Stamps.com Stock Starts Recovery After Thursday’s Dive

Stamps.com (NASDAQ:STMP) stock is starting to recover following its sharp dive on Thursday.

When the stock markets closed on Thursday, Stamps.com stock was down 10% from its closing price on Wednesday. The major blow to the stock came from news that the Trump Administration is planning to return the United States Postal Service (USPS) to “a sustainable business model.”

The information about possible changes for the USPS come packed in a package of plans that the current administration has for reforming the government. It mentions that it may choose to take the Postal Service private.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The letter argues that taking the USPS private would allow the government to still have regulatory control over it, while reducing costs. The option will still allow for competition against the service and would mimic how some European countries handle their mail services.

“A privatized Postal Service would have a substantially lower cost structure, be able to adapt to changing customer needs and make business decisions free from political interference, and have access to private capital markets to fund operational improvements without burdening taxpayers,” the reorganization letter reads. “The private operation would be incentivized to innovate and improve services to Americans in every community.”

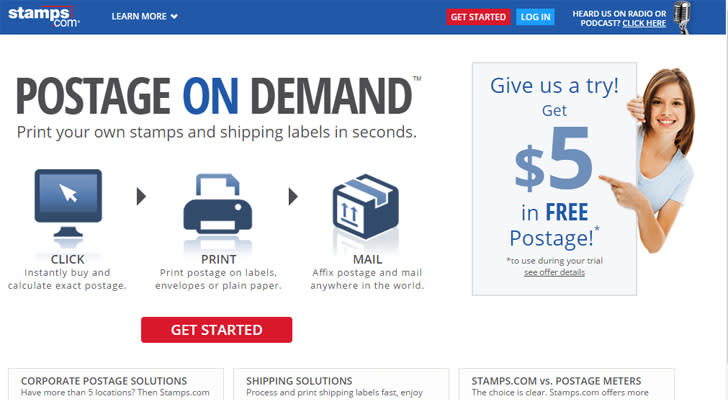

All of this matters to STMP stock because of how the company’s business works. Stamps.com offers an online service that lets subscribers print their own stamps and shipping labels. Any changes to how the USPS works could hinder its business.

STMP stock was almost 1% as of Friday afternoon and is up 34% year-to-date.

More From InvestorPlace

As of this writing, William White did not hold a position in any of the aforementioned securities.

The post Stamps.com Stock Starts Recovery After Thursday’s Dive appeared first on InvestorPlace.