Sprouts Farmers (SFM) Q4 Earnings Top, Comps Rise 3.3% Y/Y

Sprouts Farmers Market, Inc. SFM came up with fourth-quarter 2023 results, wherein the top and bottom lines not only increased year over year but also beat their respective Zacks Consensus Estimate. The company's results were favorably impacted by decent comparable sales, positive foot traffic trends, accelerating unit growth and increasing customer engagement.

Q4 in Details

The renowned grocery retailer delivered adjusted quarterly earnings of 49 cents a share, which beat the Zacks Consensus Estimate of 45 cents. Impressively, the bottom line increased 16.7% from the 42 cents reported in the year-ago period.

Net sales of this Phoenix, AZ-based company came in at $1,698.5 million, which came ahead of the Zacks Consensus Estimate of $1,690 million. The metric increased 7.7% on a year-over-year basis. The growth was driven by sales from the new stores and a jump in comparable store sales.

Comparable store sales increased 3.3% during the quarter under review, better than our estimate of a 3% jump. We note that e-commerce sales grew 17% and represented 12.4% of total sales in the quarter.

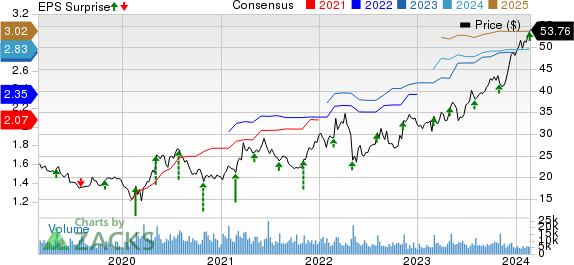

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

Margins

The adjusted gross profit rose 8.3% year over year to $620.4 million in the quarter. The adjusted gross margin expanded 20 basis points to 36.5% from the prior-year quarter. We had expected the gross margin to remain unchanged compared with the year-ago period.

Sprouts Farmers reported an adjusted operating income of $69.4 million, up from $61.9 million reported in the year-ago period. The adjusted operating margin increased 20 basis points to 4.1%. We had anticipated a 20-basis point contraction in the operating margin.

SG&A expenses increased 8.6% year over year to $513.5 million. As a percentage of net sales, the metric deleveraged 20 basis points to 30.2%. We had anticipated a 9.1% increase in SG&A expenses.

Store Update

During the quarter, Sprouts Farmers opened six new stores, thereby taking the total count to 407 stores in 23 states as of Dec 31, 2023. The company opened 30 new stores, acquired two previously licensed stores and closed 11 stores in 2023.

Sprouts Farmers Market is strategically expanding its store footprint, particularly focusing on smaller prototype formats, aiming to enhance accessibility to its differentiated assortment. It plans to open 35 new stores in 2024.

Other Financial Aspects

Sprouts Farmers ended the year with cash and cash equivalents of $201.8 million, long-term debt and finance lease liabilities of roughly $133.7 million and stockholders’ equity of $1,148.5 million. The company repurchased 5.9 million shares for a total investment of $203 million in 2023.

Sprouts Farmers generated cash from operations of $465 million and spent $213 million on capital expenditures, net of landlord reimbursement, last fiscal.

Management anticipates capital expenditures (net of landlord reimbursements) in the range of $225-$245 million for 2024. It plans to invest about $15 million in the development of a loyalty program.

Outlook

For the first quarter of 2024, Sprouts Farmers expects comparable store sales growth between 2.5% and 3.5% and adjusted earnings in the band of 98 cents-$1.02 per share compared with 98 cents reported in the year-ago period. The company anticipates additional SG&A pressure in the first quarter due to strategic initiative investments and the timing shift of holiday pay for New Year's Day.

Sprouts Farmers expects net sales growth of 5.5-7.5% and comparable store sales growth of 1.5% to 3.5% in 2024.

Sprouts Farmers guided adjusted earnings before interest and taxes between $397 million and $412 million for 2024. While the company projects a boost in the gross margin, it foresees continued pressure on SG&A due to ongoing wage increases and strategic investments, leading to further deleverage in 2024. Despite this, it expects full-year adjusted earnings in the range of $2.85-$2.95 per share, reflecting an increase from the $2.84 reported in 2023.

This Zacks Rank #2 (Buy) stock has risen 38% in the past six months compared with the industry’s growth of 20.3%.

3 Other Stocks Looking Red Hot

Casey's General Stores CASY, the third largest convenience retailer and fifth largest pizza chain in the United States, currently carries a Zacks Rank #2. CASY has a trailing four-quarter earnings surprise of 17.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Casey's current financial-year sales and earnings suggests growth of around 0.3% and 9%, respectively, from the year-ago reported numbers.

Vital Farms VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29% from the year-ago reported figure.

Costco Wholesale Corporation COST, which operates membership warehouses, currently carries a Zacks Rank #2. COST has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Costco’s current financial-year sales and earnings suggests growth of around 4.7% and 6.5%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report