Spotting Winners: Pegasystems (NASDAQ:PEGA) And Automation Software Stocks In Q2

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the automation software stocks, including Pegasystems (NASDAQ:PEGA) and its peers.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported a weak Q2; on average, revenues were in line with analyst consensus estimates while next quarter's revenue guidance was 1.13% below consensus. Tech valuation multiples have reverted to their historical means after reaching highs in early 2021, and automation software stocks have not been spared, with share prices down 13.6% on average, since the previous earnings results.

Weakest Q2: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

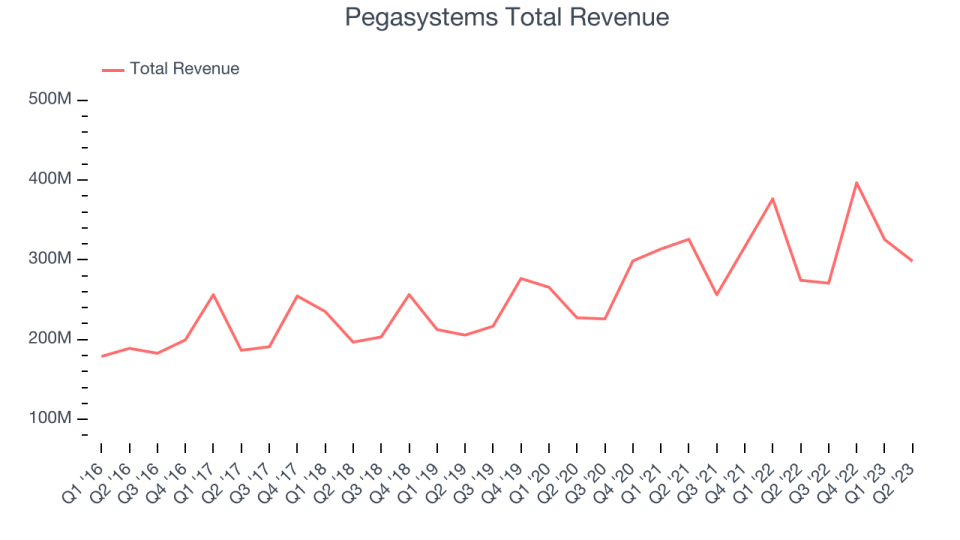

Pegasystems reported revenues of $298.3 million, up 8.72% year on year, falling short of analyst expectations by 3.98%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its gross margin.

"In this uncertain and changing environment, focusing on client success is more important than ever," said Alan Trefler, founder and CEO.

Pegasystems delivered the weakest performance against analyst estimates of the whole group. The stock is down 22.7% since the results and currently trades at $42.37.

Read our full report on Pegasystems here, it's free.

Best Q2: Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $127.7 million, up 16% year on year, outperforming analyst expectations by 3.15%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but a decline in its gross margin.

Appian achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 11.2% since the results and currently trades at $42.77.

Is now the time to buy Appian? Access our full analysis of the earnings results here, it's free.

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $110.6 million, up 7.36% year on year, in line with analyst expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

Everbridge had the slowest revenue growth and weakest full-year guidance update in the group. The stock is down 27.5% since the results and currently trades at $21.13.

Read our full analysis of Everbridge's results here.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy, who wrote the code for the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $2.15 billion, up 22.7% year on year, in line with analyst expectations. It was a mixed quarter for the company,

ServiceNow delivered the fastest revenue growth among its peers. The company added 42 enterprise customers paying more than $1m annually to reach a total of 1,724. The stock is down 2.26% since the results and currently trades at $563.41.

Read our full, actionable report on ServiceNow here, it's free.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $287.3 million, up 18.6% year on year, surpassing analyst expectations by 1.86%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but a decline in its gross margin.

The stock is up 2.39% since the results and currently trades at $16.55.

Read our full, actionable report on UiPath here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned