Spotting Winners: Udemy (NASDAQ:UDMY) And Consumer Subscription Stocks In Q3

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the consumer subscription stocks, starting with Udemy (NASDAQ:UDMY).

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 7 consumer subscription stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 2.5% while next quarter's revenue guidance was 0.8% below consensus. Inflation (despite slowing) has investors prioritizing near-term cash flows, but consumer subscription stocks held their ground better than others, with the share prices up 21.7% on average since the previous earnings results.

Udemy (NASDAQ:UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ:UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

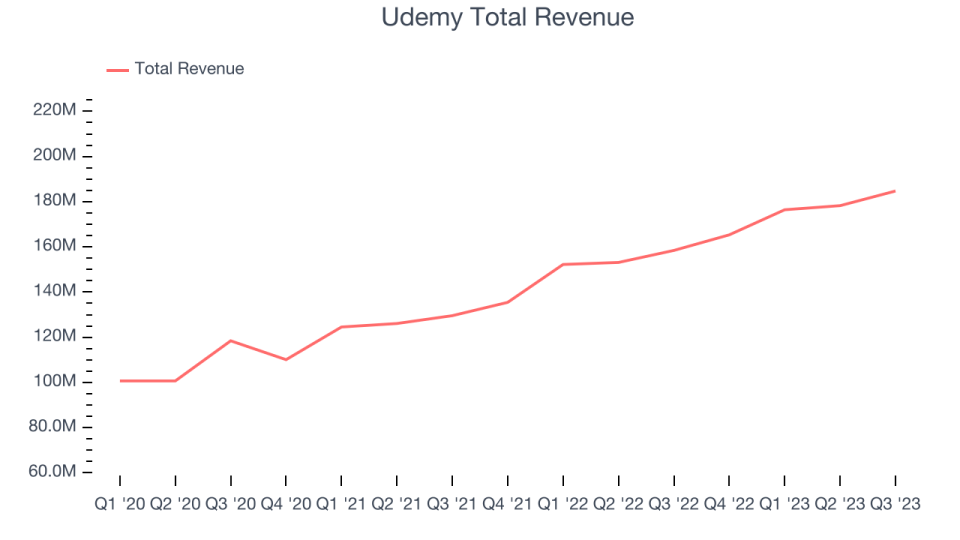

Udemy reported revenues of $184.7 million, up 16.6% year on year, topping analyst expectations by 3.6%. It was a good quarter for the company, with a decent beat of analysts' revenue estimates but slow revenue growth.

“Udemy delivered strong results that exceeded our expectations for top-line growth, and we delivered our second consecutive quarter of positive adjusted EBITDA and free cash flow,” said Greg Brown, Udemy’s President and CEO.

Udemy delivered the weakest full-year guidance update of the whole group. The company reported 1.41 million active buyers, up 6.8% year on year. The stock is up 47.4% since the results and currently trades at $13.29.

Is now the time to buy Udemy? Access our full analysis of the earnings results here, it's free.

Best Q3: Roku (NASDAQ:ROKU)

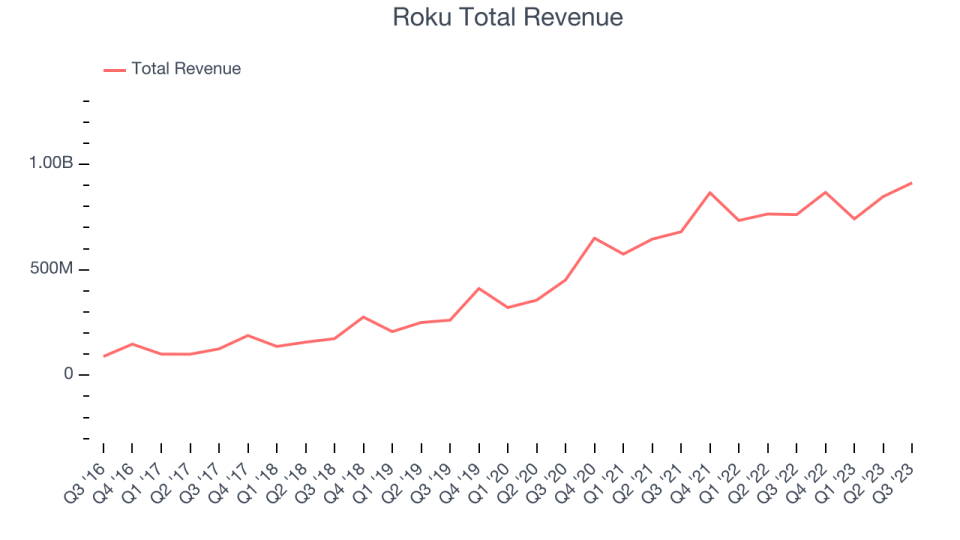

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $912 million, up 19.8% year on year, outperforming analyst expectations by 6.6%. It was a very good quarter for the company, with a solid beat of analysts' revenue estimates and strong growth in its user base.

Roku scored the biggest analyst estimates beat among its peers. The company reported 75.8 million monthly active users, up 15.9% year on year. The stock is up 45.9% since the results and currently trades at $87.11.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Match Group (NASDAQ:MTCH)

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

Match Group reported revenues of $881.6 million, up 8.9% year on year, in line with analyst expectations. It was a mixed quarter for Match. Its revenue beat analysts' expectations, driven by better-than-expected ARPU. That growth, however, was offset by year-on-year subscriber churn. This churn can be attributed to management's significant price increases, a new strategy the team implemented at the start of the year. Its subscribers did increase sequentially, however, showing that the initial shock from Match's price increase could be stabilizing. Management has also taken measures to make the company more efficient, enabling it to beat Wall Street's adjusted operating income and EPS estimates.

The stock is up 4.5% since the results and currently trades at $36.15.

Read our full analysis of Match Group's results here.

Chegg (NYSE:CHGG)

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $157.9 million, down 4.2% year on year, surpassing analyst expectations by 3.8%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

Chegg had the slowest revenue growth among its peers. The company reported 4.4 million users, down 8.3% year on year. The stock is up 10.5% since the results and currently trades at $9.8.

Read our full, actionable report on Chegg here, it's free.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $8.54 billion, up 7.8% year on year, in line with analyst expectations. It was a strong quarter for the company, with revenue roughly in line with expectations. In addition, streaming net adds (essentially its paying customers) beat across all geographies.

The company reported 247.2 million users, up 10.8% year on year. The stock is up 39.7% since the results and currently trades at $483.5.

Read our full, actionable report on Netflix here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned