Sovos Brands Inc (SOVO) Surpasses $1 Billion in Net Sales with Robust Year-Over-Year Growth

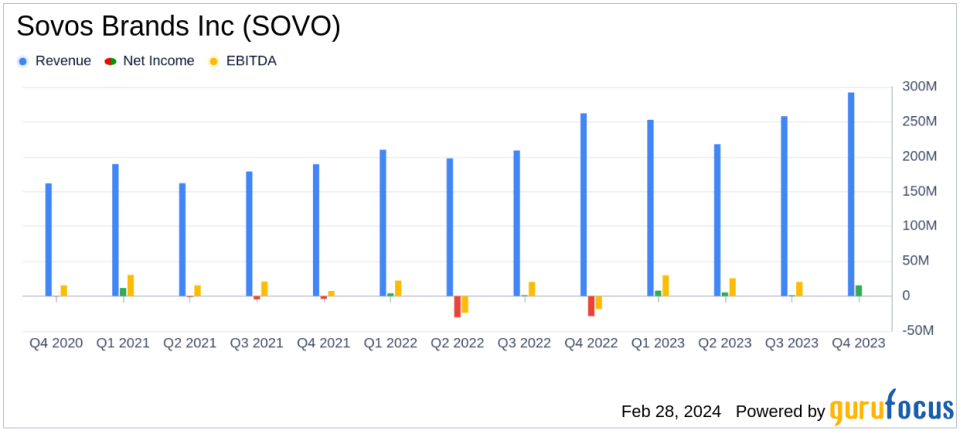

Net Sales: Achieved $1.02 billion, a 16.2% increase from the previous year.

Net Income: Reported a net income of $30.2 million, a significant turnaround from a net loss of $53.5 million last year.

Adjusted EBITDA: Grew by 30.3% to $156.1 million, with margins expanding by 170 basis points.

Rao's Performance: Rao's brand led with a 33.5% increase in reported net sales and a 36.8% organic net sales growth.

Merger Update: Merger with Campbell Soup Company expected to complete shortly after March 11, 2024.

Balance Sheet Strength: Ended the year with $232.0 million in cash and a net debt to adjusted EBITDA ratio of 1.6x.

On February 28, 2024, Sovos Brands Inc (NASDAQ:SOVO) released its 8-K filing, announcing financial results for the fourth quarter and fiscal year ended December 30, 2023. The company, known for its portfolio of food brands including Rao's, noosa, Birch Benders, and Michael Angelo's, reported a landmark fiscal year with net sales surpassing the $1 billion mark, driven by double-digit top and bottom-line growth.

Financial Performance and Challenges

SOVO's fiscal year 2023 was marked by significant achievements, with net sales growing 16.2% to $1.02 billion and net income swinging from a loss of $53.5 million in the previous year to a profit of $30.2 million. This performance is particularly noteworthy as it was primarily driven by volume growth, contrasting with the broader industry trend where growth is often driven by price increases. Adjusted EBITDA rose to $156.1 million, up 30.3% from the previous year, and the adjusted EBITDA margin expanded by 170 basis points to 15.3%. The company's focus on volume-driven growth and margin expansion is critical in the competitive Consumer Packaged Goods industry, where efficiency and scale can significantly impact profitability.

Financial Highlights and Metrics

SOVO's fourth quarter net sales increased by 11.4% year-over-year to $292.1 million, with organic net sales growth of 25.3%. The company's gross profit for the quarter was $87.5 million, a 15.2% increase from the prior year, and the gross margin improved by 100 basis points to 30.0%. Adjusted net income for the quarter was $26.8 million, or $0.26 per diluted share, up from $19.6 million, or $0.19 per diluted share, in the prior year period. The balance sheet remained strong with $232.0 million in cash and cash equivalents and a net leverage ratio of 1.6x. Cash flow from operations for the fiscal year was $105.3 million, reflecting improved profitability and working capital management.

"Fiscal year 2023 was a landmark year for Sovos Brands," commented Todd Lachman, Chief Executive Officer. "Our team delivered sector-leading, volume-driven top and bottom-line growth, surpassing $1 billion of net sales and $150 million of adjusted EBITDA, expanded margins by nearly 200 bps and improved net leverage to 1.6x. Notably, net sales growth was driven primarily by volumes in contrast to most of our peers.

Merger and Market Outlook

SOVO is also on the cusp of completing a merger with Campbell Soup Company, which is expected to finalize shortly after the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act on March 11, 2024. This merger is anticipated to deliver a 92% return for shareholders from SOVO's September 2021 IPO price. Due to the pending merger, SOVO will not be providing forward-looking guidance or holding an earnings call.

SOVO's performance in fiscal year 2023 underscores the company's ability to navigate market challenges and capitalize on growth opportunities within its brand portfolio. The company's strategic focus on driving volume growth and expanding margins has yielded significant financial achievements, setting a solid foundation for the impending merger and future endeavors.

For more detailed information on Sovos Brands Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sovos Brands Inc for further details.

This article first appeared on GuruFocus.