Spotting Winners: Noodles (NASDAQ:NDLS) And Modern Fast Food Stocks In Q3

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the modern fast food stocks, starting with Noodles (NASDAQ:NDLS).

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 6 modern fast food stocks we track reported a very strong Q3; on average, revenues beat analyst consensus estimates by 1.2% Investors abandoned cash-burning companies to buy stocks with higher margins of safety, but modern fast food stocks held their ground better than others, with the share prices up 24.8% on average since the previous earnings results.

Noodles (NASDAQ:NDLS)

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ:NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

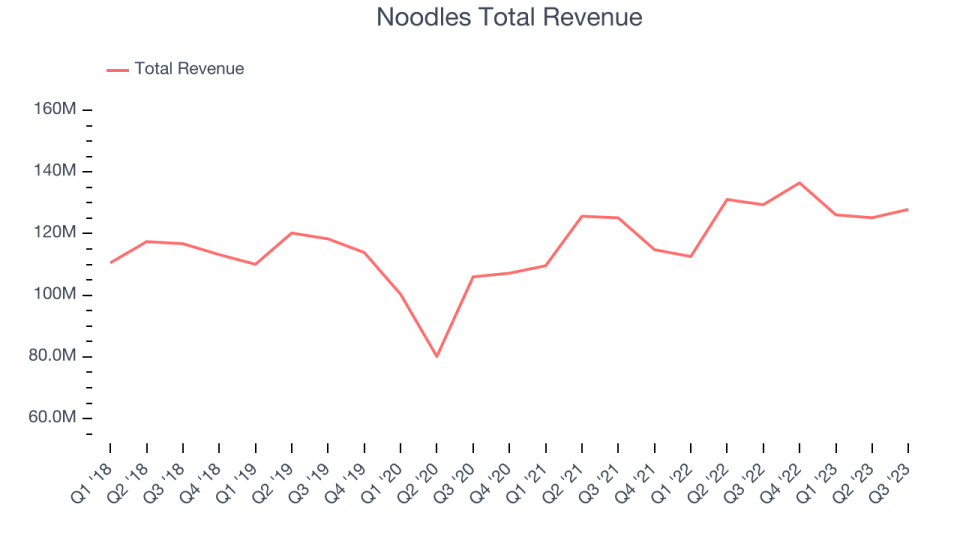

Noodles reported revenues of $127.9 million, down 1.2% year on year, topping analyst expectations by 1.4%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

“Noodles & Company made meaningful traction during the third quarter, evidenced by 200 bps of restaurant contribution margin expansion to 16.4% and nearly 20% growth in Adjusted EBITDA relative to the third quarter of the prior year,” said Dave Boennighausen, Chief Executive Officer of Noodles & Company.

Noodles scored the highest full-year guidance raise but had the slowest revenue growth of the whole group. The stock is up 14.7% since the results and currently trades at $2.53.

Is now the time to buy Noodles? Access our full analysis of the earnings results here, it's free.

Best Q3: Wingstop (NASDAQ:WING)

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Wingstop reported revenues of $117.1 million, up 26.4% year on year, outperforming analyst expectations by 7.3%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue, adjusted EBITDA and EPS estimates.

Wingstop pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 49.7% since the results and currently trades at $273.64.

Is now the time to buy Wingstop? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Sweetgreen (NYSE:SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $153.4 million, up 23.7% year on year, falling short of analyst expectations by 0.8%. It was a weak quarter for the company, with a miss of analysts' earnings estimates and full-year revenue guidance missing analysts' expectations.

Sweetgreen had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is down 6.3% since the results and currently trades at $10.34.

Read our full analysis of Sweetgreen's results here.

Shake Shack (NYSE:SHAK)

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $276.2 million, up 21.2% year on year, in line with analyst expectations. It was an impressive quarter for the company, with an solid beat of analysts' adjusted EBITDA and EPS estimates.

The stock is up 15.6% since the results and currently trades at $66.09.

Read our full, actionable report on Shake Shack here, it's free.

Potbelly (NASDAQ:PBPB)

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ:PBPB) today is a chain known for its toasty sandwiches.

Potbelly reported revenues of $120.8 million, up 2.7% year on year, falling short of analyst expectations by 0.7%. It was a mixed quarter for the company, with an impressive beat of analysts' adjusted EBITDA and EPS expectations. On the other hand, its revenue missed Wall Street's estimates, driven by its underperformance in same-store sales.

The stock is up 46.9% since the results and currently trades at $12.9.

Read our full, actionable report on Potbelly here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned