Sprouts Farmers (SFM) Poised on Customer-Centric Approach

Sprouts Farmers Market, Inc. SFM is diligently working toward creating a robust and integrated customer experience. The company is focusing on expanding its customer base through a multi-faceted approach that includes product innovation, enhanced customer experiences, targeted marketing featuring everyday great pricing, and technological advancements.

In response to the growing demand for convenience, the company is also diversifying its product offerings to include ready-to-eat, ready-to-heat and ready-to-cook items. Additionally, SFM is expanding its private-label portfolio across various departments.

Strategic partnerships with Instacart and DoorDash enabled the company to tap into new marketplaces, thereby fortifying its e-commerce growth. Evidencing the success of these efforts, e-commerce sales witnessed a substantial 16% rise in the third quarter of 2023, constituting 12.1% of the total sales for the period.

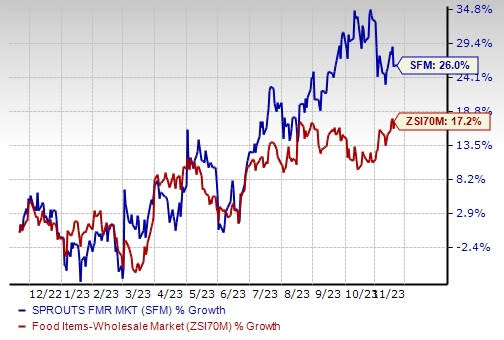

Image Source: Zacks Investment Research

Expanding Footprint

Aggressively pursuing revenue enhancement strategies, this Zacks Rank #3 (Hold) company expanded its footprint in the third quarter of 2023 by inaugurating 10 stores. The company has an ambitious plan to launch 30 stores in 2023, with an additional 35 stores slated for 2024, with the majority scheduled for the latter half of the year.

Emphasizing smaller store prototypes, this strategic shift is geared toward greater profitability, particularly in key areas such as produce and frozen goods, amplifying the potential for increased sales. These initiatives align seamlessly with Sprouts Farmers' overarching objective of achieving an annual unit growth rate of 10%, beginning in 2024.

Promising Outlook

Buoyed by a commendable third-quarter performance, Sprouts Farmers unveils an optimistic outlook for 2023. Anticipating a 3% increase in comparable store sales and robust 6.5-7% growth in net sales, the company's management has revised its adjusted earnings before interest and taxes guidance to $387-$393 million, marking an upward adjustment from the previously stated $378-$390 million.

This forecast indicates an 8.6% year-over-year increase in adjusted operating income. Furthermore, Sprouts Farmers expects full-year adjusted earnings per share to be $2.77-$2.81, indicating a substantial rise from the $2.39 reported in 2022.

This specialty food retailer, which curates products with attributes appealing to the health enthusiast customer, has seen its shares outpace the Zacks Food-Natural Foods Products industry in the past year. In the said period, the stock has rallied 26% compared with the industry’s rise of 17.2%.

3 Promising Stocks

We have highlighted three better-ranked stocks, namely Ollie's Bargain Outlet Holdings, Inc. OLLI, Ross Stores Inc. ROST and Sovos Brands Inc. SOVO.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and EPS suggests growth of 14.2% and 67.9%, respectively, from the year-ago reported figures. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

Ross Stores is an off-price retailer of apparel and home accessories. The company currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 7.2% and 21.7%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 7.8%, on average.

Sovos Brands is a food company. Its brand portfolio includes Rao's, a premium line of pasta sauces, pizza sauces, dry pastas, frozen entrees and soups. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Sovos Brands’ current financial-year sales and earnings suggests growth of 13.4% and 23.3%, respectively, from the year-ago reported numbers. SOVO has a trailing four-quarter earnings surprise of 21.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Sovos Brands, Inc. (SOVO) : Free Stock Analysis Report