Sprouts Farmers (SFM) Q1 Earnings Beat, Sales Increase Y/Y

Sprouts Farmers Market, Inc. SFM maintained its positive earnings surprise streak in first-quarter 2022. The renowned grocery retailer delivered quarterly earnings of 79 cents a share that beat the Zacks Consensus Estimate of 72 cents, thus marking the 11th straight beat. Impressively, the bottom line increased from 70 cents reported in the year-ago period.

Net sales of this Phoenix, AZ-based company were $1,641.2 million, up 4% from the prior-year quarter. The growth was driven by sales from new stores opened in the last 12 months and a jump in comparable store sales. However, the top line fell short of the Zacks Consensus Estimate of $1,645 million, following a beat in the preceding quarter. We note that e-commerce sales were 11.5% of total sales.

Comparable store sales increased 1.6% during the quarter under review against a decline of 9.4% registered in the year-ago period. Comp transactions were positive for the quarter.

Despite transaction comp being positive, management remained concerned about inflationary pressure and its impact on consumers. Consequently, it has adopted a more conservative approach toward its 2022 guidance. Sprouts Farmers now foresees total sales growth, comparable store sales growth and earnings per share to be at the low end of the outlook provided in fourth-quarter 2021 earnings release.

Shares of this Zacks Rank #2 (Buy) company have risen roughly 28.6% in the past six months compared with the industry’s growth of 12.3%.

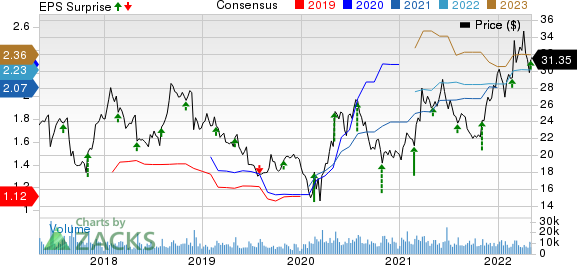

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

Margins

Gross profit rose 4% to $611.7 million due to higher sales volume. We note that gross margin increased 10 basis points to 37.3%.

The company reported EBIT of $119.6 million, up 6% from the year-ago period, while its EBIT margin rose 10 basis points to 7.3%. Meanwhile, EBITDA increased 5% to $152.4 million, while EBITDA margin expanded 10 basis points to 9.3%.

SG&A expenses jumped 5% year over year to $459.9 million, while the same, as a percentage of net sales, increased 10 basis points to 28%. The rise in SG&A expenses was driven by new stores opened since the prior-year period and increased store costs, such as utilities and supplies, due to inflation. These were partly offset by favorability in the timing of marketing spend.

Store Update

During the first quarter, the company opened six new stores and shuttered one, taking the total count to 379 stores in 23 states as of Apr 3, 2022. The company reiterated its plans to open 15 to 20 new stores in the current financial year.

Other Financial Aspects

Sprouts Farmers ended the quarter with cash and cash equivalents of $324.3 million, long-term debt and finance lease liabilities of $259.4 million and stockholders’ equity of $1,012 million. The company’s board authorized a new $600 million share buyback program. It repurchased 1.5 million shares for a total investment of $46 million in the first quarter.

The company generated cash from operations of $153 million and spent $22 million in capital expenditures net of landlord reimbursement, principally for new stores. Management projects capital expenditures (net of landlord reimbursements) to be $150-$170 million for 2022.

Outlook

Sprouts Farmers now envisions full-year total sales growth, comparable store sales growth and earnings per share to be at the low end of the outlook it provided during the earnings call in February. Management had earlier forecast net sales growth of 4-6% and comparable store sales growth in the range of 0-2% for 2022. It had projected earnings in the band of $2.14-$2.24 per share for the financial year.

For the second quarter, the company expects comparable stores sales growth to be relatively flat and earnings in the band of 49-53 cents a share. The current Zacks Consensus Estimate for the quarter is pegged at 57 cents.

3 More Hot Stocks

Here we highlight three other top-ranked stocks, namely, Kroger KR, Target TGT and Tractor Supply Company TSCO.

Kroger, the renowned grocery retailer, carries a Zacks Rank #2 at present. The company has an expected EPS growth rate of 9.9% for three-five years. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kroger’s current financial-year sales and EPS suggests growth of 2.4% and 1.9%, respectively, from the year-ago reported number. KR has a trailing four-quarter earnings surprise of 22.1%, on average.

General merchandise retailer Target currently carries a Zacks Rank #2. TGT has an expected EPS growth rate of 16.5% for three-five years.

The Zacks Consensus Estimate for Target’s current financial-year sales and EPS suggests growth of 3.7% and 7.3%, respectively, from the corresponding year-ago period’s levels. TGT has a trailing four-quarter earnings surprise of 21.3%, on average.

Tractor Supply Company, a rural lifestyle retailer in the United States, carries a Zacks Rank of 2 at present. TSCO has an expected EPS growth rate of 9.8% for three-five years.

The Zacks Consensus Estimate for Tractor Supply Company’s current financial-year sales and EPS suggests growth of 8.8% and 10.2%, respectively, from the corresponding year-ago period’s actuals. TSCO has a trailing four-quarter earnings surprise of 12.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research