Southern States Bancshares Inc (SSBK) Reports Mixed Q4 Earnings Amid Interest Rate Challenges

Net Income: Reported $8.9 million, or $0.99 per diluted share for Q4 2023.

Core Net Income: Posted $7.3 million, or $0.81 per diluted share for Q4 2023.

Net Interest Income: Decreased by 1.6% to $20.4 million from the previous quarter.

Net Interest Margin: Declined by 9 basis points to 3.69% from the prior quarter.

Loan Growth: Annualized loan growth of 24.7% for the linked quarter.

Deposit Growth: Total deposits grew by 21.1% on an annualized basis.

Nonperforming Loans: Remained low at 0.06% of the overall loan portfolio.

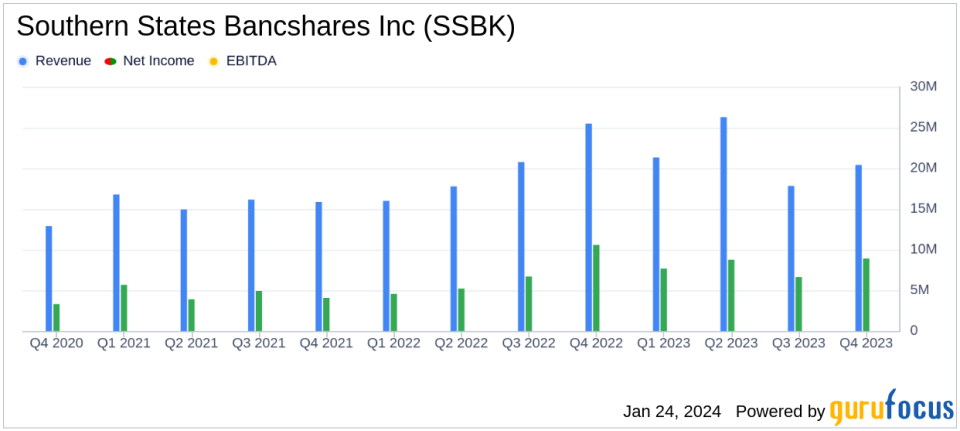

On January 22, 2024, Southern States Bancshares Inc (NASDAQ:SSBK) released its 8-K filing, announcing financial results for the fourth quarter of 2023. The company, a full-service community banking institution, reported a net income of $8.9 million, or $0.99 per diluted share, compared to $6.6 million, or $0.73 per diluted share, in the third quarter of 2023. Core net income for the quarter stood at $7.3 million, or $0.81 per diluted share, a decrease from the core net income of $9.6 million, or $1.06 per diluted share, in the previous quarter.

Despite the solid annualized loan growth of 24.7% and deposit growth of 21.1%, the bank faced challenges with net interest income and margin. Net interest income saw a slight decrease of $327,000 from the prior quarter, while the net interest margin (NIM) experienced a 9 basis point drop to 3.69%. The decline in NIM was attributed to increased funding expenses and deposit costs due to elevated interest rates.

CEO Mark Chambers commented on the earnings, emphasizing the bank's solid performance in loan and deposit growth, while also acknowledging the impact of rising interest rates on funding expenses. He stated,

We produced solid fourth quarter earnings, highlighted by annualized sequential loan growth of 24.7% and annualized deposit growth of 21.1%.

Chambers also noted the bank's focus on credit management and the low level of nonperforming loans, which totaled just 0.06% of the overall portfolio.

Noninterest income for the quarter was $3.1 million, a significant improvement from the noninterest net expense of $2.9 million in the previous quarter. This was partly due to a one-time $1.9 million fee related to the early payoff of a purchased loan. Noninterest expense increased to $9.7 million, up 13.4% from the third quarter, largely due to the return of the Employee Retention Credit (ERC).

Loans, net of unearned income, were up to $1.9 billion at the end of the quarter, marking significant growth from the previous year. The bank's allowance for credit losses stood at 1.29% of total loans, indicating a strong buffer against potential loan defaults. Total deposits reached $2.0 billion, with a notable increase in both interest-bearing and noninterest-bearing deposits.

As Southern States Bancshares Inc (NASDAQ:SSBK) moves into 2024, the company boasts a strong capital and liquidity position, with total stockholders equity reaching $215.0 million. The bank's strategic focus on growth and credit quality positions it well for the future, despite the headwinds from the current interest rate environment.

Value investors and potential GuruFocus.com members should consider the resilience and strategic positioning of Southern States Bancshares Inc (NASDAQ:SSBK) as it navigates the complex financial landscape. The company's commitment to maintaining a robust loan portfolio and expanding its deposit base, alongside prudent management of its net interest margin, underscores its potential as a stable investment in the banking sector.

Explore the complete 8-K earnings release (here) from Southern States Bancshares Inc for further details.

This article first appeared on GuruFocus.