Stagwell Inc (STGW) Navigates Market Headwinds with Strategic Growth and Cost Management

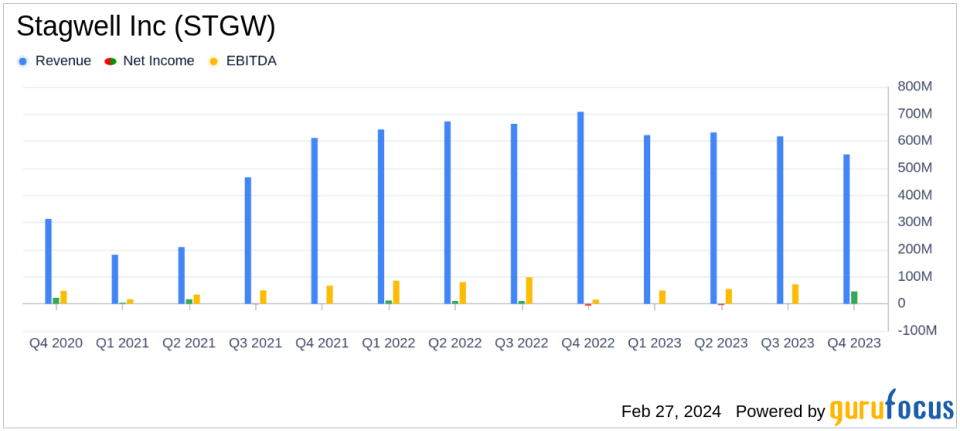

Revenue: FY23 revenue reported at $2,527 million, with a net revenue of $2,147 million.

Net Income: Achieved a net income of $42 million for FY23.

Adjusted EBITDA: FY23 Adjusted EBITDA stood at $360 million, with a margin of 17% on net revenue.

International Growth: International net revenue grew by 13% in FY23, with EMEA leading at 17% growth.

New Business: Secured $65 million in net new business in Q4; exceeding $270 million LTM.

Financial Outlook: 2024 guidance anticipates organic net revenue growth of 5% to 7%, and Adjusted EBITDA of $400 million to $450 million.

Free Cash Flow: Free Cash Flow Conversion is expected to be approximately 50%.

On February 27, 2024, Stagwell Inc (NASDAQ:STGW) released its 8-K filing, detailing the financial performance for the three and twelve months ended December 31, 2023. The company, known for transforming marketing through scaled creative performance and technology, operates primarily through its Integrated Agencies Network segment, which generates the majority of its revenue, predominantly in the United States.

Despite facing a challenging year marked by economic headwinds and a complex client mix, Stagwell Inc (NASDAQ:STGW) managed to grow its share with key customers and strategically manage costs. The company's focus on digital innovation, including AI and AR products, positions it well for future growth. Notably, the inclusion of ARound into Major League Baseball's native Ballpark app exemplifies Stagwell's commitment to integrating cutting-edge technology into marketing strategies.

Financial Performance and Strategic Highlights

Stagwell Inc (NASDAQ:STGW) reported a full-year revenue of $2,527 million, with a net revenue of $2,147 million. The company's net income for the year was $42 million, with an Adjusted EBITDA of $360 million. The Adjusted EBITDA margin stood at 17% on net revenue, reflecting the company's ability to maintain profitability amidst market challenges.

International growth was a bright spot, with a 13% increase in international net revenue, led by a 17% growth in the EMEA region. This expansion underscores Stagwell's increasing global footprint and the successful execution of its international strategy.

The company also reported significant new business wins, with $65 million in net new business in the fourth quarter and more than $270 million in the last twelve months. These wins demonstrate Stagwell's competitive edge and ability to attract and retain clients.

Outlook and Management Commentary

Looking ahead to 2024, Stagwell Inc (NASDAQ:STGW) anticipates organic net revenue growth of 5% to 7%, with an Adjusted EBITDA forecast of $400 million to $450 million. The company expects a Free Cash Flow Conversion rate of approximately 50%, highlighting its efficient capital management.

Mark Penn, Chairman and CEO, expressed optimism about the upcoming year, citing the political season and the market introduction of AI and AR products as opportunities for growth. Frank Lanuto, Chief Financial Officer, emphasized the company's proactive cost alignment and the realization of $30 million in synergies, with an additional $35 million in cost savings underway.

The sale of ConcentricLife in Q4 resulted in a significant gain, contributing to the year's net income, reducing debt, and improving leverage. This strategic divestiture is part of Stagwell's ongoing efforts to optimize its portfolio and strengthen its financial position.

Financial Statements and Non-GAAP Measures

Stagwell Inc (NASDAQ:STGW) reported a decrease in FY23 revenue by 6% compared to the previous year and a 3% decrease in net revenue. The company's organic net revenue declined by 6% year-over-year, with a 4% decline when excluding Advocacy. Adjusted earnings per share for FY23 were $0.57.

The company's balance sheet remains solid, with a focus on maintaining liquidity and managing liabilities effectively. Stagwell's cash flow statement reflects its operational efficiency and ability to generate cash from its core business activities.

In its earnings release, Stagwell Inc (NASDAQ:STGW) includes non-GAAP financial measures such as Adjusted EBITDA and Adjusted Diluted EPS, which provide additional insight into the company's operational performance and financial health.

Investors and stakeholders can access further details on Stagwell's financial performance and outlook during the video webcast scheduled for February 27, 2024, at 8:30 a.m. ET, available at the company's website.

For a comprehensive understanding of Stagwell Inc (NASDAQ:STGW)'s financial results, including detailed income statements, balance sheets, and cash flow data, readers are encouraged to review the full 8-K filing.

As Stagwell Inc (NASDAQ:STGW) navigates the evolving marketing landscape, its strategic focus on growth, cost management, and technological innovation positions the company to capitalize on emerging opportunities and continue delivering value to its clients and shareholders.

Explore the complete 8-K earnings release (here) from Stagwell Inc for further details.

This article first appeared on GuruFocus.