Spectrum Brands (SPB) Sells HHI Unit, On Track With Transformation

Spectrum Brands Holdings, Inc. SPB has concluded its previously announced sale of the Hardware and Home Improvement business ("HHI") to ASSA ABLOY for cash proceeds of $4.3 billion, before purchase price adjustments. After taxes, fees and customary price adjustments, the company anticipates receiving $3.6 billion of net proceeds from the sale.

Earlier this month, SPB received a green signal from the Mexico competition authority to sell its Hardware and Home Improvement segment to ASSA ABLOY. This was the last step to complete the divestiture.

The definitive agreement to sell the HHI business was initially announced on Sep 8, 2021. The sale is part of the company’s strategic transformation plan. The transaction is likely to strengthen its balance sheet. The company plans to use the proceeds from the sale to lower debt levels, strengthen its operating performance and fund M&A activities.

The company plans to prioritize innovation to accelerate organic growth and pursue synergistic acquisitions to further drive value creation in Global Pet Care, and Home & Garden. SPB will now be able to establish itself as a pure-play consumer staples company.

The company has already simplified the business into three segments — Global Pet Care, Home & Garden, and Home and Personal Care.

The company revealed plans to reduce its indebtedness by nearly $1.6 billion through the repayment of its outstanding loans under its term loan and revolving credit facilities. These loan facilities had outstanding principal amounts of $392 million and $715 million, respectively, as of the time of the close of the sale. Additionally, it plans to redeem all its 5.75% notes due on Jul 15, 2025. Of this, an aggregate principal amount of nearly $450 million is outstanding.

After these repayments, Spectrum Brands proposes to permanently terminate the $500-million revolving loan commitments under its $1.1-billion revolving credit facility. Currently, the company has $600 million of revolving loan commitments available for borrowings under its credit agreement.

Following the conclusion of the deal, the company approved a share repurchase program. It authorized the repurchase of up to $1 billion of common stock, which will replace its prior share repurchase program.

The company also noted that after the completion of this program, it plans to announce an accelerated share repurchase (“ASR”) agreement to buy back an aggregate of $500 million of common stock. Pursuant to the debt repayment and funding of the ASR, the company expects its net cash position to be robust at the end of fiscal 2023.

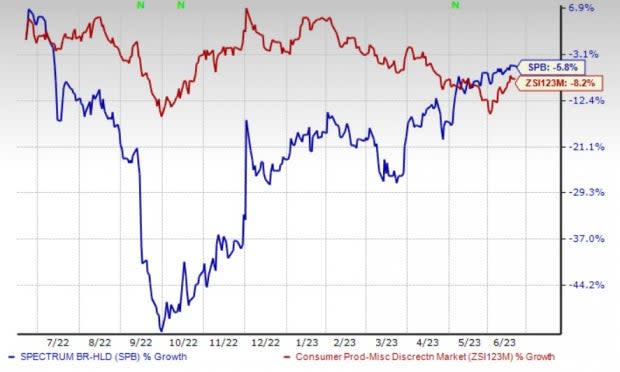

Shares of this Zacks Rank #3 (Hold) company have declined 5.8% in the past year compared with the industry’s fall of 8.2%.

Image Source: Zacks Investment Research

Transformation on Track

Spectrum Brands’ Global Productivity Improvement Plan and strategic transformation plans bode well. The company is streamlining its organizational structure and re-energizing its employee base. Also, gains from cost-reduction efforts act as upsides.

SPB is progressing well with its Global Productivity Improvement Plan, which aims at improving the company's operating efficiency and effectiveness, while focusing on consumer insights and growth-enabling functions, including technology, marketing, and research and development.

The majority of the savings are expected to be reinvested into growth initiatives and consumer insights, R&D, and marketing across each of its businesses. This plan will also enable the company to deliver value creation and sustainable growth in the long term.

Stocks to Consider

Some better-ranked companies are GIII Apparel Group GIII, lululemon athletica LULU and Guess GES.

GIII Apparel sports a Zacks Rank #1 (Strong Buy) at present. GIII has a trailing four-quarter earnings surprise of 47.4%, on average. It has an expected long-term EPS growth rate of 15%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII’s fiscal 2024 sales indicates growth of 1.4% from the year-ago reported levels, while the same for EPS suggests a decline of 2.1%. The consensus estimate for EPS has moved up 6.9% in the past 30 days.

lululemon carries a Zacks Rank #2 (Buy) at present. LULU has a trailing four-quarter earnings surprise of 9.9%, on average. It has an expected long-term EPS growth rate of 20%.

The Zacks Consensus Estimate for LULU’s fiscal 2023 sales and EPS implies increases of 17% and 18.1%, respectively, from the year-ago period’s reported levels. The consensus estimate for EPS has moved up 2.3% in the past 30 days.

Guess presently carries a Zacks Rank #2. GES has a trailing four-quarter earnings surprise of 21%, on average.

The Zacks Consensus Estimate for Guess’ current financial-year sales and earnings suggests growth of 2.8% and 2.6%, respectively, from the year-ago period’s reported figure. The consensus estimate for EPS has moved up 4.9% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Spectrum Brands Holdings Inc. (SPB) : Free Stock Analysis Report