Standard BioTools Inc (LAB) Reports Growth and Margin Expansion in FY2023 Despite Economic ...

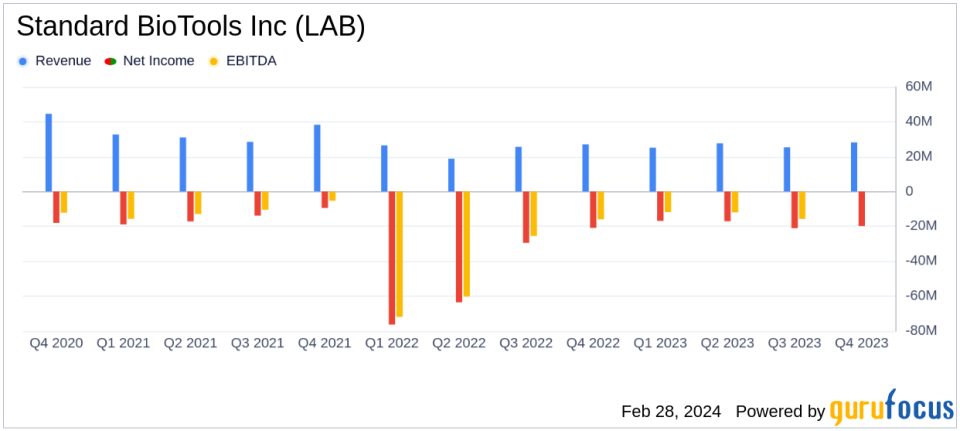

Revenue Growth: Standard BioTools Inc (NASDAQ:LAB) reported a 9% increase in total revenue for fiscal year 2023 and a 4% increase in the fourth quarter.

Gross Margin Expansion: Non-GAAP gross margin expanded significantly, reaching 60.1% for the fiscal year 2023.

Operating Expenses Reduction: Non-GAAP operating expenses declined by 17% in fiscal year 2023, reflecting disciplined cost management.

Net Loss Improvement: Non-GAAP adjusted EBITDA loss improved by $34 million in fiscal year 2023.

Strong Liquidity Position: Combined pro forma cash, cash equivalents, restricted cash, and short-term investments stood at approximately $565 million as of December 31, 2023.

2024 Outlook: The combined company expects revenue in the range of $200 million to $205 million for fiscal year 2024.

On February 28, 2024, Standard BioTools Inc (NASDAQ:LAB) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a manufacturer of life science tools focused on single-cell analysis and genomics, reported a year of growth and operational efficiency improvements, despite a challenging economic environment.

Financial Performance and Strategic Developments

Standard BioTools achieved its core financial objectives for FY2023, delivering substantial reductions in expenses and cash burn while expanding revenue and gross margins. The company completed a merger with SomaLogic, a move aimed at building a scaled leader in life sciences tools and services. The combined pro forma revenue for FY2023 totaled $192 million, with a fortified balance sheet showing $565 million in combined pro forma cash and investments.

Michael Egholm, PhD, President and CEO of Standard BioTools, highlighted the company's focus on operational discipline and strategy to integrate unique technologies. The company's efforts have led to a reduction in expenses and cash consumption, while returning a declining business back to growth.

In our first full year of operational execution, the Standard BioTools team hit our major target of standardizing the core business units and instilling SBS business systems throughout the organization. We also did so in one of the more challenging economic environments Ive seen in life sciences over the last 20 years," said Egholm.

Key Financial Metrics

Standard BioTools reported a 9% increase in total revenue for fiscal year 2023 and a 4% increase in the fourth quarter. Instrument sales grew by 46% for the fiscal year and 44% in the fourth quarter. Non-GAAP gross margin expanded by 900 basis points to 60.1% for the fiscal year and by 630 basis points to 59.6% in the fourth quarter. Non-GAAP operating expenses declined by $20 million, or 17%, for the fiscal year and by $1 million, or 5%, in the fourth quarter. The non-GAAP adjusted EBITDA loss improved by $34 million for the fiscal year and by over $3 million in the fourth quarter. Operating cash use declined by $47 million, or 53%, in fiscal 2023 and by $6 million, or 32%, in the fourth quarter.

Looking ahead to fiscal year 2024, Standard BioTools expects revenue in the range of $200 million to $205 million. The company also provided an Investor Relations presentation with additional information on its business and operations.

Financial Statements Highlights

The company's balance sheet as of December 31, 2023, showed total assets of $323.1 million, with current assets including $51.7 million in cash and cash equivalents and $63.2 million in short-term investments. Total liabilities stood at $159.9 million, with current liabilities accounting for $109.3 million.

Standard BioTools' commitment to operational efficiency and strategic growth, as evidenced by its FY2023 performance and the merger with SomaLogic, positions the company to capitalize on the life sciences market's potential. Value investors may find the company's disciplined approach to cost management and its strategic vision for scaling operations compelling reasons to consider Standard BioTools as a potential investment opportunity.

For more detailed information about Standard BioTools Inc (NASDAQ:LAB)'s financial results, please refer to the full 8-K filing.

Investor Contacts:David HolmesGilmartin Group LLC(332) 330-1031ir@standardbio.com

Explore the complete 8-K earnings release (here) from Standard BioTools Inc for further details.

This article first appeared on GuruFocus.