Southern First Bancshares Inc (SFST) Reports Earnings for Q4 and Full Year 2023

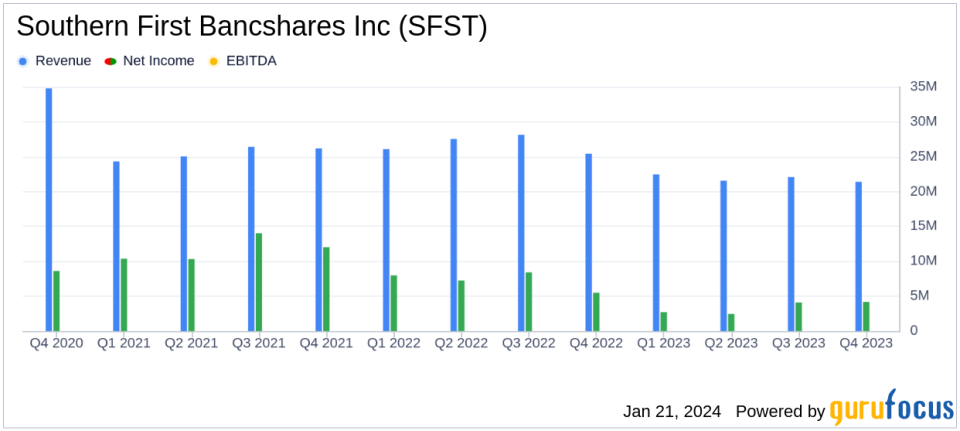

Net Income: Q4 net income available to common shareholders was $4.2 million, a decrease from the same quarter last year.

Earnings Per Share: Diluted earnings per share for Q4 stood at $0.51, compared to $0.68 in Q4 2022.

Total Revenue: Q4 total revenue reached $21.4 million, a decrease from $25.8 million in Q4 2022.

Net Interest Margin: The net interest margin for Q4 was 1.92%, showing a decline from 2.88% in the same quarter the previous year.

Total Assets: Total assets increased to approximately $4.1 billion as of December 31, 2023.

Loan to Deposit Ratio: The loans to deposits ratio stood at 106.60% at the end of Q4.

Asset Quality: Nonperforming assets to total assets were 0.10%, showing a slight increase from Q4 2022.

On January 18, 2024, Southern First Bancshares Inc (NASDAQ:SFST) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The bank holding company, which operates Southern First Bank, reported a mix of growth in book value and challenges in net interest income and margin.

Company Overview

Southern First Bancshares Inc, headquartered in Greenville, South Carolina, is the parent company of Southern First Bank. The bank offers a range of financial services including traditional deposit and lending products to commercial and retail clients. With a strong presence in South Carolina and expanding operations in North Carolina and Georgia, Southern First Bancshares has grown to hold approximately $4.1 billion in assets.

Financial Performance and Challenges

The company's net income for Q4 2023 was $4.2 million, or $0.51 per diluted share, which is a decrease from the $5.5 million, or $0.68 per diluted share, reported in the same quarter of the previous year. Total revenue for the quarter was $21.4 million, down from $25.8 million in Q4 2022. The net interest margin, a key indicator of profitability for banks, decreased to 1.92% from 2.88% in Q4 2022, reflecting the impact of the Federal Reserve's interest rate hikes on deposit costs.

Art Seaver, the company's CEO, commented on the results:

We are pleased with our fourth quarter results as we saw further growth in book value, stability in net interest margin and strong credit quality, stated Art Seaver, the Companys Chief Executive Officer. We are beginning 2024 with excellent momentum and a proven ability to grow organic and high quality client relationships in every market we serve.

Financial Achievements

Despite the challenges, Southern First Bancshares Inc achieved growth in book value per common share, which increased to $38.63 from $36.76 at the end of 2022. The company also reported a stable loans to deposits ratio and a strong capital position, with a total risk-based capital ratio of 12.56%.

Key Financial Metrics

Key metrics from the income statement show a decrease in net interest income and a reversal of the provision for credit losses, indicating lower expected loss rates. The balance sheet reflects growth in total loans to $3.6 billion and total deposits to $3.4 billion. The cash flow statement was not explicitly discussed in the filing, but the overall financial position of the company appears solid with an increase in total assets.

Analysis of Performance

While Southern First Bancshares Inc has demonstrated resilience with its asset quality and capital ratios, the declining net interest margin and lower net income compared to the previous year highlight the challenges faced in a rising interest rate environment. The company's ability to maintain a strong credit quality and manage its loan portfolio effectively will be crucial for future performance.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing of Southern First Bancshares Inc (NASDAQ:SFST).

Explore the complete 8-K earnings release (here) from Southern First Bancshares Inc for further details.

This article first appeared on GuruFocus.