Sprouts Farmers Market Inc Reports Solid Growth in Q4 and Full Year 2023 Earnings

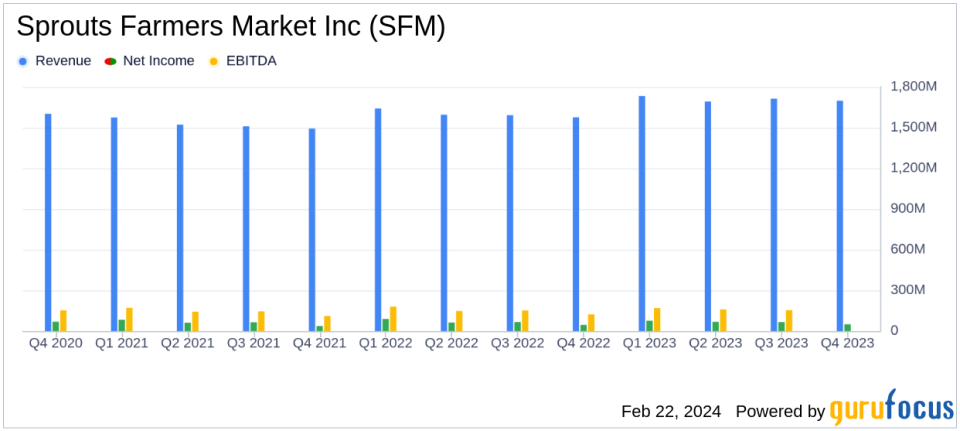

Net Sales: $1.7 billion in Q4, an 8% increase year-over-year; $6.8 billion for full year, a 7% increase from 2022.

Comparable Store Sales Growth: 3.3% in Q4; 3.4% for full year.

Diluted Earnings Per Share (EPS): $0.49 in Q4, up from $0.42 in the same period in 2022; $2.50 for full year, with adjusted EPS of $2.84.

New Stores: Opened 30 new stores and acquired 2, closed 11, ending the year with 407 stores.

Liquidity: Ended the year with $202 million in cash and cash equivalents.

Share Repurchase: Bought back 5.9 million shares for $203 million, excluding excise tax.

Capital Expenditures: Invested $213 million in capital expenditures, net of landlord reimbursement.

Sprouts Farmers Market Inc (NASDAQ:SFM) released its 8-K filing on February 22, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading American specialty grocer known for its fresh and naturally derived products, has demonstrated resilience and growth amidst a challenging retail environment. With a strong focus on produce, which constituted around 20% of sales in fiscal 2022, and a significant presence in the southern United States, Sprouts has continued to expand its footprint, ending the year with 407 stores across 23 states.

CEO Jack Sinclair expressed confidence in the company's strategy and team, which have led to exceeding original expectations for 2023. The fourth quarter saw net sales of $1.7 billion, marking an 8% increase from the same period in 2022. The full year net sales reached $6.8 billion, a 7% increase from the previous year. Comparable store sales growth was steady at 3.3% for the quarter and 3.4% for the year, indicating a positive reception from customers and a strong competitive position in the specialty retail market.

The company's financial achievements, including a diluted EPS of $0.49 for the quarter and $2.50 for the full year, with an adjusted EPS of $2.84, reflect its operational efficiency and ability to navigate market fluctuations. The opening of 30 new stores and the acquisition of 2 additional ones underscore Sprouts' commitment to growth and market penetration. However, the closure of 11 stores also points to strategic adjustments to maintain a strong portfolio of locations.

Financial Health and Future Outlook

Sprouts ended the year with a solid balance sheet, including $202 million in cash and cash equivalents. The company's leverage and liquidity position are further supported by a $125 million balance on its $700 million revolving credit facility. The repurchase of 5.9 million shares of common stock for $203 million, excluding excise tax, demonstrates Sprouts' commitment to returning value to shareholders and confidence in its long-term prospects.

For the upcoming year, Sprouts anticipates continued growth with net sales expected to increase by 5.5% to 7.5% and comparable store sales growth projected to be between 1.5% and 3.5%. The company also plans to open approximately 35 new stores and expects capital expenditures, net of landlord reimbursements, to be between $225 million and $245 million.

Overall, Sprouts Farmers Market Inc (NASDAQ:SFM) has delivered a robust financial performance for the fourth quarter and full year of 2023, with strategic store expansions and solid sales growth. The company's focus on fresh, natural, and organic products continues to resonate with consumers, positioning it well for continued success in the competitive specialty grocery market.

Explore the complete 8-K earnings release (here) from Sprouts Farmers Market Inc for further details.

This article first appeared on GuruFocus.