Spotting Winners: Spectrum Brands (NYSE:SPB) And Household Products Stocks In Q3

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Spectrum Brands (NYSE:SPB) and the rest of the household products stocks fared in Q3.

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

The 10 household products stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 1.9% Stocks have faced challenges as investors prioritize near-term cash flows, but household products stocks held their ground better than others, with the share prices up 7% on average since the previous earnings results.

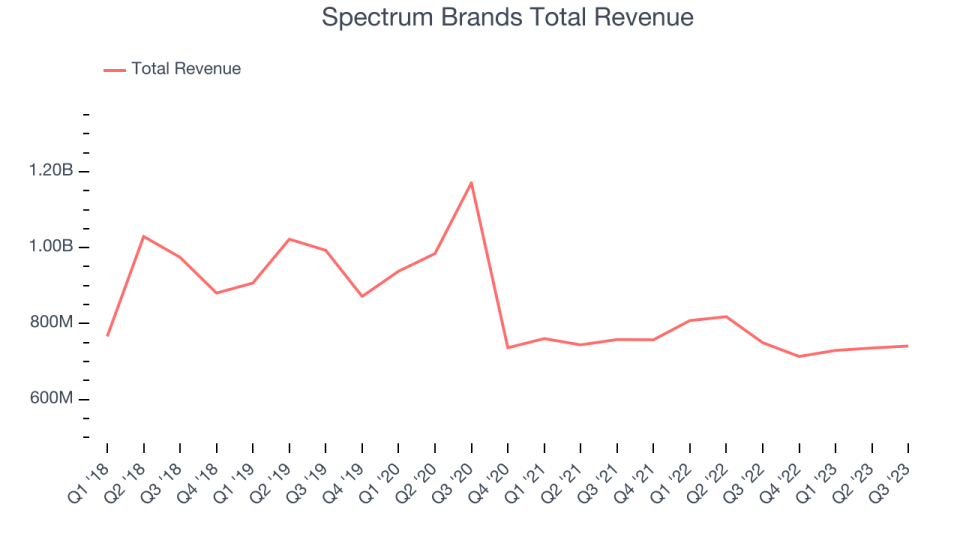

Spectrum Brands (NYSE:SPB)

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $740.7 million, down 1.2% year on year, in line with analyst expectations. It was a mixed quarter for the company, with Adjusted EBITDA and EPS exceeding expectations. That stood out as a positive in these results. The company's fiscal 2024 outlook was mixed, with revenue missing but Adjusted EBITDA guided above.

“We have concluded a pivotal year for the business as we close out our fourth quarter. We have already paid down $1.6 billion of our outstanding debt with the proceeds from the sale of our HHI business and have ended the year in a net cash position. We have reduced our inventory by over $300 million since the beginning of the year while improving fill rates across all businesses. We have also improved our margin structure by driving cost improvements and exiting non-core unproductive categories. With the latest financial results for the quarter, we have started to transition our business from defending against the various headwinds and preserving cash to leaning into the opportunities that a strong balance sheet and improved margins present to us,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

The stock is up 1.9% since the results and currently trades at $78.36.

Read our full report on Spectrum Brands here, it's free.

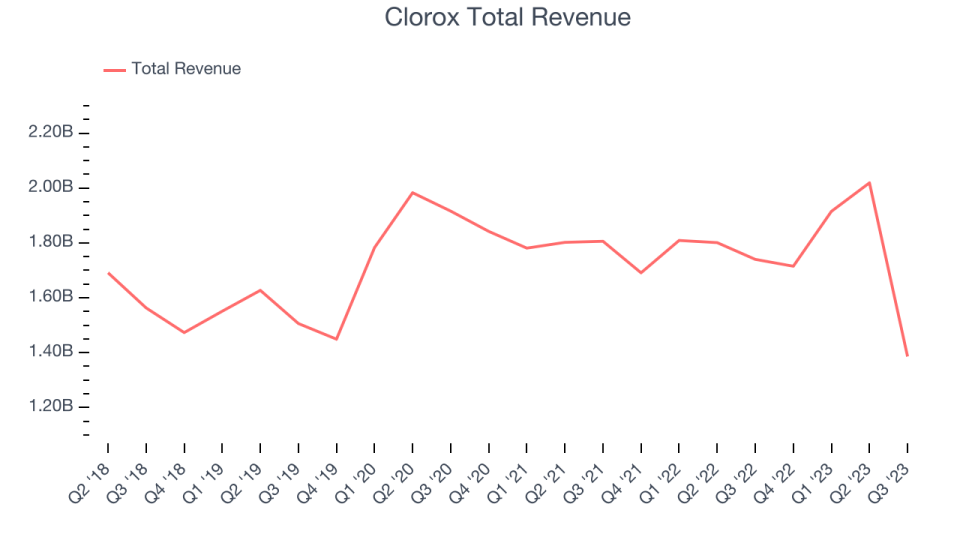

Best Q3: Clorox (NYSE:CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox reported revenues of $1.39 billion, down 20.3% year on year, outperforming analyst expectations by 5.8%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

Clorox scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 24.8% since the results and currently trades at $143.99.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $750.1 million, up 6% year on year, exceeding analyst expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' adjusted EBITDA, and EPS estimates.

The stock is up 7.8% since the results and currently trades at $47.27.

Read our full analysis of Central Garden & Pet's results here.

Colgate-Palmolive (NYSE:CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $4.92 billion, up 10.3% year on year, surpassing analyst expectations by 2.1%. It was a mixed quarter for the company, with an impressive beat of analysts' revenue estimates. On the other hand, its EPS missed analysts' expectations and its operating margin missed Wall Street's estimates.

The stock is up 9.9% since the results and currently trades at $80.29.

Read our full, actionable report on Colgate-Palmolive here, it's free.

Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $811.1 million, up 2.6% year on year, surpassing analyst expectations by 2.1%. It was a weaker quarter for the company as guidance for Q1'24 and full year 2024 adjusted EPS missed expectations.

The stock is down 6.2% since the results and currently trades at $31.59.

Read our full, actionable report on Energizer here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned