Sportsman's Warehouse (SPWH) Misses on Q2 Earnings, Sales Dip Y/Y

Sportsman's Warehouse Holdings, Inc. SPWH released second-quarter fiscal 2023 results, wherein both the top and bottom lines missed the Zacks Consensus Estimate and declined year over year.

The outdoor sporting goods retailer is struggling with the slow-down in store traffic, as the challenging macroeconomic conditions continue to pressurize consumer discretionary spending.

The company is implementing additional measures aimed at aligning the overall expense structure with current sales trends. Furthermore, a more aggressive and strategic approach to promotional activities is being pursued to increase in-store traffic and make the most of the omni-channel platform in delivering an industry-leading product range to consumers.

Sportsman's Warehouse Holdings, Inc. Price, Consensus and EPS Surprise

Sportsman's Warehouse Holdings, Inc. price-consensus-eps-surprise-chart | Sportsman's Warehouse Holdings, Inc. Quote

Let’s Delve Deeper

Sportsman's Warehouse posted an adjusted loss of 4 cents per share in the fiscal second quarter, which missed the Zacks Consensus Estimate of earnings of 2 cents per share. The company recorded earnings of 36 cents per share in the year-ago period.

Net sales were $309.5 million, down 11.8% year over year. The top line also missed the Zacks Consensus Estimate of $321 million. Also, same store sales decreased 16.1% year over year. Our model predicted same store sales to decline 13.5% in the second quarter of fiscal 2023.

The decrease in net sales and same store sales was mainly due to reduced demand across all product categories and a decline in store traffic, which stemmed from the persistent influence of consumer inflationary pressures on discretionary spending.

Image Source: Zacks Investment Research

Gross profit amounted to $100.8 million, down 14.2% from $117.5 million reported in the year-ago quarter. Also, the gross margin contracted 90 bps to 32.6% from the prior-year period’s level. This was primarily driven by a greater portion of sales from promotional activities and reduced product margins in its ammunition category.

Selling and administrative expenses rose 5.5% to $102.3 million. As a percentage of net revenues, selling and administrative expenses increased 550 bps to 33.1% in the second quarter of fiscal 2023. This was largely due to an increase in rent, depreciation and new store pre-opening expenses, primarily related to the opening of 14 new stores since Jul 30, 2022.

Adjusted EBITDA amounted to $13.1 million, down 57.2% from $30.6 million reported in the year-ago quarter.

Other Financial Details

Sportsman's Warehouse ended the quarter with net debt of $200.2 million, comprised of $2.9 million of cash and cash equivalents and $203.1 million of borrowings outstanding under the company’s revolving credit facility. Total stockholders' equity was $272.7 million at the end of the quarter under review.

Guidance

For third-quarter fiscal 2023, Sportsman's Warehouse anticipates net sales to be in the range of $310-$330 million, expecting same store sales to be down 14-19% year over year.

The company’s loss per share estimate for the third quarter of fiscal 2023 lies in the range of 5-20 cents.

SPWH is committed to streamlining expenses for increased efficiency, with potential annualized savings of up to $25 million.

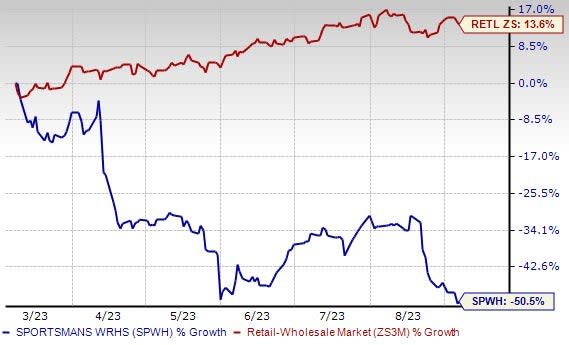

Shares of this Zacks Rank #4 (Sell) company have fallen 50.5% in the past six months against the industry's growth of 13.6%.

Stocks to Consider

A few better-ranked stocks are Urban Outfitters, Inc. URBN, Abercrombie & Fitch Co. ANF and Crocs, Inc. CROX.

Urban Outfitters, which specializes in the retail and wholesale of general consumer products, sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s expected EPS growth rate for three to five years is 23.8%.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year earnings and sales indicates growth of 81.7% and 6.6% from the year-ago period’s reported figures. URBN has a trailing four-quarter average earnings surprise of 19.2%.

Abercrombie & Fitch Co. operates as a specialty retailer of premium, high-quality casual apparel. The company currently sports a Zacks Rank #1. ANF delivered a significant earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 10.1% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 724.8%.

Crocs is one of the leading footwear brands with a focus on comfort and style. It currently carries a Zacks Rank #2 (Buy). CROX delivered an earnings surprise of 20.5% in the last reported quarter.

The Zacks Consensus Estimate for Crocs’ current financial-year earnings and sales indicates growth of 11.2% and 12.9%, respectively, from the previous year’s reported numbers. CROX has a trailing four-quarter average earnings surprise of 19.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Sportsman's Warehouse Holdings, Inc. (SPWH) : Free Stock Analysis Report