SPX Technologies Inc (SPXC) Reports Strong Earnings Growth in Q4 and Full-Year 2023

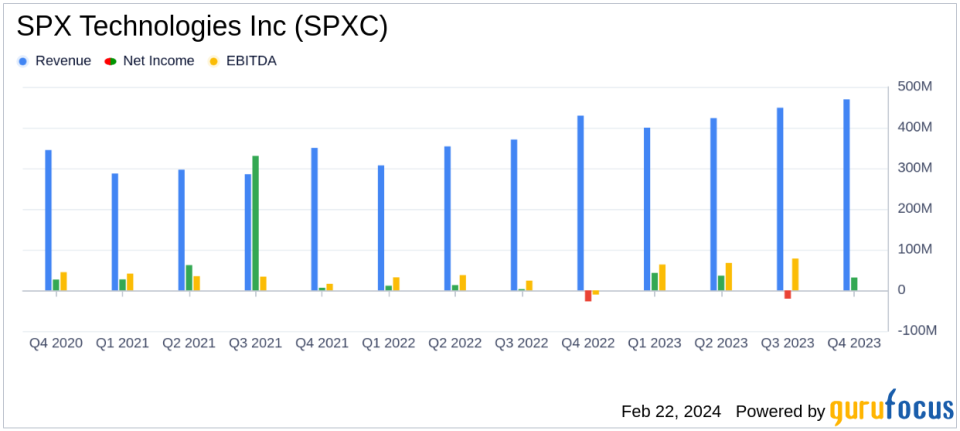

Revenue Growth: Q4 revenue increased to $469.4 million, up from $429.3 million in Q4 2022.

Operating Income: Operating income for Q4 2023 was $63.1 million, a significant turnaround from the operating loss of $(24.9) million in Q4 2022.

Net Income: Full-year GAAP net income soared to $89.9 million in 2023, compared with just $0.2 million in 2022.

Earnings Per Share (EPS): GAAP EPS for Q4 stood at $0.67, and full-year EPS was $3.10, up from $(0.55) and $0.43 respectively in the previous year.

Adjusted EPS: Q4 and full-year adjusted EPS were $1.25 and $4.31, showing growth from $1.17 and $3.10 in 2022.

2024 Guidance: SPX Technologies Inc (NYSE:SPXC) introduces full-year adjusted EPS guidance for 2024 in the range of $4.85-$5.15.

On February 22, 2024, SPX Technologies Inc (NYSE:SPXC) released its 8-K filing, detailing a robust financial performance for the fourth quarter and full year of 2023. The company, a leading supplier of engineered HVAC products, detection and measurement technologies, and power equipment, has demonstrated significant growth in revenue and profitability, particularly in its HVAC segment.

Company Overview

SPX Technologies Inc operates primarily in the American domestic market, with its HVAC segment delivering a standout performance. The segment's revenue for Q4 2023 was $312.5 million, a 14.0% increase from the previous year. Full-year revenue for the HVAC segment reached $1,122.3 million, marking a 22.8% increase from 2022. This growth is attributed to strategic acquisitions and robust customer demand, leading to record margin and profitability.

Financial Performance and Challenges

The company's financial achievements are underscored by a 50% growth in Adjusted EBITDA and a 39% increase in Adjusted EPS for the full year. These metrics are crucial for SPX Technologies Inc (NYSE:SPXC) as they reflect the company's operational efficiency and profitability, which are key indicators of success in the construction and engineering industry. However, challenges such as potential fluctuations in raw material costs and the competitive landscape could impact future performance.

Income Statement and Balance Sheet Highlights

SPX Technologies Inc (NYSE:SPXC) reported a strong balance sheet with total assets of $2,439.7 million as of December 31, 2023. The company's debt management is evident with total outstanding debt standing at $558.3 million against a cash position of $104.9 million. The ability to generate net operating cash from continuing operations of $243.8 million in 2023 demonstrates the company's solid cash flow management.

Looking Ahead

President and CEO Gene Lowe expressed confidence in the company's trajectory, stating:

"I am very pleased with our full-year 2023 results... Looking ahead we see continued demand strength in key markets and solid execution trends in our businesses, positioning us well to achieve another year of strong revenue and earnings growth."

For 2024, SPX Technologies Inc (NYSE:SPXC) anticipates Adjusted EBITDA in the range of $375 million to $405 million, reflecting approximately 25% growth at the midpoint, and Adjusted EPS in the range of $4.85 to $5.15, indicating 16% growth at the midpoint.

The company's full-year guidance and strategic acquisitions, such as the recent addition of Ingenia, suggest a continued focus on growth and market expansion. Investors and stakeholders can look forward to an Investor Day on March 26th in New York City for further insights into the company's future plans.

SPX Technologies Inc (NYSE:SPXC)'s strong performance in 2023 sets a positive tone for the year ahead, with the company well-positioned to capitalize on market opportunities and drive shareholder value.

Explore the complete 8-K earnings release (here) from SPX Technologies Inc for further details.

This article first appeared on GuruFocus.