Specialty Retail Stocks Q3 Recap: Benchmarking Ulta (NASDAQ:ULTA)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Ulta (NASDAQ:ULTA), and the best and worst performers in the specialty retail group.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 7 specialty retail stocks we track reported a mixed Q3; on average, revenues missed analyst consensus estimates by 1.1% while next quarter's revenue guidance was 2.3% above consensus. Investors abandoned cash-burning companies to buy stocks with higher margins of safety, but specialty retail stocks held their ground better than others, with the share prices up 16% on average since the previous earnings results.

Ulta (NASDAQ:ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

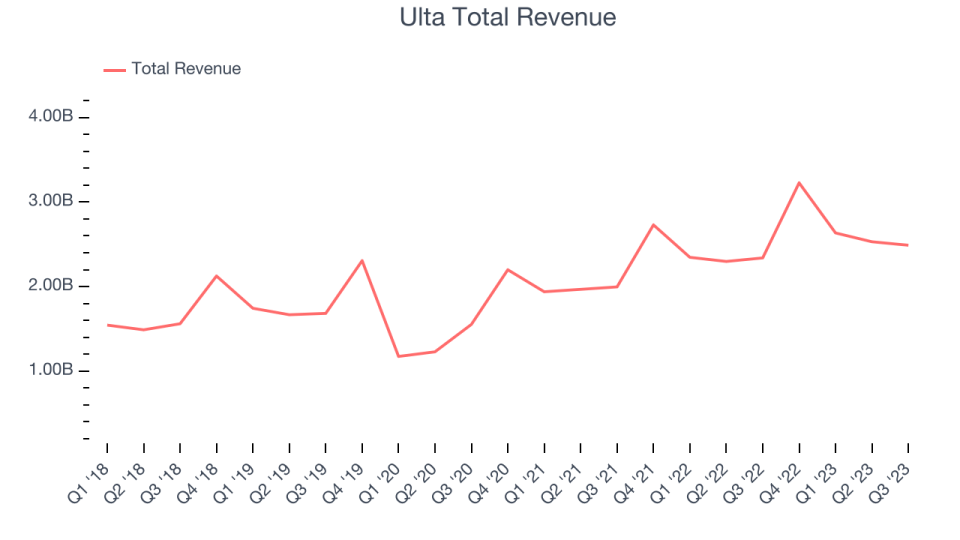

Ulta reported revenues of $2.49 billion, up 6.4% year on year, in line with analyst expectations. It was a strong quarter for the company, with same-store sales posting a convincing beat, although revenue only narrowly topped expectations. Profitability was sound, leading to a nice EPS beat. Looking ahead, the company raised its full year outlook for important metrics such as same-store sales, revenue, and EPS.

“The third quarter represented another strong performance by the Ulta Beauty team, as sales, gross profit, and diluted EPS all exceeded our internal expectations. Our traffic trends remained healthy, our brand awareness increased, and we expanded our loyalty program to a record 42.2 million members,” said Dave Kimbell, chief executive officer.

Ulta pulled off the fastest revenue growth and highest full-year guidance raise of the whole group. The stock is up 13.1% since the results and currently trades at $481.98.

Is now the time to buy Ulta? Access our full analysis of the earnings results here, it's free.

Best Q3: Sportsman's Warehouse (NASDAQ:SPWH)

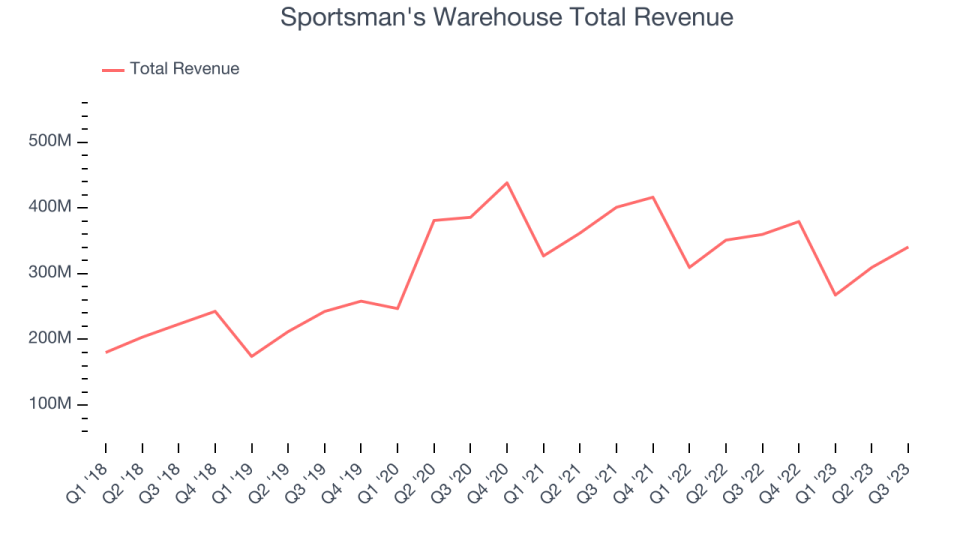

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $340.6 million, down 5.3% year on year, outperforming analyst expectations by 5.1%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings and revenue estimates.

Sportsman's Warehouse delivered the biggest analyst estimates beat among its peers. The stock is down 21.2% since the results and currently trades at $4.19.

Is now the time to buy Sportsman's Warehouse? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Academy Sports (NASDAQ:ASO)

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Academy Sports reported revenues of $1.40 billion, down 6.4% year on year, falling short of analyst expectations by 3%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 24.5% since the results and currently trades at $62.92.

Read our full analysis of Academy Sports's results here.

Sally Beauty (NYSE:SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $921.4 million, down 4.3% year on year, falling short of analyst expectations by 1.1%. It was a slower quarter for the company, with a miss of analysts' revenue and earnings estimates.

The stock is up 50.6% since the results and currently trades at $12.24.

Read our full, actionable report on Sally Beauty here, it's free.

Best Buy Co (NYSE:BBY)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE:BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy Co reported revenues of $9.76 billion, down 7.8% year on year, falling short of analyst expectations by 1.4%. It was a slower quarter for the company, with a miss of analysts' revenue estimates and full-year revenue guidance missing analysts' expectations.

Best Buy Co had the weakest full-year guidance update among its peers. The stock is up 9.8% since the results and currently trades at $74.75.

Read our full, actionable report on Best Buy Co here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned