This Specialty Chemicals Company Is a Real Treatt

Treatt PLC (LSE:TET) manufactures ingredient solutions for beverages, fragrances, flavors and consumer products in the U.K., U.S. and Kenya. It deals with production and research of current and new molecules (solutions) that add flavor to foods and scents to a number of items.

The company organizes its products into two categories: flavor ingredients and fragrance ingredients. Treatts flavor ingredients are branded to be a healthy alternative to sugar a way of replacing the decreasing demand for sugary foods among consumers. This is enforced from its advertisement of 100% natural ingredients and Treatts ability to provide taste without compromising health. Innovation on new flavors, however, is what the company says is its unique selling point.

Strategy

Treatt has a large focus on navigating its sales through macroeconomic trends, mainly innovation on synthesis of new tastes, smells and awareness of consumer diet trends. Sustainability is a large focus, too, and its new headquarters built in Suffolk, England, called Skyliner Way, has tried to incorporate this as much as possible. By congregating its workers under one roof, it should increase efficiency and profitability. Further, the company hopes to double its workforce.

As innovation is one of its unique selling points, Treatt wishes to triple its research and development spending in the next five years to enforce its model as a company that provides new concepts to the market. The company's hopes of empowering its workforce should help, increasing morale and attracting the best scientific minds. Adding value through a high-quality workforce and assisting them in their progression is how Treatt's management team hopes to achieve this.

The company maintains uncompromising quality standards, and its R&D efforts consistently generate products that perform their intended function of delivering reliable taste and scent. Nevertheless, Treatt must compete on the basis of cost, sales volume and pricing, which requires improving its economies of scale. Although it currently lacks a distinctive competitive advantage, the company has embarked on an ambitious plan to set itself apart from other chemical companies by investing in innovative research and valuing its workforce - a unique characteristic in this sector. Its strategy involves expanding R&D facilities and hiring more scientists to perform research.

Financial review

2022 was a challenging year for Treatt. While revenue experienced a gain of 12.8% for the year ended Sept. 30, reaching 140 million pounds ($174 million), the gross margin declined to 27.9% due primarily to reduced sales of hard tea and losses in foreign exchange. Therefore, earnings before tax and exceptional items were reduced by 27.1%, amounting to 15.30 million pounds.

The revenue growth was broad-based across all of Treatt's categories, except for tea, which declined due to lower demand for hard tea (ready-to-drink canned cocktails) in the U.S. and an exceptional 2021 performance. Citrus, which contributed 47.6% of revenue, grew 23.2%, with margins remaining broadly in line. The company implemented selective price increases to offset higher commodity prices, and its expertise in citrus procurement and robust supply chain ensured that it mitigated exposure as much as possible to the rising market.

Synthetic Aroma sales increased by 13.6% with growth in products used to flavor alternative proteins and savory snack foods. Health & Wellness, including sugar reduction, had another strong year, growing 15.3% with sustained consumer demand for "better for you" products driving sales in the specialist solutions, such as the reduction of calorific content in beverages. This reflects the important intellectual property, know-how and technical expertise that Treatt possesses in this field. The Fruit & Vegetables category continued to grow by 8.3%, with mango, pineapple, strawberry and kiwi natural extracts leading contributors to growth. Meanwhile, the group's traditional range of herbs, spices and florals grew by 10.4% in large part because of improved demand post-pandemic.

Despite logistical challenges caused by global supply chain issues and recent site relocations, the company maintained its performance in the U.K., Europe and the Americas. Sales to mainland Europe increased by 25%, with strong performance from both Citrus and Synthetic Aroma. Revenue in the U.S. grew a modest 0.7%, mainly due to successful growth in Orange products. The subsidiary in China reported a 6.2% increase in revenue despite extended Covid-19-related restrictions. The Rest of the World (excluding China) grew by 26.8%, with many customers and markets recovering from the impact of the pandemic.

