Stabilis Solutions, Inc.'s (NASDAQ:SLNG) Shares Not Telling The Full Story

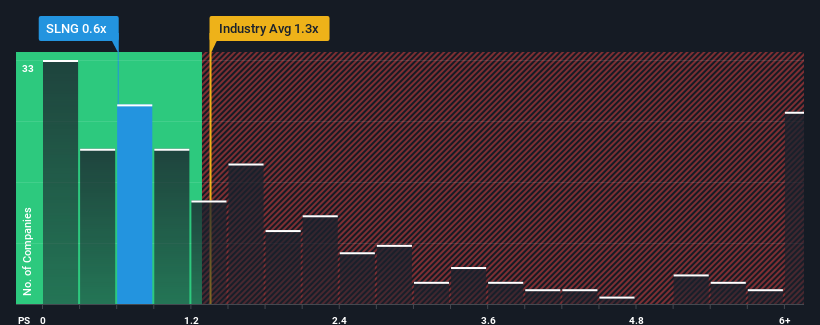

When you see that almost half of the companies in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, Stabilis Solutions, Inc. (NASDAQ:SLNG) looks to be giving off some buy signals with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Stabilis Solutions

How Stabilis Solutions Has Been Performing

Stabilis Solutions certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Stabilis Solutions will help you shine a light on its historical performance.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Stabilis Solutions' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. The latest three year period has also seen an excellent 110% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 8.8% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Stabilis Solutions is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Stabilis Solutions revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Plus, you should also learn about these 3 warning signs we've spotted with Stabilis Solutions (including 1 which makes us a bit uncomfortable).

If these risks are making you reconsider your opinion on Stabilis Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here