Is Stag Industrial the Best Dividend Stock for You?

Owning and managing real estate provides a great opportunity to earn passive income. But not everyone wants to be a landlord. Those looking for an alternative might want to consider a real estate investment trust. Buy their stock and these companies are required by law to share their profits with you.

Stag Industrial (NYSE: Stag) provides a great example of how a real estate investment trust (REIT) lets investors in on the real estate opportunities out there. It rents out single-tenant industrial properties, something most people would never have the opportunity to do by themselves. Because of its tax structure, a REIT must pay at least 90% of its taxable income to shareholders as dividends, making it a great option for those seeking income from their investments.

But is it the best dividend stock for you? Here are some reasons it could be.

A closer look at this REIT

Stag Industrial has a unique business model designed to give everyday people the opportunity to own and enjoy the perks of real estate. Real estate is very diverse, and some property types are very different than others, so most REITs typically focus on a specific niche, an area of expertise. Stag Industrial likes industrial properties, especially warehouses and distribution centers used by e-commerce companies.

Its portfolio holds roughly 568 buildings today, totaling more than 112 million square feet. Approximately 31% of Stag's business is with e-commerce-focused tenants.

Unlike most U.S. companies that pay dividends quarterly, Stag Industrial pays monthly. For those who reinvest their dividends back into the stock, this provides an opportunity to boost the compounding effects of reinvestment. For those investors who rely on passive income to pay monthly bills, getting a monthly dividend makes budgeting much easier.

Stag Industrial has paid and raised its dividend for 11 consecutive years. The stock's dividend yield is a solid 4%. Additionally, the payout ratio is just 74% of distributable cash flow, meaning Stag could endure a dip in rent and still have enough left over to pay the dividend.

There might be higher-yielding stocks, but Stag Industrial has grown its business enough that the dividend and share price taken together generate outstanding investment returns. The stock has a total return of nearly 500% since its initial public offering (IPO) in 2011, outpacing the S&P 500's 350% total return over a comparable period.

Dividend income with market-beating total returns is just what income investors look for.

Is the price right for Stag Industrial's potential growth?

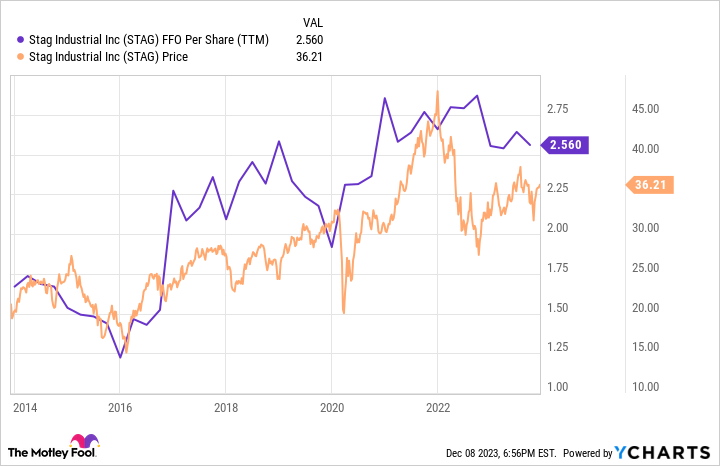

Of course, the price you pay for a stock today can impact your future returns. Stag earns $2.56 per share in funds from operations (FFO), a REIT's best stand-in for earnings per share (EPS). At its current price, that's a price-to-FFO ratio (P/FFO) of just over 14. According to management, its peer group trades at an average ratio of 21. Does that mean the stock is fairly cheap?

STAG FFO Per Share (TTM) data by YCharts

Investors can look at the company's growth prospects to find out. Stag found success investing in its properties to create value (drive higher rents). Since 2020, Stag Industrial's portfolio rent has grown by 33.4% versus the industry's 23.8%, a sizable gap.

Don't overlook the industry's strong growth, a tailwind that could continue putting in a high floor for Stag Industrial's rent growth moving forward. The United States is reshoring industrials as part of its "Invest in America" program, creating mega-projects, which are situated within 60 miles of 30% of Stag Industrial's properties.

Considering the healthy growth opportunities in industrial real estate and Stag Industrial's ability to outgrow the industry average, the stock's valuation looks like a great buying opportunity. If you're a dividend investor hungry for total returns, Stag Industrial could be the best dividend stock for you.

More From The Motley Fool

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Stag Industrial. The Motley Fool has a disclosure policy.

Is Stag Industrial the Best Dividend Stock for You? was originally published by The Motley Fool