Treatt's gross profit fell by 7.4%, with the gross profit margin dropping from 34%. The margin decline was driven by three factors. First, a shift in sales mix toward lower-margin citrus products and away from higher-margin hard tea sales. Second, input cost inflation, which the company has been able to pass on to some customers but not all due to some longer-term contracts not yet being adjusted. Finally, a downturn in profits was caused by increasing losses due to foreign exchange contracts that were over-hedged, as the British pound depreciated a lot against the dollar in the latter half of the year.

The company's first-half 2023 results will be announced on May 9.

Valuation

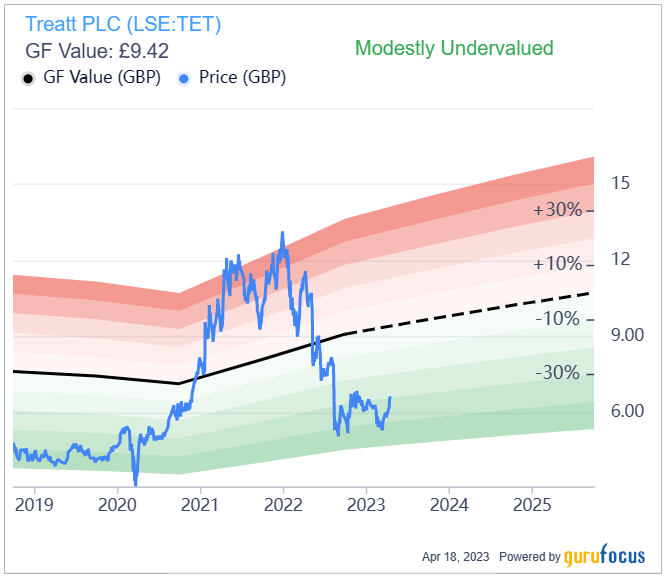

The GF Value Line suggests the stock is modestly undervalued currently based on historical ratios, past financial performance and analysts' earnings expectations.

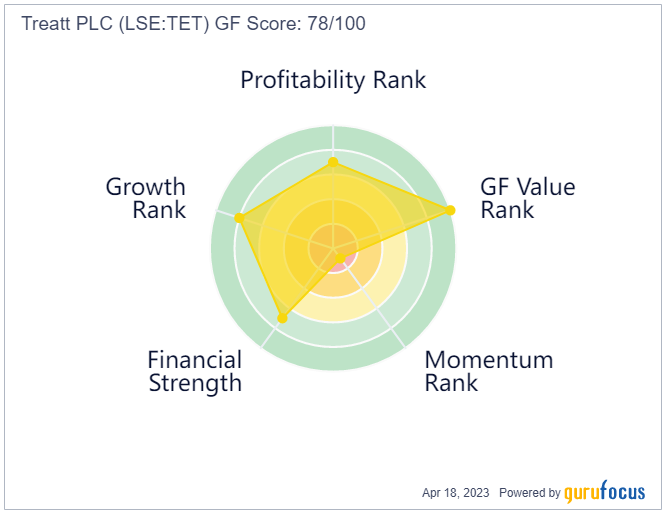

Although the company has a low Piotroski F-Score of 2 out of 9, it does have a very safe Altman Z-Score of 6.50. In terms of its overall GF Score of 78 out of 100, it is let down only by momentum, but ranks reasonably well for profitability, value, growth and financial strength.

Conclusion

Overall, Treatt's focus on meeting current consumer trends, along with its strong commitment to sustainability, positions the company well for long-term growth and success. Its business strategy aligns with major macro trend drivers in key markets. The company is expanding to incorporate positive sustainability credentials, which is an important driver for many consumers worldwide.

Furthermore, Treatt's focus on premium products that add value through increased functionality, as well as its emphasis on healthier products that cater to consumer demands is perfectly in line with the current wellness trends. The company's expertise in natural ingredients, as well as its commitment to ethical sourcing, makes it a compelling investment opportunity for those looking for exposure to this growing trend.

This article first appeared on GuruFocus.