Sportsman's Warehouse (NASDAQ:SPWH) Reports Bullish Q3 But Stock Drops

Outdoor specialty retailer Sportsman's Warehouse (NASDAQ:SPWH) beat analysts' expectations in Q3 FY2023, with revenue down 5.3% year on year to $340.6 million. Guidance for next quarter's revenue was also optimistic at $377.5 million at the midpoint, 2.3% above analysts' estimates. It made a non-GAAP loss of $0.01 per share, down from its profit of $0.34 per share in the same quarter last year.

Is now the time to buy Sportsman's Warehouse? Find out by accessing our full research report, it's free.

Sportsman's Warehouse (SPWH) Q3 FY2023 Highlights:

Revenue: $340.6 million vs analyst estimates of $323.9 million (5.1% beat)

EPS (non-GAAP): -$0.01 vs analyst estimates of -$0.12

Revenue Guidance for Q4 2023 is $377.5 million at the midpoint, above analyst estimates of $368.9 million

EPS Guidance for Q4 2023 is ($0.30) at the midpoint, well below estimates of $0.03

Free Cash Flow of $22.49 million is up from -$9.35 million in the same quarter last year

Gross Margin (GAAP): 30.3%, down from 33.6% in the same quarter last year

Same-Store Sales were down 11.4% year on year (beat vs. expectations of down 15.8% year on year)

“During the third quarter the team successfully executed our near-term initiatives and I am pleased that we exceeded our prior guidance for both net sales and adjusted diluted earnings per share,” said Paul Stone, Sportsman’s Warehouse President and Chief Executive Officer.

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Sales Growth

Sportsman's Warehouse is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

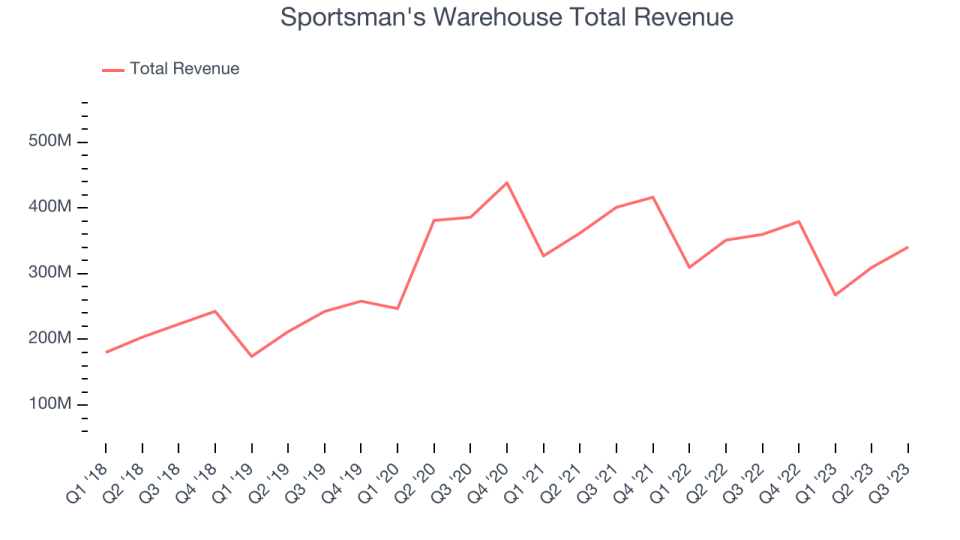

As you can see below, the company's annualized revenue growth rate of 10.5% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and expanded its reach.

This quarter, Sportsman's Warehouse's revenue fell 5.3% year on year to $340.6 million but beat Wall Street's estimates by 5.1%. The company is guiding for revenue to rise 0.5% year on year to $377.5 million next quarter, improving from the 8.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, the Wall Street analysts covering the company expect revenue to remain relatively flat over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Same-Store Sales

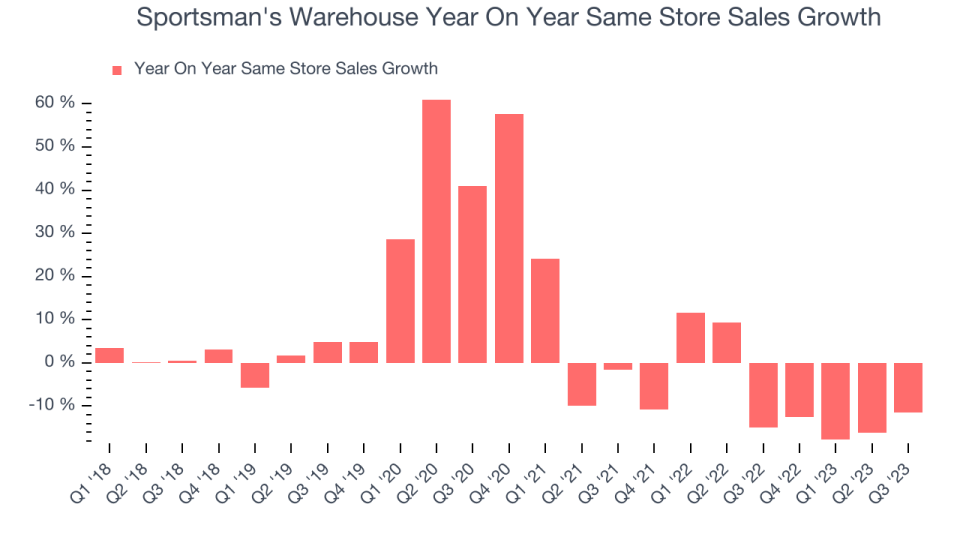

Sportsman's Warehouse's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 7.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Sportsman's Warehouse's same-store sales fell 11.4% year on year. This decrease was a further deceleration from the 15% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Sportsman's Warehouse's Q3 Results

With a market capitalization of $189.5 million, Sportsman's Warehouse is among smaller companies, but its more than $2.92 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We were impressed that same-store sales, revenue, and EPS beat analysts' expectations this quarter. On the other hand, next quarter's EPS guidance was well below expectations. The company blamed "more aggressive promotional activities" and said that gross margins will contract meaningfully because of this. Zooming out, we think this was a fine quarter but with weak guidance. The stock is down 5.8% after reporting, trading at $5.01 per share.

Sportsman's Warehouse may have had a weak quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.