Southern Copper Corp (SCCO) Faces Headwinds Amidst Lower Metal Prices and Operational Challenges

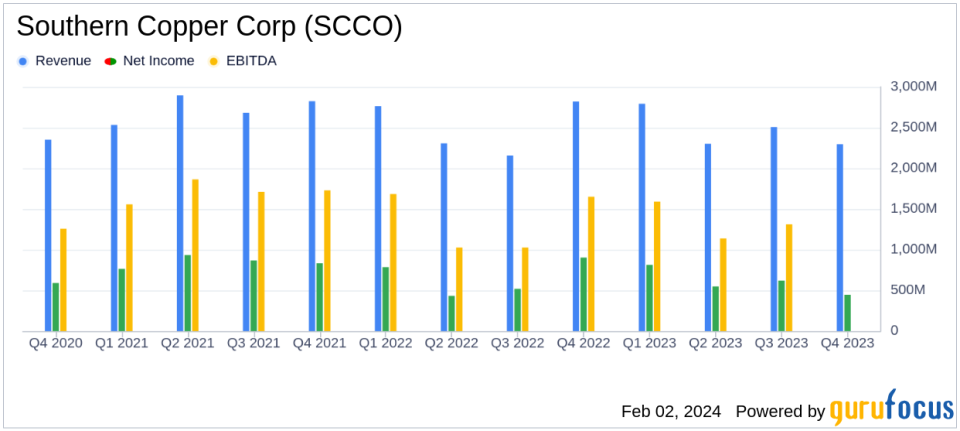

Net Sales Decline: Southern Copper Corp reported an 18.6% decrease in Q4 net sales and a 1.5% decrease for the full year 2023.

Operating Income and Net Income Drop: Operating income and net income fell by 36.6% and 50.7% respectively in Q4, and by 5.5% and 8.1% for the full year.

Adjusted EBITDA Margin Compression: Adjusted EBITDA margin decreased by 11.8 percentage points in Q4 and by 2.4 percentage points for the full year.

Capital Investments Increase: Capital investments rose by 6.3% in 2023, reflecting the company's commitment to strategic growth projects.

Stock Performance: As of December 31, 2023, there were 773.1 million shares of SCCO outstanding.

On February 2nd, 2024, Southern Copper Corp (NYSE:SCCO) released its 8-K filing, revealing the financial results for the fourth quarter and full year of 2023. The year posed significant challenges for SCCO, with net sales impacted by lower metal prices and increased copper anode inventory. Despite these hurdles, the company managed to reduce operating cash costs and advance key capital projects.

SCCO is an integrated producer of copper and other minerals, with operations in Peru and Mexico. The company's production includes copper, molybdenum, zinc, and silver, with the majority of revenue generated from copper sales. SCCO operates through segments including Peruvian operations, Mexican open-pit operations, and Mexican underground mining operations, serving markets across The Americas, Europe, and Asia.

Financial Performance and Challenges

SCCO's financial performance in 2023 was marked by a decrease in net sales, operating income, and net income, primarily due to a year-end accounting adjustment for lower metal prices and a larger copper anode inventory. The company's net sales for 2023 would have been 3.2% higher than in 2022 if these effects were excluded. The reduction in fresh water at the Buenavista operation also presented a significant operational challenge, which the company plans to address by securing alternative water supplies for 2024.

Chairman of the Board, Mr. German Larrea, commented on the volatile copper market and the company's strategic focus.

We are witnessing a highly volatile copper market... Southern Copper continues to focus on developing its capital projects and keeping its costs controlled at a very competitive level."

Larrea's statement underscores the importance of cost control and project development in navigating market volatility.

Strategic Capital Investments and Project Updates

SCCO's capital investment program exceeds $15 billion for the decade, including significant projects in Mexico and Peru aimed at increasing production capacity and creating jobs. The Buenavista Zinc and Pilares projects in Mexico and the Tia Maria, Los Chancas, and Michiquillay projects in Peru are key components of this investment strategy. These projects are expected to contribute significantly to the company's future production and revenue.

The company's ESG practices have also shown progress, with SCC achieving high scores in key sustainability indicators and increasing investment in social infrastructure. These efforts reflect SCCO's commitment to sustainability and community development.

Analysis of Financial Statements

SCCO's income statement reflects the challenges faced in 2023, with a notable decline in net income margin. The balance sheet and cash flow statements, while not detailed in this summary, are crucial for understanding the company's financial health and liquidity. The company's capital investments and strategic projects are expected to bolster future performance, despite the current headwinds.

For value investors and potential GuruFocus.com members, understanding SCCO's financial position and strategic investments is essential. The company's ability to navigate a challenging market environment and its commitment to growth projects may offer long-term value, despite short-term pressures.

For a more detailed analysis and to stay updated on SCCO's progress, investors are encouraged to join the earnings conference call and access the live presentation through the provided links.

SCCO's full financial statements and additional details on its operations can be found in the 8-K filing. Investors looking to delve deeper into the company's financials and strategic outlook are advised to review the complete document.

As Southern Copper Corp navigates the complexities of the metals and mining industry, its focus on cost control, strategic capital investments, and sustainability practices will be critical in shaping its future success.

For further insights and investment analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Southern Copper Corp for further details.

This article first appeared on GuruFocus.