Spirit Technology Solutions Ltd's (ASX:ST1) Share Price Is Matching Sentiment Around Its Revenues

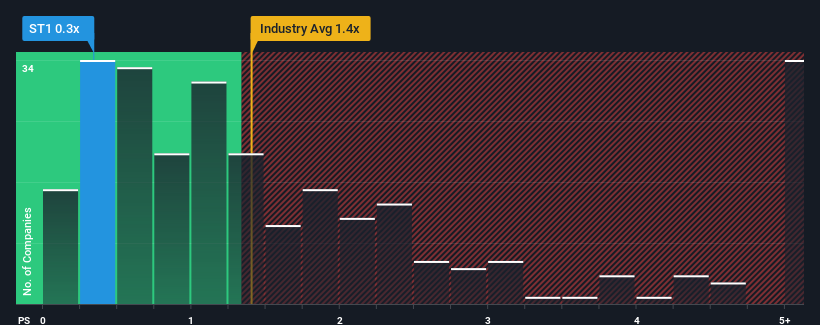

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Spirit Technology Solutions Ltd (ASX:ST1) is a stock worth checking out, seeing as almost half of all the Telecom companies in Australia have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Spirit Technology Solutions

What Does Spirit Technology Solutions' P/S Mean For Shareholders?

Recent times haven't been great for Spirit Technology Solutions as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Spirit Technology Solutions' future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Revenue Growth Forecasted For Spirit Technology Solutions?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Spirit Technology Solutions' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.6%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 5.0% over the next year. That's not great when the rest of the industry is expected to grow by 7.3%.

With this in consideration, we find it intriguing that Spirit Technology Solutions' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Spirit Technology Solutions' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Spirit Technology Solutions maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Spirit Technology Solutions' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Spirit Technology Solutions has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Spirit Technology Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here