The St. Joe Co (JOE) Reports Record Revenue in 2023, Declares Quarterly Dividend

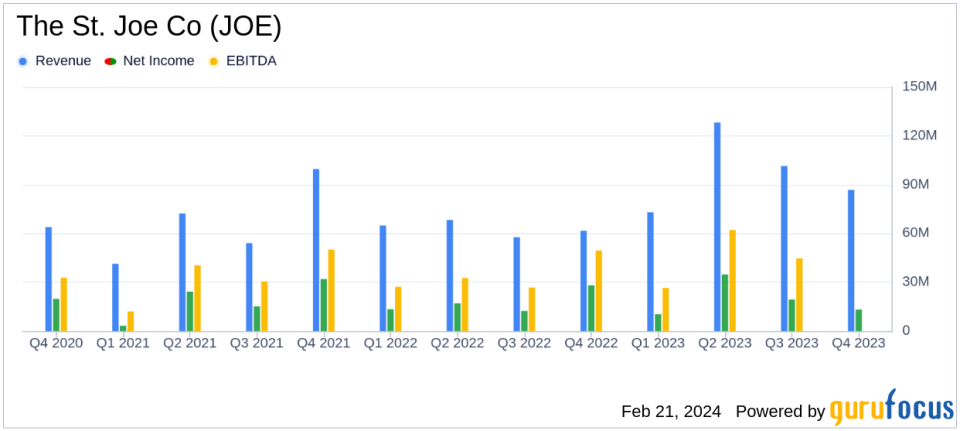

Total Revenue: Increased by 54% to $389.2 million in 2023.

Net Income: Grew to $77.7 million, or $1.33 per share in 2023.

Real Estate Revenue: Up by 60% to $186.0 million in 2023.

Hospitality Revenue: Achieved a record $152.4 million in 2023, a 57% increase.

Leasing Revenue: Increased by 30% to a record $50.8 million in 2023.

Dividend: Declared a quarterly dividend of $0.12 per share.

Capital Expenditures: Funded $217.8 million in 2023 for development and growth.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 21, 2024, The St. Joe Co (NYSE:JOE) released its 8-K filing, announcing a significant increase in revenue and net income for the full year 2023. The company, a real estate development, asset management, and operating company, operates through three segments: Residential, Hospitality, and Commercial. These segments encompass a wide range of services, including residential community development, hotel operations, and commercial property leasing.

The company's President and CEO, Jorge Gonzalez, highlighted the strategic investments made throughout the year, totaling $217.8 million, aimed at enhancing long-term shareholder value and focusing on recurring revenue streams. The St. Joe Co achieved a record single-year revenue in hospitality and leasing, with new hotels and leasing properties contributing to this growth despite not operating for the full year.

Additionally, The St. Joe Co's unconsolidated joint ventures played a significant role in the company's profitability, contributing $22.7 million in pre-tax income and generating $351.0 million in revenue for the year.

Financial Highlights and Performance Analysis

The St. Joe Co's consolidated revenue for the fourth quarter of 2023 increased by 41% to $86.7 million, compared to the fourth quarter of 2022. The full-year consolidated revenue saw an impressive 54% increase to $389.2 million. The real estate segment experienced a 60% increase in revenue, reaching $186.0 million, while hospitality and leasing revenues also saw substantial increases, setting new company records.

Net income attributable to the company for the full year 2023 increased to $77.7 million, or $1.33 per share, compared to $70.9 million, or $1.21 per share, in the previous year. This growth in net income is particularly noteworthy considering the after-tax gains from the sale of the Sea Sound Apartments and insurance recoveries included in the 2022 figures.

The company's balance sheet remains strong, with $267.4 million invested in development property and 1,486 homesites under contract, expected to result in approximately $451.0 million in sales value upon closing. The unconsolidated Latitude Margaritaville Watersound joint venture also contributed significantly, with 609 homes under contract expected to yield approximately $318.5 million in sales value.

On the dividend front, The St. Joe Co's Board of Directors declared a cash dividend of $0.12 per share, payable on March 27, 2024, to shareholders of record as of March 4, 2024, underscoring the company's commitment to returning value to its shareholders.

Segment Performance and Future Outlook

The Residential segment saw a record number of homesite sales, with an average sales price increase from approximately $98,000 in 2022 to approximately $107,000 in 2023. The Hospitality segment's revenue growth was bolstered by the addition of new hotels and the expansion of the Watersound Club membership program. The Leasing segment also reported growth, with an increase in leasable multi-family and senior living units and a high occupancy rate for rentable space.

Looking ahead, The St. Joe Co anticipates continued demand across its segments, driven by the influx of visitors and new residents to Northwest Florida. The company's disciplined capital allocation strategy, including investments in business development, dividend growth, and share repurchases, is expected to deliver attractive shareholder returns over the long term.

For a more detailed analysis of The St. Joe Co's financial performance, investors are encouraged to review the company's Form 10-K, which will be filed with the SEC and is available at www.joe.com and the SEC's website at www.sec.gov.

Value investors and potential GuruFocus.com members interested in The St. Joe Co's growth trajectory and financial health can find additional insights and updates on the company's website and through its regular project progress videos at https://www.joe.com/video-gallery.

For investor relations inquiries, contact Marek Bakun, Chief Financial Officer, at 1-866-417-7132 or via email at Marek.bakun@joe.com.

Explore the complete 8-K earnings release (here) from The St. Joe Co for further details.

This article first appeared on GuruFocus.