 2016, with dividends currently distributed on a bi-annual basis. The chart below shows annual Dividends Per Share for tracking historical trends.

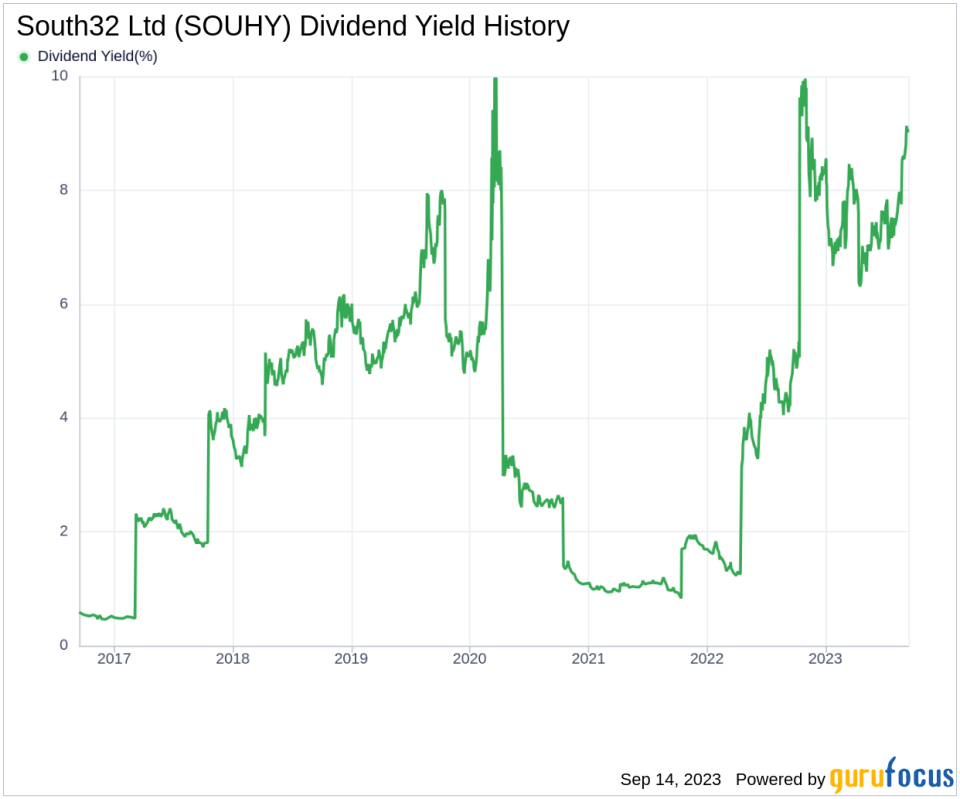

Dissecting South32 Ltd's Dividend Yield and Growth

As of today, South32 Ltd currently has a 12-month trailing dividend yield of 9.08% and a 12-month forward dividend yield of 3.89%. This suggests an expectation of decreased dividend payments over the next 12 months.

Over the past three years, South32 Ltd's annual dividend growth rate was 69.80%. Extended to a five-year horizon, this rate decreased to 8.90% per year. Based on South32 Ltd's dividend yield and five-year growth rate, the 5-year yield on cost of South32 Ltd stock as of today is approximately 13.91%.

Assessing the Sustainability of South32 Ltd's Dividend

When evaluating the sustainability of a dividend, it's important to consider the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, South32 Ltd's dividend payout ratio is 0.00, indicating a strong potential for future growth.

South32 Ltd's profitability rank of 6 out of 10 suggests fair profitability. The company has reported net profit in 5 years out of the past 10 years.

Future Growth Prospects for South32 Ltd

For dividends to be sustainable, a company must have robust growth metrics. South32 Ltd's growth rank of 6 out of 10 suggests that the company has a fair growth outlook. South32 Ltd's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. South32 Ltd's revenue has increased by approximately 17.80% per year on average, a rate that outperforms approximately 65.28% of global competitors.

Concluding Thoughts

South32 Ltd's consistent dividend payments, healthy growth rate, low payout ratio, and fair profitability all point to a sustainable dividend strategy. However, the anticipated decrease in dividend payments over the next 12 months may be a cause for concern for some investors. As always, investors are encouraged to conduct their own comprehensive analysis before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.