SouthState Corp (SSB) Reports Growth in Loans and Deposits Amid Economic Headwinds

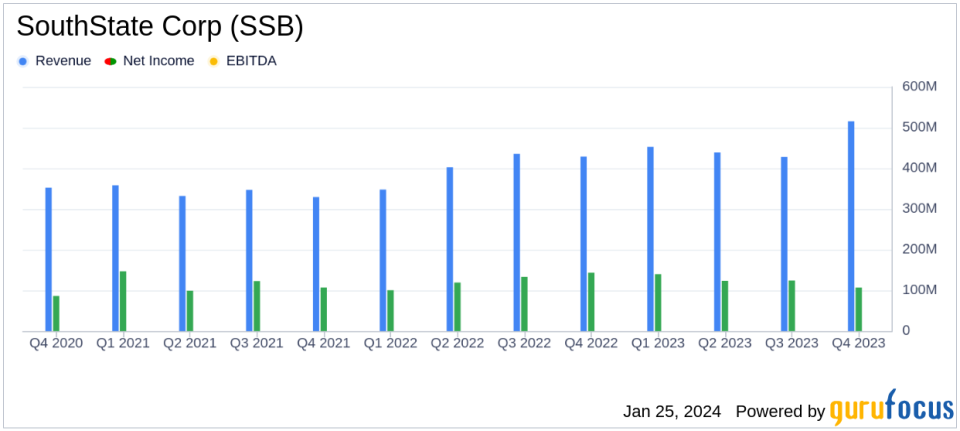

Net Income: Reported $106.791 million for Q4 2023, with adjusted net income at $128.271 million.

Interest Income: Increased to $515.435 million in Q4 2023 from $423.889 million in Q4 2022.

Loan Growth: Loans, including fees, grew to $1.716 billion in 2023, up from $1.178 billion in 2022.

Deposits: Noninterest-bearing deposits decreased, while interest-bearing deposits increased, reflecting a shift in deposit mix.

Efficiency Ratio: Improved to 63.43% in Q4 2023 from 54.21% in the same period last year.

Dividends: Declared quarterly cash dividend of $0.52 per common share.

Capital Ratios: Maintained strong equity-to-assets and risk-based capital ratios.

On January 25, 2024, SouthState Corp (NYSE:SSB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The report showcases the company's ability to navigate a challenging economic landscape, marked by significant interest rate changes and demographic shifts.

SouthState Corp, a prominent bank holding company in the United States, operates through its subsidiary, South State Bank. The bank offers a comprehensive suite of services, including retail and commercial banking, mortgage lending, and wealth management across several fast-growing states.

Financial Performance and Balance Sheet Strength

The fourth quarter of 2023 saw SouthState Corp achieving a net income of $106.791 million, with an adjusted net income of $128.271 million when accounting for non-GAAP items such as securities losses and FDIC special assessments. The company's interest income rose to $515.435 million, up from $423.889 million in the same quarter the previous year, driven by growth in loans and investment securities. This increase in interest income was partially offset by higher interest expenses, which grew to $161.204 million due to rising deposit costs and other borrowings.

SouthState Corp's loan portfolio expanded by 7% over the year, reflecting the company's strategic focus on growth and resilience. The balance sheet remained robust, with total assets reaching $44.902 billion by the end of December 2023. The bank's deposit mix shifted, with noninterest-bearing deposits decreasing, while interest-bearing deposits increased, indicating a changing depositor behavior in response to the interest rate environment.

Operational Efficiency and Shareholder Returns

The bank's efficiency ratio, a key measure of operational effectiveness, improved to 63.43% for the quarter, compared to 54.21% in the prior year. This improvement indicates a more cost-effective management of the bank's noninterest expenses relative to its revenue. Additionally, SouthState Corp continued to return value to shareholders, declaring a quarterly cash dividend of $0.52 per common share.

Capital ratios remained strong, with equity-to-assets at 12.3% and Tier 1 risk-based capital at 11.8%, demonstrating the bank's solid capital position and its ability to withstand potential economic stresses.

"We ended a year that demonstrated the resilience of the SouthState deposit franchise in the face of unprecedented change. In addition, loans grew 7% and we materially built our reserve," said John C. Corbett, SouthStates Chief Executive Officer. "While we remain cautious of the lag effects of the recent rate increases, we see tremendous opportunity coming out of the cycle."

Looking Ahead

SouthState Corp's performance in the fourth quarter of 2023 underscores its adaptability and strategic positioning in a dynamic economic environment. The bank's focus on loan growth, cost management, and capital strength positions it well for future opportunities, particularly in the rapidly growing regions it serves. As the company looks ahead, it remains cautious about the lag effects of recent rate increases but optimistic about its potential to deliver outsized results for shareholders.

For detailed financial tables and further information, investors and analysts are encouraged to review the full 8-K filing.

SouthState Corp's commitment to prudent growth, operational efficiency, and shareholder value, combined with its strategic market presence, suggests a positive outlook for the company as it navigates the evolving financial landscape.

Explore the complete 8-K earnings release (here) from SouthState Corp for further details.

This article first appeared on GuruFocus.