Standard Lithium Announces Positive Results of Definitive Feasibility Study for First Commercial Lithium Extraction Plant at LANXESS South Plant

First Production in 2026; Strong Project Economics with NPV of $550 Million and IRR 24%; Average Annual Production of 5,400 Tonnes of Battery-Quality Lithium Carbonate Over 25 Years

Figure 1

Figure 2

EL DORADO, Ark., Sept. 06, 2023 (GLOBE NEWSWIRE) -- Standard Lithium Ltd. (“Standard Lithium” or the “Company”) (TSXV:SLI) (NYSE American:SLI) (FRA:S5L), announced today the positive results of a Definitive Feasibility Study (the “DFS”) for its first commercial lithium extraction plant project (“Phase 1A”) proposed to be located at the LANXESS South Plant (“South Plant”). The DFS considers first production of battery-quality lithium carbonate in 2026, using direct lithium extraction, from Smackover brine currently being produced by LANXESS Corporation (“LANXESS”) from their South Brine Unit.

All figures are in US dollars unless otherwise stated.

Phase 1A Highlights:

First production in 2026. Average annual production of 5,400 tonnes per annum (“tpa”) over the operating life with peak annual production of 5,700 tpa

25-year minimum operating life. Proven and Probable Reserves of 208 Kt lithium carbonate equivalent (“LCE”) at an average concentration of 217 mg/L support up to 40 years of operations

Strong project economics. After-tax NPV $550 million and IRR of 24% assuming discount rate of 8% and a long-term price of $30,000/t for battery-quality Li2CO3

Operating costs reflect first step to commercial production. Average annual operating costs of $6,810/t over the operating life

CAPEX of $365 million. Total capex estimate of $365 million includes 15% contingency

Upgraded Measured Resource. Total Measured and Indicated Resource of 2.8 Mt LCE at average concentration of 148 mg/L for the combined LANXESS South, Central and West Brine Units; Phase 1A represents production of approximately 5% of the total Measured and Indicated Resources

“We are taking a thoughtful, phased approach to project development,” said Dr. Andy Robinson, President and COO of Standard Lithium. “Phase 1A is the first commercial lithium extraction plant proposed for the Smackover, and a modest scale up from the Demonstration Plant that has been operating and efficiently extracting lithium from the same brine for over 3½ years. The Phase 1A Project is substantially de-risked as we move rapidly towards commercialization. We have a deep understanding of the Resource and history of extracting lithium from the brine using DLE, and we’ll be the first to do so at a commercial scale in the Smackover in partnership with LANXESS. We expect to replicate and scale the core elements of this first commercial plant across our extensive and growing project portfolio in the Smackover Formation in Arkansas and Texas.”

Robert Mintak, CEO of Standard Lithium, commented, “Building on the success of our demonstration DLE facility, Phase 1A taps into the long-established expertise in brine processing, complemented by the infrastructure at the LANXESS South Plant. Phase 1A marks the beginning of a series of lithium projects we've charted across the Smackover Formation, a region that's been integral to the U.S. energy sector for over a century. Leveraging this vast reservoir of knowledge and the region's culture of innovation, we aim to position the region as a significant contributor addressing the U.S.'s needs for sustainably produced lithium.”

“Following the completion of our DFS, our next steps include finalizing commercial agreements with LANXESS and securing project financing. We've partnered with BNP Paribas, a global leader in financial advisory and project financing for critical minerals projects, to serve as our lead debt advisor. We're also actively exploring opportunities within the U.S. Critical Mineral initiatives and the Inflation Reduction Act, focusing on non-dilutive funding solutions to advance our goals.”

Overview of the Project: A Phased Approach

Phase 1A, Standard Lithium’s first commercial lithium extraction plant, is proposed to be located at the South Plant, approximately 13 kilometers (8 miles) southwest of the City of El Dorado in Union County, Arkansas. LANXESS, a subsidiary of LANXESS AG, a specialty chemicals company, has exclusive brine extraction rights for 149,442 acres which is contained within three brine production units, referred to as the South, Central and West Brine Units. Development at Phase 1A including commercial agreements, equity participation and phasing are governed by a Memorandum of Understanding, which was outlined in the Company’s news release dated February 24, 2022.

The DFS is focused solely on Phase 1A, located at the South Plant and serves as a comprehensive review of this first project. Standard Lithium expects to make a Final Investment Decision (“FID”) related to Phase 1A in the first half of 2024, subject to continuing project definition, finalization of commercial agreements with LANXESS and project financing initiatives. Assuming a positive FID, the Company expects to commence construction in 2024 and reach commercial production in 2026.

Table 1: Phase 1A Definitive Feasibility Study Highlights

Initial Annual Production of Li2CO3 | tpa[1] | 5,730[2] |

Average Annual Production of Li2CO3 | tpa | 5,400 |

Plant Operating Life | years | 25[3] |

Total Capital Expenditures | $ millions | 365[4,5] |

Average Annual Operating Cost | $/t | 6,810 |

Average Annual All-in Operating Cost | $/t | 7,390[6,7] |

Selling Price | $/t | 30,000[8] |

Discount Rate | % | 8 |

Net Present Value (NPV) Pre-Tax | $ millions | 772 |

Net Present Value (NPV) After-Tax | $ millions | 550[9] |

Internal Rate of Return (IRR) Pre-Tax | % | 29.5 |

Internal Rate of Return (IRR) After-Tax | % | 24.0 |

Notes:

All model outputs are expressed on a 100% project ownership basis with no adjustments for project financing assumptions.

[1] Tonnes (1,000 kg) per annum.

[2] Initial annual production figure represents Year 2 production, following a ramp-up period in Year 1.

[3] Plant design and financial modelling based on 25-year economic life. Proven and Probable Reserves support a 40-year operating life.

[4] Capital Expenditures include 15% contingency.

[5] No inflation or escalation has been carried for the economic modelling.

[6] Includes operating expenditures and sustaining capital.

[7] Brine lease-fees-in-lieu-of-royalties (to be approved by AOGC) have not been defined and are not currently included in the economic modelling.

[8] Selling price of battery-quality lithium carbonate based on a flatline price of $30,000/t over total project lifetime.

[9] Assumes a U.S. Federal tax rate of 21% and State of Arkansas Tax rate of 5.1%, as well as variable property taxes.

[10] Any discrepancies in the totals are due to rounding effects.

Phase 1A Production Plan and Assumptions

The DFS for Phase 1A contemplates production of battery-quality lithium carbonate averaging 5,400 tonnes per annum (“tpa”) over a 25-year operating life, producing 135,000 tonnes LCE from the LANXESS South Brine Unit which represents production of approximately 5% of the in-situ Measured and Indicated Resources (see Table 2). Phase 1A has the potential to operate over a 40-year life based on the Proven and Probable Reserves of 208,000 tonnes LCE (see Table 3). The DFS makes very conservative assumptions that production of brine will occur from the existing wellfield, and that no additional wells are drilled in the future to supplement or add to the current brine flow, or to add additional brine from higher lithium content zones available in the production unit(s). See Figure 1 below for more details.

Figure 1: Phase 1A Production Plan

Mineral Resource Assessment

The total in-situ Measured and Indicated Brine Resources for the combined LANXESS South, Central and West Brine Units are estimated at 2.8 Mt LCE or 529,000 tonnes of elemental lithium at an average concentration of 148 mg/L.

This was informed by an updated Mineral Resource estimate completed as part of the Study, which included an update of the Mineral Resource from the 2019 Preliminary Economic Assessment from ‘Indicated’ to ‘Measured.’ The Company’s advancements in lithium recovery, as well as the completion of additional brine sampling and geochemistry work, resulted in the updated Mineral Resource.

Table 2: Measured and Indicated Resource Estimation

Measured and Indicated Resource | ||||||

|

| South | West | Central | Central Expansion | Total |

Gross Volume | km³ | 20.8 | 32.8 | 24.0 | 3.9 | 81.5 |

Net Volume | km³ | 5.1 | 11.2 | 7.4 | 1.4 | 25.1 |

Average Porosity | % | 14.4 | 14.1 | 14.2 | 14.3 | 14.2 |

Brine Volume | km3 | 0.73 | 1.58 | 1.05 | 0.20 | 3.56 |

Average Lithium Concentration | mg/L | 204 | 122 | 164 | 78 | 148 |

Measured Lithium Resource | thousand tonnes | 148 | 192 | 173 | - | 513 |

Indicated Lithium Resource | thousand tonnes | - | - | - | 16 | 16 |

Measured LCE Resource | thousand tonnes | 788 | 1,022 | 921 | - | 2,731 |

Indicated LCE Resource | thousand tonnes | - | - | - | 85 | 85 |

Notes:

[1] Volumes are in-place.

[2] Cutoff of 9% porosity.

[3] The effective date of the resource estimate is August 18, 2023.

[4] Mineral Resources are inclusive of Mineral Reserves.

[5] The Qualified Persons for the Mineral Resource Estimates is Randal M. Brush, PE and Robert Williams, PG, CPG.

[6] The Mineral Resource estimate follows 2014 CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

[7] These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

[8] Calculated brine volumes only include Measured and Indicated Mineral Resource volumes that when blended from the well field result in feed above the cut-off grade of 100 mg/L.

[9] Lithium Carbonate Equivalent (“LCE”) is calculated using mass of LCE = 5.323 multiplied by mass of lithium metal.

[10] Results are presented in-situ. The number of tonnes was rounded to the nearest thousand. Any discrepancies int the totals are due to rounding effects.

[11] The Qualified Person is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or market issues, or any other relevant issue that could materially affect the potential development of Mineral Resources other than those discussed in the Mineral Resource Estimates.

The DFS completed is related to Phase 1A, which would process tail brine from the South Plant. Phase 1A contemplates production of battery-quality lithium carbonate averaging 5,400 tpa over a 25-year operating life.

The total Proven and Probable Brine Reserves for Phase 1A are estimated at 208,000 tonnes of LCE or 45,200 tonnes of elemental lithium at an average lithium concentration of 217 mg/L. In simple terms, the Reserves for the DFS are a quantification of the lithium that can be produced by the existing operational brine wells in the South Unit, over the lifetime of the Project. The Reserves do not contemplate any other lithium production that could take place either from the other operational brine supply wells across the LANXESS facilities in El Dorado, or from future additional wells that could be used to supplement or bolster lithium production.

A numerical reservoir model was constructed using industry standard software. The reservoir model was calibrated using the extensive geological information and more than 60 years of brine production on the Property. Reserves were calculated from the simulated Smackover Formation brine production rates and lithium concentrations in the South production unit. Proven and Probable Reserves were estimated based on the existing operating capacity of the South Plant brine supply and disposal network, and as such, the reported Reserves are exclusive only to the South Brine Unit of LANXESS.

Table 3: Phase 1A Proven and Probable Reserve Estimation

Proven and Probable Reserves | ||||

|

| Proven | Probable | Proven + Probable |

Brine Reserves | million m³ | 124 | 84 | 209 |

Average Lithium Concentration | mg/L | 227 | 201 | 217 |

Lithium Metal | thousand tonnes | 28.2 | 17.0 | 45.2 |

LCE Reserves | thousand tonnes | 129 | 79 | 208 |

Notes:

[1] The effective date of the reserve estimate is August 18, 2023.

[2] Any discrepancies in the totals are due to rounding effects.

[3] The Qualified Person for the Mineral Reserve estimate is Randal M. Brush, PE.

[4] Converted Reserves are exclusive to the South Brine Unit.

[5] The average lithium concentration is weighted per well simulated extraction rates.

[6] The Proven case assumes a 25-year operating life at 4.96 million m3/year of brine production at a cut-off of 100 mg/L.

[7] Proven plus Probable reserves assume a 40-year operating life at 5.21 million m3/year of brine production at a cut-off of 100 mg/L.

[8] The Reserves reference point for the Brine Pumped, Average Lithium Concentration, and Lithium Metal is the brine inlet to the processing plant.

[9] The Reserves reference point for the LCE is the product output of the processing plant.

[10] Lithium Carbonate production values consider plant processing efficiency factors.

[11] The Mineral Reserve estimate follows 2014 CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

[12] Lithium Carbonate Equivalent (“LCE”) is calculated using mass of LCE = 5.323 multiplied by mass of lithium metal.

[13] The Qualified Person is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue, that could materially affect the potential development of Mineral Resources other than those discussed in the Mineral Resource Estimates.

Capital Costs

Assuming average production over 25 years of 5,400 tpa of Li2CO3, the direct capital costs are estimated at $259 million, with indirect costs of $56 million. A contingency of 15% was applied to total direct and indirect costs, yielding an estimated all-in capital cost of $365 million.

The Company has undertaken efforts to effectively de-risk the construction process for Phase 1A and ensure on-time delivery. This includes a Term Sheet with the nominated EPC contractor, Optimized Process Designs LLC, which sets out construction performance and schedule guarantees to ensure on-time construction, as well as guarantees related to the production of battery-quality lithium carbonate at the facilities’ design capacity. This Term Sheet is subject to agreement between the parties on pricing and definitive documentation.

Table 4: Phase 1A Capital Cost Summary

| Capital Cost ($ millions) |

Brine Delivery (Tie-ins) | 9.0 |

Brine Pretreatment | 43.3 |

Direct Lithium Extraction | 38.1 |

Concentration and Purification | 53.3 |

Carbonation | 53.4 |

Drying, Milling and Packaging | 18.9 |

Effluent Brine Disposal | 24.3 |

Reagent Systems | 8.8 |

Utilities | 51.1 |

Other (First Fills, Membranes, Commercial Fees) | 14.7 |

Contingency | 49.9 |

Total Capital Cost | 364.9 |

Notes:

[1] Direct costs were estimated using either vendor-supplied quotes, and/or engineer estimated pricing (based on recent experience) for all major equipment.

[2] Indirect costs include all contractor costs (including engineering); indirect labor costs and Owner’s Engineer costs.

[3] Any discrepancies in the totals are due to rounding effects.

Operating Costs

The operating cost over the life of the Phase 1A is $6,810/t of Li2CO3. All-in operating cost, including sustaining capital expenditures and assumed brine fees, is $7,390/t.

Table 5: Phase 1A Operating Cost Summary

| Average Annual Cost ($/t)[1] |

Electrical Power & Infrastructure | 950 |

Reagents & Consumables | 2,880 |

Maintenance and External Services[2] | 610 |

Workforce[3] | 1,930 |

Insurance | 340 |

Miscellaneous Costs[4] | 100 |

Total Operating Cost | 6,810 |

Sustaining Capital Expenditures | 580 |

All-in Operating Cost[5][6] | 7,390 |

Notes:

[1] Operating costs are calculated based on a Phase 1A average annual production of 5,400 tonnes of lithium carbonate.

[2] Includes contract maintenance, solids waste disposal, and external lab services.

[3] Approximately 89 full time equivalent positions.

[4] Includes general and administrative expenses.

[5] Does not include future brine lease-fees-in-lieu-of-royalties which are still to be determined and subject to regulatory approval (lease-fees-in-lieu-of-royalties have been determined for bromine and certain other minerals in the State of Arkansas but have not yet been determined for lithium extraction).

[6] Does not include brine fees which may be due to LANXESS as a result of finalization of the commercial arrangements between LANXESS and Company.

Processing Overview

Phase 1A will receive bromine depleted lithium rich tail brine from the South Plant, extract lithium from the tail brine and convert it to a saleable product, and return the lithium depleted brine to the existing South Plant brine network for re-injection.

The lithium processing facility is designed to process a tail brine flowrate of approximately 5 million m3/yr from the South Plant. The Demonstration Plant, currently operating at the South Plant, has the ability to process 11.4 m3/hr or 50 US gallons per minute resulting in a modest 60 times scale-up required for the proposed first commercial production facility.

The DFS for Phase 1A does not contemplate any potential future increase in brine production by LANXESS above current South Plant brine production levels, nor the construction of additional brine supply and disposal wells which could result in increased lithium carbonate production through a future expansion of the processing facilities.

The tail brine entering the production facility is expected to be treated, filtered and then processed via Koch Technology Solutions’ Lithium Selective Sorption (“LSS”) direct lithium extraction (“DLE”) process to produce raw lithium chloride, while the lithium depleted brine and ancillary waste streams will be returned to the South Plant for reinjection.

Standard Lithium has been developing two forms of direct lithium extraction at the Demonstration Plant: the Company’s proprietary LiSTR process and a co-developed Lithium Selective Sorption (“LSS”) process. LSS is a Koch Technology Solutions, LLC (“KTS”) proprietary technology. Under the Joint Development Agreement with KTS, Standard Lithium has Smackover regional exclusivity for the LSS process (see news release dated 9th May 2023).

Both the LiSTR and LSS DLE processes have been successful in selectively extracting lithium from Smackover brine; however, the Company currently expects to use the LSS technology as the basis for the Project based on improved economics as well as the expected performance guarantees to be provided by KTS. Use of KTS’ LSS technology is subject to the parties entering into a license agreement and other definitive documentation related to the technology.

The LSS process has been in operation at the Demonstration Plant since October 2022. Over 6,000 operating cycles have been concluded at the time of the Study, achieving consistent lithium extraction efficiencies of greater than 95% and contaminant rejection efficiencies over 99%.

The LSS process produces a high-quality lithium chloride solution which will be further purified and concentrated by means of reverse osmosis, chemical softening and ion exchange. After purification and concentration of the raw lithium chloride, a conventional, two-stage, lithium carbonate crystallization process will be used for final conversion of the polished lithium chloride to battery-quality Li2CO3.

The DFS assumes production of lithium carbonate using conventional crystallization technology readily available from qualified vendors with performance guarantees for production and quality. The Company engaged two vendors for pilot scale testing of lithium carbonate production one using lithium chloride produced by LiSTR and the other using lithium chloride produced by LSS. Both vendors successfully produced battery-quality lithium carbonate.

Overall, the commercial processing facility is expected to recover and convert into battery-quality lithium carbonate more than 93% of the lithium contained in the brine delivered by LANXESS.

Project Economics

The financial results are derived from inputs based on the annual production schedule as set forth in the DFS and summarized in Table 1. Sensitivity analysis on the unlevered economic results over a 25-year operating life are summarized in Table 6 below.

Table 6: Phase 1A Sensitivity Analysis

| After-Tax NPV(US$ millions) | After-Tax IRR(%) | |

Li2CO3Price ($/t) |

|

| |

-20% | $337 | 18.4% | |

0% | $550 | 24.0% | |

+20% | $762 | 29.3% | |

Production |

|

| |

-5% | $502 | 22.8% | |

0% | $550 | 24.0% | |

+5% | $597 | 25.3% | |

Capital Costs |

|

| |

+20% | $491 | 20.4% | |

0% | $550 | 24.0% | |

-20 | $608 | 29.2% | |

Operating Costs |

|

| |

+20% | $507 | 22.9% | |

0% | $550 | 24.0% | |

-20% | $592 | 25.2% | |

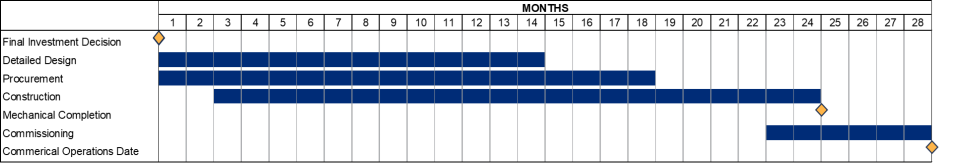

Development Timeline

A detailed development schedule for construction of Phase 1A has been developed as part of the DFS. The expected summary schedule is presented in Figure 2 below.

Figure 2: Phase 1A Development Timeline

The development schedule for the project remains subject to ongoing engineering, finalization of commercial agreements, Arkansas Oil and Gas Commission approvals, permit approvals, EPC contract finalization, license agreement and other related definitive documentation, market conditions and financing activities.

Permitting and Environmental Considerations

The Company completed an environmental study which included field inspection and sampling programs to establish baseline environmental conditions. The results of this study will be used to establish baseline environmental values associated with the development site, inform the design process and support future environmental performance monitoring.

Currently, there are no material, federal permits or authorizations required. Permit development activities for the State of Arkansas construction and operating permits are ongoing and on-schedule for completion ahead of required timelines to support the construction and commissioning of Phase 1A.

Next Steps and Recommendation

The Phase 1A DFS results demonstrate a robust technical and financial case for Standard Lithium to proceed with project development. The Company expects to make a Final Investment Decision in the first half of 2024, and assuming a positive FID, commence construction and deliver commercial production in 2026.

Summary of Consultants - Quality Assurance

Report was prepared by a multi-disciplinary team of Qualified Persons (“QPs”) that include geologists, reservoir engineers, civil, mining, metallurgical, and chemical engineers with relevant experience in brine geology, brine resource modelling and estimation, lithium-brine processing, and project development/execution. This was combined with an update of the resource assessment completed by William Cobb & Associates (“Cobb & Associates”). A National Instrument 43-101 report is required to be filed, in conjunction with the disclosure of the Study in this news release, within 45 days.

The companies and independent contractors involved in completing the DFS include:

RESPEC: RESPEC is a 100% employee-owned global leader in geoscience, engineering, data and integrated technology solutions. The Company was founded in 1969 and has more than 525 employees in 28 offices across 14 U.S. states and two Canadian provinces.

William M. Cobb & Associates (“Cobb & Associates”): Cobb & Associates is based in Dallas Texas and was formed in 1983 to provide quality reservoir engineering, formation evaluation, and geological services. Cobb & Associates is recognized as an industry leader in identifying and solving complex technical problems with considerable experience and expertise in the areas of brine resource production and management, reservoir analyses, waterflood studies, miscible and immiscible gas injection projects, reserve analyses, property evaluations, geology and petrophysics, economic studies, and expert witness testimony.

Alliance Technical Group: Alliance Technical Group is headquartered in Decatur, Alabama, with a core competency location in Bryant, Arkansas and was established in 2000 to provide environmental support to engineering and construction projects.

Hunt, Guillot & Associates (“HGA”): HGA is a private company founded in 1997 with more than 650 engineering and project management professionals. Its headquarters are in Ruston, Louisiana. HGA has extensive engineering and construction expertise in the Gulf Coast region.

Mike Rockandel: Mr. Rockandel is an independent consulting metallurgical engineer based in Tucson, Arizona. He holds a B.S. in Metallurgical Engineering from the University of British Columbia and has more than 45 years of experience at all levels of project development, including laboratory development through commissioning, startup, and operations supervision.

Susan B. Patton, PE: Ms. Patton is a Principal Consultant of RESPEC based in Grand Junction, Colorado, USA. She has more than 35 years of experience as a mine engineer. Ms. Patton holds a B.S. in Mining Engineering from the New Mexico Institute of Mining and Technology, a M.S. in Mineral Engineering from the University of Alabama and an interdisciplinary Doctorate in Mineral and Environmental Engineering from the University of Alabama.

News Release Quality Assurance

The information contained in this news release relating to the Phase 1A has been compiled by the above-mentioned companies and independent contractors.

The information in this press release has been reviewed and approved by Susan B. Patton, PE. Ms. Patton is a “Qualified Person” as the term is defined in National Instrument 43-101 and is independent of Standard Lithium.

About Standard Lithium Ltd.

Standard Lithium is a leading near-commercial lithium development company with a portfolio of projects in progress. The Company's flagship projects, Phase 1A Project and the South West Arkansas Project, are located in south western Arkansas in the heart of the Smackover Formation. The Company is focused on producing lithium from brine using direct lithium extraction (“DLE”) across approximately 180,000 acres of leases from these two projects.

The Company operates an industrial-scale DLE Demonstration Plant at the Phase 1A. The scalable, environmentally friendly process eliminates the use of evaporation ponds, reduces processing time from months to hours and greatly increases the effective recovery of lithium.

The Company has completed a Definitive Feasibility Study (“DFS”) for its first commercial lithium extraction plant project, Phase 1A, and expects to make a Final Investment Decision in the first half of 2024, commence construction thereafter and deliver commercial production in 2026. Phase 1A is expected to produce an average 5,400 tonnes of battery-quality lithium carbonate per year over a 25-year operating life. For the South West Arkansas project, located 50 miles west of Phase 1A, Standard Lithium completed a Preliminary Feasibility Study and expects to complete a DFS by the end of 2024, commence construction in 2025 and deliver first production in 2027. The Company anticipates South West Arkansas to produce at least 30,000 tonnes per annum of battery-quality lithium hydroxide over a 20-plus year operating life.

Concurrently, the Company is pursuing resource development of other projects in the Smackover Formation in East Texas, as well as approximately 45,000 acres of mineral leases located in the Mojave Desert in San Bernardino County, California.

Standard Lithium is jointly listed on the TSX Venture Exchange and the NYSE American under the trading symbol “SLI”; and on the Frankfurt Stock Exchange under the symbol “S5L”. Please visit the Company’s website at https://www.standardlithium.com.

Investor and Media Inquiries

Allysa Howell

Vice President, Corporate Communications

+1 720 484 1147

a.howell@standardlithium.com

Twitter: @standardlithium

LinkedIn: https://www.linkedin.com/company/standard-lithium/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to intended development timelines, future prices of commodities, accuracy of mineral or resource exploration activity, reserves or resources, regulatory or government requirements or approvals, the reliability of third party information, continued access to mineral properties or infrastructure, fluctuations in the market for lithium and its derivatives, changes in exploration costs and government regulation in Canada and the United States, and other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2a233384-f3e1-4b18-a8d6-8f288e6162a0

https://www.globenewswire.com/NewsRoom/AttachmentNg/d09a6abc-43e0-4a66-91a5-1ea2a18e83cd