Spotting Winners: Williams-Sonoma (NYSE:WSM) And Home Furniture Retailer Stocks In Q2

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how the home furniture retailer stocks have fared in Q2, starting with Williams-Sonoma (NYSE:WSM).

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

The 4 home furniture retailer stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 2.53% while next quarter's revenue guidance was 3.22% below consensus. Higher interest rates have hurt growth companies as investors search for near-term cash flows, and home furniture retailer stocks have not been spared, with share prices down 19.4% on average, since the previous earnings results.

Slowest Q2: Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

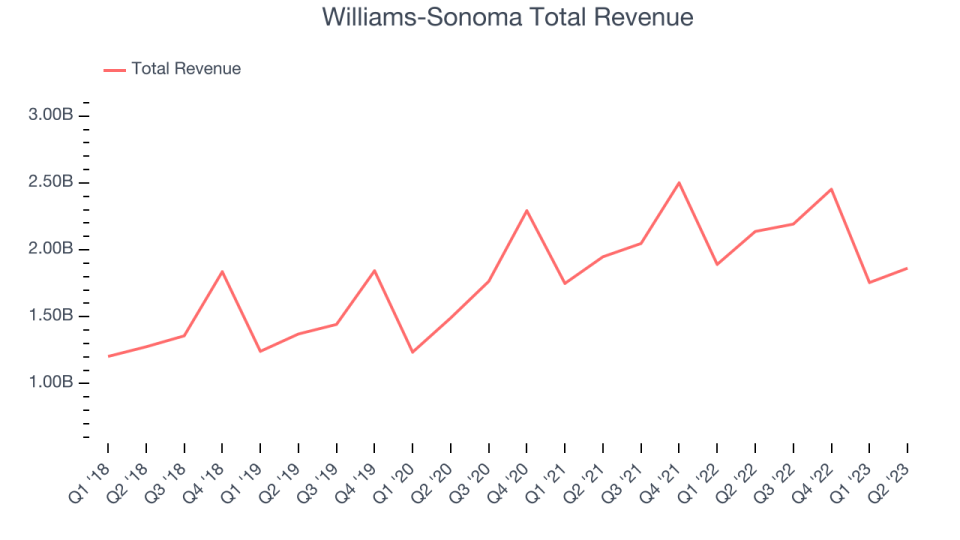

Williams-Sonoma reported revenues of $1.86 billion, down 12.9% year on year, falling short of analyst expectations by 4.81%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a miss of analysts' gross margin estimates.

“We are pleased to deliver another quarter of strong earnings. We significantly exceeded profitability estimates with an operating margin of 14.6% with earnings per share of $3.12, well-above our pre-pandemic results. Our sales ran -11.9% in Q2, but our 2-year comp was essentially flat, and our 4-year comp to 2019 was +39.7%. We achieved these results against an increasingly promotional environment and softening industry metrics by focusing on regular price selling, driving improved customer service and controlling costs,” said Laura Alber, President and Chief Executive Officer.

Williams-Sonoma delivered the weakest performance against analyst estimates of the whole group. The stock is up 25.3% since the results and currently trades at $156.85.

Read our full report on Williams-Sonoma here, it's free.

Best Q2: RH (NYSE:RH)

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

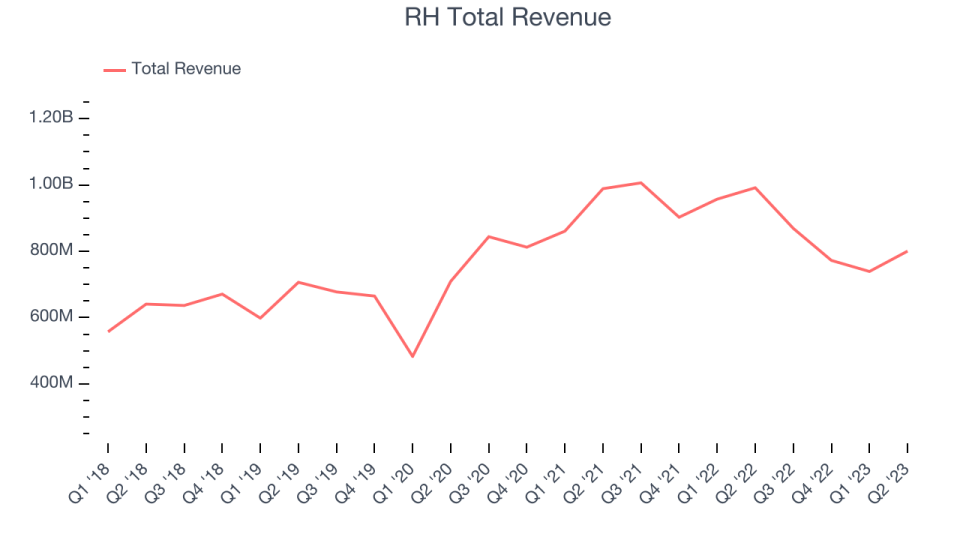

RH reported revenues of $800.5 million, down 19.3% year on year, outperforming analyst expectations by 1.84%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' gross margin estimates.

RH delivered the biggest analyst estimates beat but had the slowest revenue growth and slowest revenue growth among its peers. The stock is down 37.8% since the results and currently trades at $229.38.

Is now the time to buy RH? Access our full analysis of the earnings results here, it's free.

Arhaus (NASDAQ:ARHS)

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ:ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Arhaus reported revenues of $312.9 million, up 2.17% year on year, falling short of analyst expectations by 4.49%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a miss of analysts' gross margin estimates.

Arhaus pulled off the fastest revenue growth and highest full-year guidance raise in the group. The stock is down 22.9% since the results and currently trades at $8.95.

Read our full analysis of Arhaus's results here.

Sleep Number (NASDAQ:SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $458.8 million, down 16.4% year on year, falling short of analyst expectations by 2.67%. It was a weaker quarter for the company, with a miss of analysts' gross margin estimates and a miss of analysts' revenue estimates.

The stock is down 42.5% since the results and currently trades at $22.13.

Read our full, actionable report on Sleep Number here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned