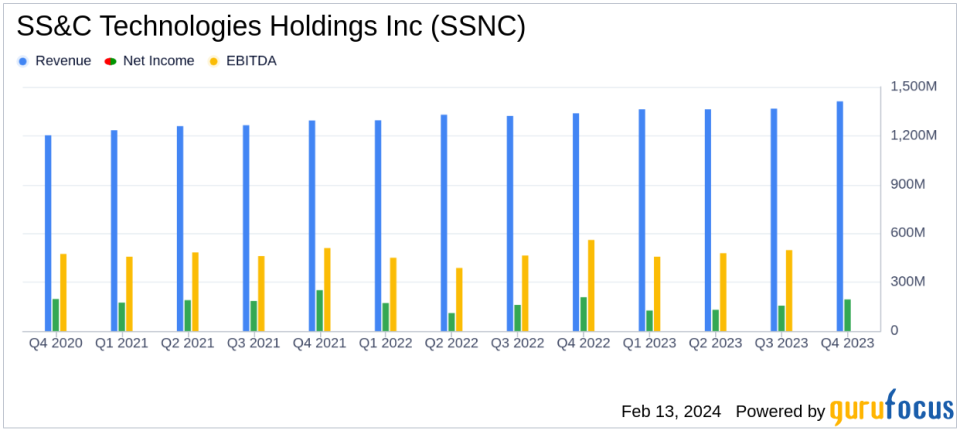

SS&C Technologies Holdings Inc (SSNC) Reports Mixed Q4 and Full Year 2023 Results

GAAP Revenue: Increased by 5.5% to $1,411.6 million in Q4, and by 4.2% to $5,502.8 million for the full year.

Adjusted Revenue: Slightly higher at $1,412.3 million in Q4, marking a 5.5% increase year-over-year.

GAAP Net Income: Decreased by 6.3% to $194.4 million in Q4, with a full-year drop of 6.6%.

Adjusted Diluted EPS: Rose by 8.6% to $1.26 in Q4, though there was a slight decrease of 0.9% for the full year.

Operating Cash Flow: Improved by 7.1% to $1,215.1 million for the twelve months ended December 31, 2023.

Debt Reduction: SS&C paid down $150.2 million in debt in Q4, reducing net leverage ratio to 3.05 times consolidated EBITDA.

Share Buyback: Repurchased 2.4 million shares for $130.7 million at an average price of $54.74 per share in Q4.

On February 13, 2024, SS&C Technologies Holdings Inc (NASDAQ:SSNC) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of software products and software-enabled services to financial and healthcare firms, reported a year-over-year increase in GAAP revenue for both the quarter and the full year. However, GAAP net income and GAAP diluted earnings per share saw declines, attributed to various operational and market challenges.

SS&C Technologies' financial achievements, including a record adjusted revenue and EBITDA for the fourth quarter, underscore the company's ability to grow its top line and manage operational efficiency. These achievements are particularly significant in the competitive software industry, where innovation and service quality are key drivers of success.

Financial Performance Analysis

The company's income statement reflects a solid performance with a 5.5% increase in GAAP revenue for Q4 2023, reaching $1,411.6 million. Adjusted revenue, which accounts for certain non-GAAP adjustments, also saw a similar increase. The operating income margin improved by 120 basis points to 23.7% for the quarter, indicating better operational efficiency.

Despite the revenue growth, SS&C Technologies experienced a decrease in GAAP net income by 6.3% to $194.4 million in Q4, and a 4.9% decrease in GAAP diluted earnings per share to $0.77. Conversely, adjusted diluted earnings per share, a key metric for investors, increased by 8.6% to $1.26, reflecting the company's ability to enhance profitability on an adjusted basis.

The balance sheet shows a strong liquidity position with $432.2 million in cash and cash equivalents. The company's efforts to strengthen its financial position are evident in the reduction of its net leverage ratio to 3.05 times consolidated EBITDA, following the repayment of $150.2 million in debt during the fourth quarter.

SS&C's cash flow statement indicates robust cash generation from operating activities, which increased by 7.1% to $1,215.1 million for the twelve months ended December 31, 2023. This is a critical metric as it demonstrates the company's ability to generate cash to fund operations, investments, and return capital to shareholders.

Chairman and Chief Executive Officer Bill Stone commented on the results, stating,

SS&C exited 2023 with record adjusted revenue and record adjusted consolidated EBITDA, and we believe we have momentum to start the year. We are seeing opportunities across the financial services industry, and anticipate market conditions to strengthen. And with DomaniRX successfully launching on January 1, 2024, we are seeing opportunities in healthcare.

Looking ahead, SS&C provided guidance for Q1 2024 with adjusted revenue expected to be between $1,396.7 million and $1,436.7 million, and adjusted net income projected to be between $300.5 million and $316.5 million. The company anticipates adjusted diluted earnings per share to range from $1.19 to $1.25 for Q1 2024.

For value investors and potential GuruFocus.com members, SS&C Technologies' latest earnings report presents a mixed picture with strong revenue growth and adjusted earnings performance, balanced by a dip in GAAP earnings. The company's strategic initiatives, including share buybacks and debt reduction, alongside its positive outlook for 2024, suggest a continued focus on creating shareholder value and capitalizing on market opportunities.

Explore the complete 8-K earnings release (here) from SS&C Technologies Holdings Inc for further details.

This article first appeared on GuruFocus.