Staffing 360 Solutions Inc (STAF): A Deep Dive into Its Performance Metrics

Long-established in the Business Services industry, Staffing 360 Solutions Inc (NASDAQ:STAF) has enjoyed a stellar reputation. However, it has recently witnessed a decline of 9.1%, juxtaposed with a three-month change of -22.33%. Fresh insights from the GuruFocus Score Rating hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Staffing 360 Solutions Inc.

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

1. Financial strength rank: 4/10

2. Profitability rank: 2/10

3. Growth rank: 1/10

4. GF Value rank: 4/10

5. Momentum rank: 3/10

Based on the above method, GuruFocus assigned Staffing 360 Solutions Inc the GF Score of 51 out of 100, which signals poor future outperformance potential.

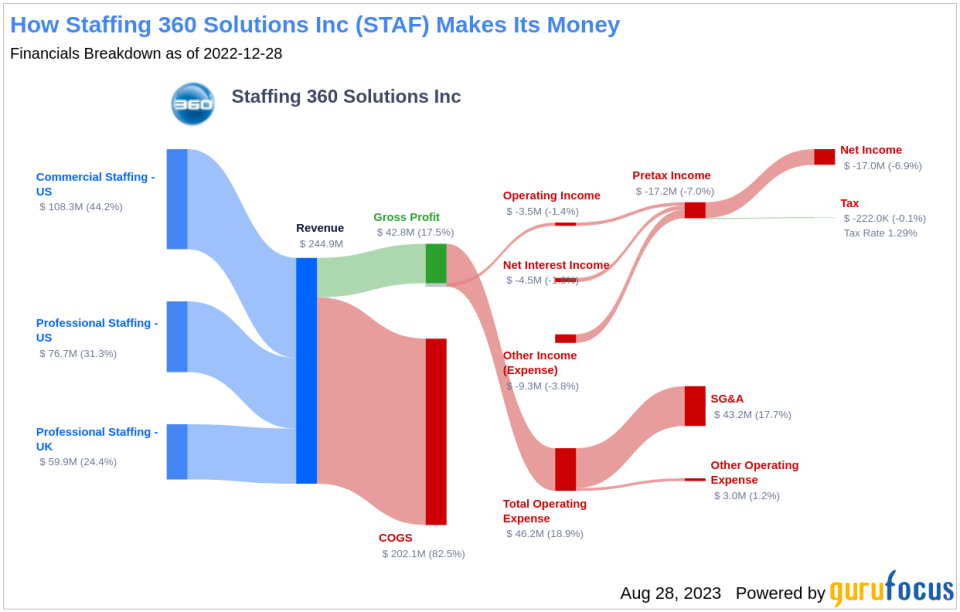

Staffing 360 Solutions Inc: A Snapshot

Staffing 360 Solutions Inc operates in the international staffing sector. It is engaged in the execution of an international buy-integrate-build process through the acquisition of domestic and international staffing organizations. The company carries its business through the reportable Commercial- U.S.; Professional- U.S. and Professional-UK segments. Geographically, the group has business operations in the U.S, UK, and Canada. With a market cap of $3.45 million and sales of $244.92 million, the company has an operating margin of -1.41%.

Financial Strength Analysis

Staffing 360 Solutions Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company's interest coverage ratio of 0 positions it worse than 0% of 787 companies in the Business Services industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. It's worth noting that the esteemed investor Benjamin Graham typically favored companies with an interest coverage ratio of at least five.

The company's Altman Z-Scoreis just 0.49, which is below the distress zone of 1.81. This suggests that the company may face financial distress over the next few years. Additionally, the company's low cash-to-debt ratio at 0.05 indicates a struggle in handling existing debt levels. The company's debt-to-equity ratio is 4.43, which is worse than 96.4% of 888 companies in the Business Services industry. A high debt-to-equity ratio suggests over-reliance on borrowing and vulnerability to market fluctuations.

Profitability Analysis

Staffing 360 Solutions Inc's low Profitability rank can also raise warning signals. Staffing 360 Solutions Inc's Operating Margin has declined over the past five years ((-330.04%)), as shown by the following data: 2018: 0.61; 2019: 0.22; 2020: -2.84; 2021: -2.12; 2022: -1.41. Additionally, Staffing 360 Solutions Inc's Gross Margin has also declined over the past five years, as evidenced by the data: 2018: 18.51; 2019: 17.35; 2020: 17.02; 2021: 17.12; 2022: 17.46. This trend underscores the company's struggles to convert its revenue into profits.

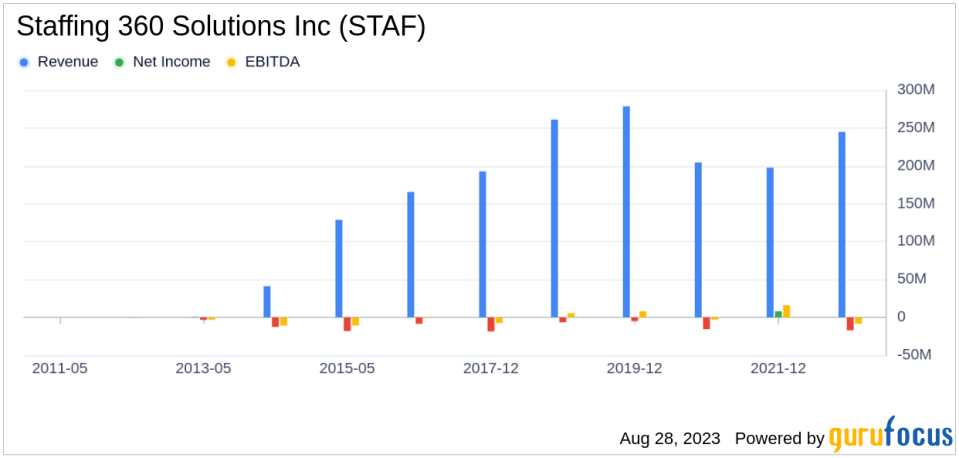

Growth Prospects

A lack of significant growth is another area where Staffing 360 Solutions Inc seems to falter, as evidenced by the company's low Growth rank. The company's revenue has declined by -61.5 per year over the past three years, which underperforms worse than 98.98% of 981 companies in the Business Services industry. Stagnating revenues may pose concerns in a fast-evolving market. Lastly, Staffing 360 Solutions Inc predictability rank is just one star out of five, adding to investor uncertainty regarding revenue and earnings consistency.

Conclusion

Given the company's financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm's unparalleled position for potential underperformance. While Staffing 360 Solutions Inc has a commendable history, its current financial indicators suggest that it may struggle to maintain its performance in the future. Investors should consider these factors when making investment decisions.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.