Specialized Consumer Services Stocks Q4 Results: Benchmarking LKQ (NASDAQ:LKQ)

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the specialized consumer services stocks, starting with LKQ (NASDAQ:LKQ).

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 8 specialized consumer services stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 0.9% while next quarter's revenue guidance was 4.6% below consensus. Investors abandoned cash-burning companies to buy stocks with higher margins of safety, and while some of the specialized consumer services stocks have fared somewhat better than others, they have not been spared, with share prices declining 5.2% on average since the previous earnings results.

LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.50 billion, up 16.7% year on year, falling short of analyst expectations by 0.4%. It was a mixed quarter for the company, with a miss of analysts' organic revenue estimates. On the other hand, EPS came in ahead of expectations.

“The fourth quarter was a strong finish to a successful year for LKQ. I am proud of how the entire team worked through challenging macroeconomic conditions, persistent inflation and declining commodity prices to deliver solid organic revenue growth, year over year improvement in Segment EBITDA, and strong cash flow generation. I look forward to collaborating with Justin Jude, my successor as Chief Executive Officer, over the coming months to continue enhancing LKQ’s industry leading business,” stated Dominick Zarcone, President and Chief Executive Officer.

LKQ pulled off the fastest revenue growth of the whole group. The stock is down 5.6% since the results and currently trades at $47.5.

Read our full report on LKQ here, it's free.

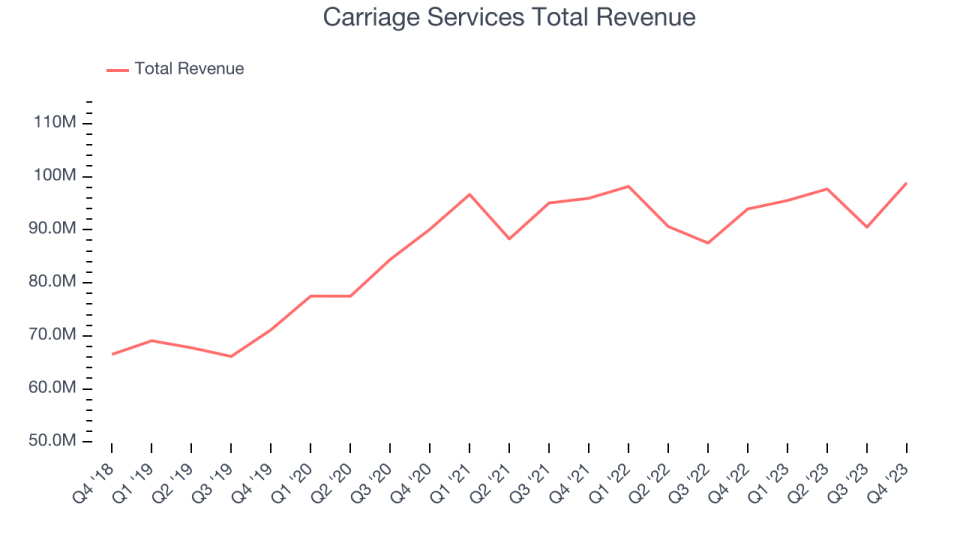

Best Q4: Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $98.83 million, up 5.2% year on year, outperforming analyst expectations by 5.5%. It was a very strong quarter for the company, with an impressive beat of analysts' revenue and earnings estimates.

Carriage Services delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 7.8% since the results and currently trades at $27.04.

Is now the time to buy Carriage Services? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Mister Car Wash (NYSE:MCW)

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $230.1 million, up 7.4% year on year, falling short of analyst expectations by 0.1%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year. Mister Car Wash slightly topped analysts' EPS expectations this quarter despite a same store sales and revenue miss.

The stock is down 11% since the results and currently trades at $7.75.

Read our full analysis of Mister Car Wash's results here.

Pool (NASDAQ:POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.00 billion, down 8.5% year on year, falling short of analyst expectations by 1.6%. It was a weaker quarter for the company, with a miss of analysts' organic revenue estimates.

Pool had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 3.6% since the results and currently trades at $403.51.

Read our full, actionable report on Pool here, it's free.

WW (NASDAQ:WW)

Formerly known as Weight Watchers, WW (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WW reported revenues of $206 million, down 7.6% year on year, falling short of analyst expectations by 0.5%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

WW had the weakest full-year guidance update among its peers. The stock is down 50.7% since the results and currently trades at $1.88.

Read our full, actionable report on WW here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.