Southern Company (SO) Q2 Earnings Top, Sticks to Vogtle Dates

Power supplier Southern Company SO reported second-quarter 2020 earnings per share (excluding certain one-time items) of 78 cents, surpassing the Zacks Consensus Estimate of 66 cents. The robust performance primarily stemmed from cost control as well as positive effects of rates, usage and pricing changes.

However, the Atlanta-based utility’s bottom line compared unfavorably with the year-ago adjusted profit of 80 cents, reflecting the impact of mild weather conditions.

Meanwhile, the utility reported revenues of $4.6 billion, which missed the Zacks Consensus Estimate of $5 billion and was 9.4% lower than second-quarter 2019 sales.

The company, which gave an EPS guidance of $1.15 for the third quarter, further updated that the consequence of the ongoing coronavirus epidemic on its retail sales has been lower than expected. Southern Company still sees the pandemic’s impact on this year’s base revenues of $250-400 million that can be offset through cost containment measures. The utility though cautioned that the economic uncertainties are far from over and will linger through the second half of 2020.

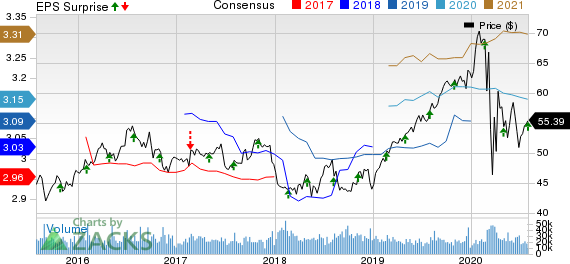

Southern Company The Price, Consensus and EPS Surprise

Southern Company The price-consensus-eps-surprise-chart | Southern Company The Quote

Vogtle Updates

Per Southern Company’s latest earnings presentation, it continues to progress toward completing the Units 3 and 4 of the Vogtle nuclear project by the November 2021 and November 2022 regulatory approved in-service dates. However, subsidiary Georgia Power's share of total costs has increased by approximately $150 million, primarily stemming from coronavirus-induced disruptions.

Overall Sales Breakup

Southern Company’s wholesale power sales decreased 5.1%. There was also a steep fall in retail electricity demand.

Consequently, there was a downward movement in overall electricity sales and usage. In fact, total electricity sales during the second quarter were down 10.1% from the same period last year.

Southern Company’s total retail sales were down 11.7%, with residential and commercial sales going down by 5.6% and 15%, respectively. Moreover, industrial sales declined 14%.

Expenses Summary

The power supplier’s operations and maintenance cost was down 8.9% to $1.2 billion, while the utility’s total operating expense for the period – at $3.6 billion – fell 5.2% from the prior-year level.

Zacks Rank & Stock Picks

Southern Company – one of the largest generators of electricity in the nation along with the likes of Exelon Corporation EXC and Duke Energy Corporation DUK – carries a Zacks Rank #3 (Hold).

Meanwhile, investors interested in the utility space could look at a better option like Entergy Corporation ETR that carries a Zacks Rank #2 (Buy). The firm has a 100% track of outperforming estimates over the last four quarters at an average rate of 11.2%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company The (SO) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

To read this article on Zacks.com click here.