SpartanNash Co (SPTN) Reports Fiscal 2023 Earnings: Net Earnings Jump 51%, Adjusted EBITDA Climbs 6%

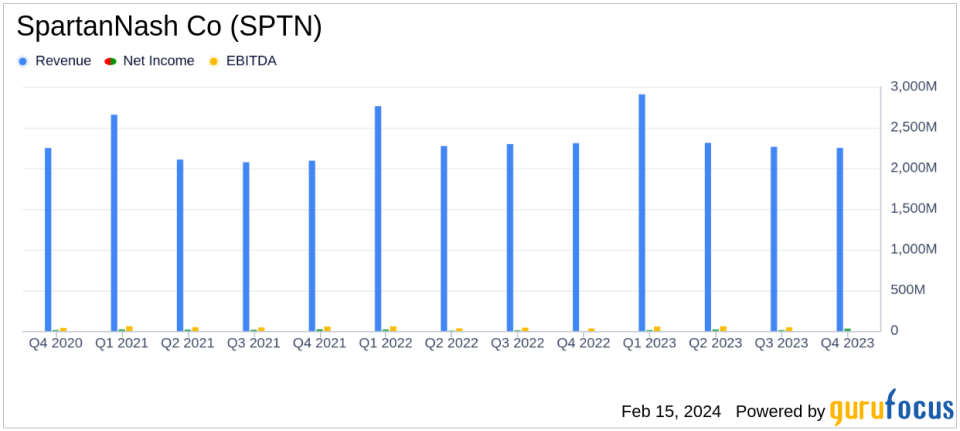

Net Sales: Slight increase of 0.9% to $9.73 billion in fiscal 2023.

Net Earnings: Significant increase to $1.50 per diluted share, up from $0.95.

Adjusted EBITDA: Grew to $257.4 million, a 6% rise from the previous year.

Adjusted EPS: Decreased to $2.18 from $2.33 in the prior year.

Cash Flow: Operating activities generated $89.3 million, a decrease from $110.4 million.

Debt Ratio: Net long-term debt to adjusted EBITDA ratio increased to 2.3x at year-end.

Shareholder Returns: $48.3 million returned through share repurchases and dividends.

On February 15, 2024, SpartanNash Co (NASDAQ:SPTN) released its 8-K filing, announcing its financial results for the fourth quarter and the full fiscal year ended December 30, 2023. The company, a leading food solutions provider operating in both retail and wholesale segments, reported a year of growth amidst a challenging economic landscape.

Company Overview

SpartanNash serves a diverse customer base through its two main segments: Retail and Wholesale. The Wholesale segment, which is the primary revenue driver, distributes products to a variety of customers including independent retailers, national accounts, and the company's own retail stores. The Retail segment operates 144 grocery stores under various banners, offering a wide range of products and services.

Fiscal Performance and Challenges

For the fiscal year 2023, SpartanNash reported a modest net sales increase of 0.9% to $9.73 billion. However, the fourth quarter saw net sales decrease by 2.8% to $2.25 billion, attributed to lower volumes in both segments. The company faced headwinds from reduced food assistance program benefits and lower fuel sales, impacting the Retail segment's performance.

Despite these challenges, net earnings for the year soared by 51% to $1.50 per diluted share, compared to $0.95 in the previous year. This increase was primarily due to a higher gross profit rate and lower incentive compensation, partially offset by lower unit volumes and increased restructuring and asset impairment charges. Adjusted EBITDA also grew by 6% to $257.4 million, reflecting the company's ability to navigate a tough economic environment successfully.

Financial Achievements and Importance

The growth in net earnings and adjusted EBITDA is particularly significant for SpartanNash and the Retail - Defensive industry, as it demonstrates the company's resilience and effective management in a competitive and fluctuating market. The ability to increase profitability in such conditions is a testament to the strength of SpartanNash's strategic initiatives and operational efficiency.

Key Financial Metrics

Important metrics from the financial statements include:

"Our team is proud of another strong year in which we have demonstrated year-over-year growth, delivered record profitability, and performed in line with our expectations, all in spite of a challenging macroeconomic environment," said SpartanNash President and CEO Tony Sarsam.

Adjusted EPS decreased slightly to $2.18 from $2.33, while the cash generated from operating activities saw a decrease to $89.3 million from $110.4 million. The net long-term debt to adjusted EBITDA ratio increased to 2.3x, indicating a higher leverage position. Capital expenditures and IT capital rose to $127.4 million, up from $102.1 million, reflecting ongoing investments in the company's infrastructure and technology.

Analysis and Outlook

Looking ahead to fiscal 2024, SpartanNash anticipates total net sales to be between $9.7 billion and $9.9 billion, with adjusted EBITDA ranging from $255 million to $270 million, and adjusted EPS between $1.85 and $2.10. These projections incorporate the company's strategic initiatives, including transformational programs and potential acquisitions.

The company's performance in fiscal 2023, despite sales challenges, underscores its ability to adapt and thrive. With a focus on market share growth and cost-saving measures, SpartanNash is poised to continue its trajectory of profitability and shareholder value creation.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing and attend the company's conference call and webcast.

Explore the complete 8-K earnings release (here) from SpartanNash Co for further details.

This article first appeared on GuruFocus.