Southside Bancshares (SBSI) Hikes Dividend Payout by 2.9%

Southside Bancshares, Inc. SBSI has increased its dividend payment. The company announced a quarterly cash dividend of 36 cents per share, which is 2.9% higher than the prior payout. This dividend will be paid out on Feb 29, 2024, to shareholders on record as of Feb 15.

SBSI hiked its dividend by 2.9% to 35 cents per share in February 2023. The current dividend marks the fourth hike in the past three years.

Also, the company has five-year annualized dividend growth of 3.45%. Currently, SBSI's payout ratio is 49% of earnings.

Given yesterday's closing price of $29.80, Southside Bancshares currently has a dividend yield of 4.70%, which is above the industry average of 0.61%.

Lee R. Gibson, president and CEO of SBSI, stated, “We are proud to continue our long history of increases to quarterly dividend.”

Southside Bancshares has consistently maintained the trend to announce the special cash dividend annually in November, since 2005. In 2023, a dividend of 2 cents per share was paid to the shareholders.

Furthermore, the company has a share repurchase program in place. In March 2022, the company announced a buyback plan to purchase up to one million shares. In December 2022, SBSI increased its authorization by another one million, adding up to two million shares. In 2023, the company bought almost 1.44 million shares. As of Dec 2023, approximately 0.56 million shares remained available under the authorization.

The company had a total debt of $722.5 million and cash and due from banks of $122 million as of Dec 31, 2023.

With a track record of steady dividend hikes and a focus on organic growth, the company's strong liquidity and balance sheet position will support its future growth.

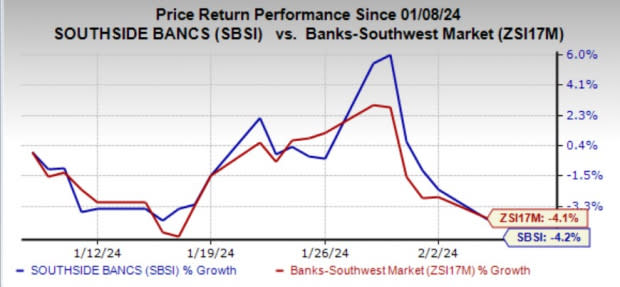

In the past month, shares of SBSI have lost 4.2% compared with the industry's 2.8% decline.

Image Source: Zacks Investment Research

Southside Bancshares currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Banks Taking Similar Steps

In January 2024, Bank OZK OZK announced a hike in its quarterly dividend. The company declared a quarterly cash dividend of 38 cents per share, marking an increase of 2.7% from the prior quarter. The dividend was paid out on Jan 23 to shareholders on record as of Jan 16.

Prior to the recent hike, OZK raised its dividend by 2.8% to 37 cents per share in October 2023. Also, the company has a five-year annualized dividend growth of 10.6%. Currently, the company's payout ratio is 25% of earnings.

In December 2023, Fulton Financial Corporation FULT announced a sequential dividend hike. The company declared a quarterly cash dividend of 17 cents per share, reflecting a rise of 6.3% from the prior payout. The dividend was paid out on Jan 12, 2024, to shareholders of record as of Jan 2.

Prior to the current hike, the company increased its dividend by 6.7% to 16 cents per share in June 2023. FULT raised its quarterly dividend eight times in the last five years. Further, it has a five-year annualized dividend growth of 5.4%. Currently, the company's payout ratio is 36% of earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fulton Financial Corporation (FULT) : Free Stock Analysis Report

Southside Bancshares, Inc. (SBSI) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report