Sprouts Farmers (SFM) to Post Q3 Results: A Peek Into Comps

Market watchers are eagerly awaiting Sprouts Farmers Market, Inc.’s SFM third-quarter 2023 earnings results, scheduled to be reported on Oct 31 before market open. This time too, investors’ focus will center around comparable store sales, the key metric to gauge the company’s performance.

We believe Sprouts Farmers’ commitment to offering unique in-store and online experiences, differentiated products and superior customer service is expected to drive third-quarter results.

Insights Into Comparable Sales

Building on the solid 3.2% growth in comparable store sales achieved in the second quarter, Sprouts Farmers is expected to maintain its positive momentum. While the second quarter witnessed a slight decrease in the number of items in the basket due to retail inflation, the third quarter is anticipated to see a gradual tapering of year-over-year price inflation and unit declines. This steady performance is a testament to Sprouts Farmers' strategic approach to customer engagement and product differentiation.

Sprouts Farmers strategically concentrates on key categories such as grocery, bakery, dairy and proteins, which have consistently performed well. This focus aligns with the preferences of the company’s health-conscious customer base. We expect to see these categories continue to be the driving force behind the company's success.

Sprouts Farmers’ private-label brand has been a major growth driver, and we expect the company to have registered further growth in this area, thanks to its unique and quality offerings. The private label represents roughly 20% of total sales, a testament to the value placed on product differentiation.

Cumulatively, the aforementioned factors are likely to have favorably impacted the top line. On its last earnings call, Sprouts Farmers guided a low-single-digit increase in comparable store sales for the third quarter. We expect comparable store sales growth of 2% for the quarter under review.

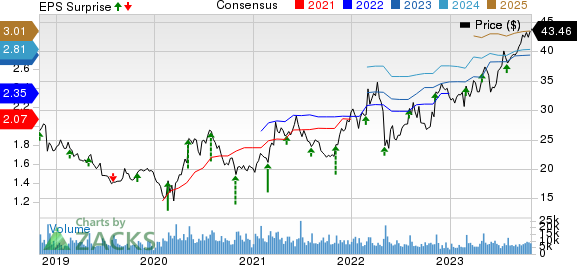

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

How Are Estimates Shaping Up?

The favorable trends observed in the second quarter, including decent comparable store sales growth and successful e-commerce initiatives, are anticipated to have persisted in the third quarter, positioning Sprouts Farmers for continued success in a dynamic retail environment.

The Zacks Consensus Estimate for revenues stands at $1,681 million, indicating an increase of 5.6% from the prior-year reported figure. The consensus mark for earnings per share has been stable at 62 cents over the past 30 days. The figure suggests growth of roughly 1.6% from the year-ago period.

Sprouts Farmers has an Earnings ESP of +4.26% and a Zacks Rank #2. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 More Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Build-A-Bear Workshop BBW currently has an Earnings ESP of +0.66% and sports a Zacks Rank #1. The Zacks Consensus Estimate for third-quarter fiscal 2023 earnings per share is pegged at 51 cents, flat year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Build-A-Bear Workshop’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $107.6 million, which indicates an increase of 3% from the figure reported in the prior-year quarter. BBW has a trailing four-quarter earnings surprise of 21.6%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +2.19% and a Zacks Rank of 3. The company is likely to register a decrease in the bottom line when it reports third-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.98 suggests a decline of 6.7% from the year-ago reported number.

Ulta Beauty’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.48 billion, which suggests an increase of 6.1% from the prior-year quarter. ULTA has a trailing four-quarter earnings surprise of 12.9%, on average.

The Home Depot HD currently has an Earnings ESP of +0.63% and a Zacks Rank #3. The company is expected to register a bottom-line decline when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $3.80 suggests a drop of 10.4% from the year-ago quarter.

Home Depot’s top line is anticipated to decline year over year. The consensus mark for revenues is pegged at $37.71 billion, indicating a decline of 3% from the figure reported in the year-ago quarter. HD has a trailing four-quarter earnings surprise of 2.2%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report