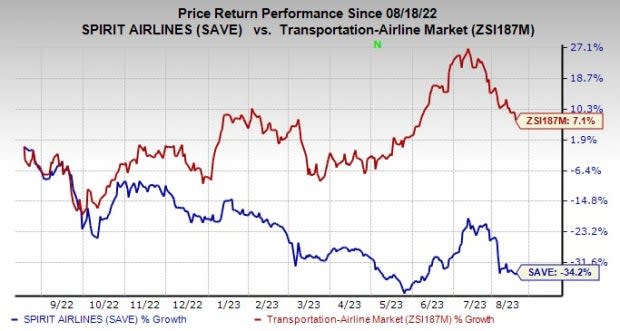

Spirit Airlines (SAVE) Falls 34.2% in a Year: Here's Why

Spirit Airlines, Inc. SAVE is being affected by rising fuel costs and capital expenditures.

The current scenario of rising fuel costs does not bode well for the airline and is hurting its bottom line. Average fuel cost per gallon in the June quarter reached $2.62. Fuel price per gallon is suggested to be $2.80 in the third quarter of 2023.

Apart from high fuel costs, expenses on labor are also increasing and negatively impacting the bottom line. Evidently, expenditures on salaries, wages and benefits jumped 32.1% year over year. Adjusted operating expenses (excluding fuel) rose marginally to $1,412.3 million year over year.

High capital expenditure may play spoilsport and dent the company's free cash flow generating ability. During 2022, capital expenditures were $237.6 million, primarily related to the purchase of spare parts. Capex for 2023 is expected to be $305 million. Owing to these headwinds, the stock has plunged 34.2% in the past year against 7.1% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Unfavorable Estimate Revision

In the past 60 days, the Zacks Consensus Estimate for 2023 was revised downward to a loss of $1.22 per share from earnings of 41 cents.

Zacks Rank & Key Pcks

SAVE currently carries Zacks Rank #4 (Sell).

Some better-ranked stocks for investors interested in the Zacks Transportation sector are GATX Corporation GATX and Kirby Corporation KEX.

GATX, which presently carries a Zacks Rank #2 (Buy), is aided by gradual improvement in the North American railcar leasing market. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For third-quarter and full-year 2023, GATX’s earnings are estimated to register 36.6% and 14.3% climb, respectively, on a year-over-year basis.

Kirby currently carries a Zacks Rank #2. Strong segmental performances are boosting Kirby’s top line.

For third-quarter and full-year 2023, KEX’s earnings are suggested to record 58.5% and 76.2% improvement, respectively, on a year-over-year basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report