Sprouts Farmers (SFM) Poised on Healthy Products & Expansion

Sprouts Farmers Market, Inc. SFM has been gaining from its efforts to improve in-store and online customer experience. This includes the launch of a prototype store design that is more efficient and customer-friendly, as well as investments in digital marketing aimed at driving more shopping occasions with target customers.

SFM is dedicated to a gradual expansion of its store network. With the goal of achieving an annual unit growth rate of 10%, the company is well-positioned to boost its market presence. As it looks forward to the launch of 30 stores in 2023, the company is reaffirming its steadfast commitment to strengthening its competitive advantage.

Sprouts Farmers has made substantial investments in the expansion of its exclusive label products, with a specific focus on departments such as the Sprouts Market Corner Deli and The Butcher Shop. The strong emphasis on private-label merchandise not only distinguishes the company from its rivals but also cultivates customer loyalty by providing distinctive, high-quality goods. In the second quarter of 2023, Sprouts brand product sales rose 12% year over year, accounting for 20% of the total sales.

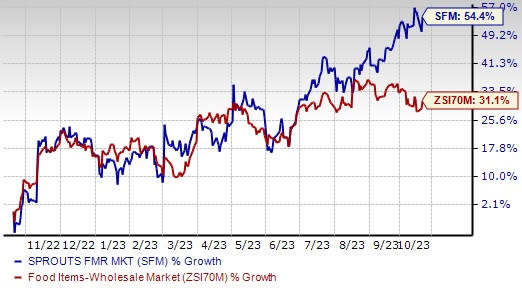

Image Source: Zacks Investment Research

Improved Supply Chain and E-commerce Efficiency

SFM is working on creating a faster and more efficient supply chain. It operates distribution centers strategically, with 85% of its stores located within 250 miles of these centers. The introduction of a store format is helping it reduce costs and improve profitability.

The company is investing in omni-channel capabilities by partnering with Instacart and DoorDash. This allows it to enter new marketplaces and strengthen its e-commerce presence. The company’s e-commerce sales grew 16% year over year in the quarter, representing 12.1% of the total sales.

However, SFM observed an 8% year-over-year rise in selling, general, and administrative expenses, reaching $498 million in the second quarter of 2023, driven by the expansion of new stores and higher e-commerce fees.

Wrapping Up

With unwavering determination, Sprouts Farmers has been reshaping its strategies and enhancing its capabilities to maintain a leading position. The company has established bullish financial forecasts that underscore its confidence in these strategic endeavors.

For 2023, Sprouts Farmers anticipates a 5-6% net sales rise and 2-3% comparable store sales growth. The Zacks Rank #3 (Hold) company envisions full-year adjusted earnings per share between $2.68 and $2.76, marking a substantial increase from the $2.39 reported in 2022.

This specialty food retailer, which curates products with attributes appealing to the health enthusiast customer, has seen its shares outpace the Zacks Food-Natural Foods Products industry in the past year. In the said period, the stock has rallied 54.4% compared with the industry’s rise of 31.1%.

3 Promising Stocks

We have highlighted three better-ranked stocks, namely Ollie's Bargain Outlet Holdings, Inc. OLLI, Ross Stores Inc. ROST and Walmart Inc. WMT.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and EPS suggests growth of 14.1% and 67.3%, respectively, from the year-ago reported figures. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

Ross Stores is an off-price retailer of apparel and home accessories. The company currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 7.1% and 19.4%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 5% and 2.2%, respectively, from the year-ago reported numbers. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report