Standard Motor Products Inc Reports Mixed 2023 Results Amid Market Softness

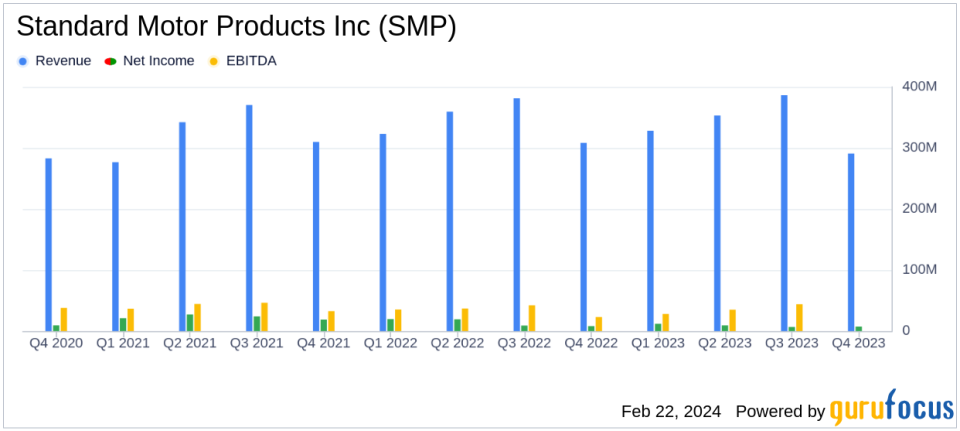

Net Sales: Fourth-quarter net sales decreased to $290.8 million from $308.2 million in the prior year.

Earnings: Earnings from continuing operations for Q4 stood at $7.2 million, down from $8.5 million year-over-year.

Diluted EPS: Q4 diluted EPS from continuing operations fell to $0.32 compared to $0.39 in the same quarter last year.

Annual Performance: Full-year net sales slightly down at $1.36 billion, with earnings from continuing operations at $63.1 million or $2.85 per diluted share.

Debt Reduction: Total debt reduced by $83.6 million in 2023, ending the year with a net leverage ratio of 1.0X.

Adjusted EBITDA: Full-year adjusted EBITDA finished at 9.3%, slightly below the guidance of approximately 9.5%.

On February 22, 2024, Standard Motor Products Inc (NYSE:SMP), a prominent automotive parts manufacturer and distributor, released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, which operates in the automotive aftermarket industry with segments including Engineered Solutions, Vehicle Control, and Temperature Control, saw a year-over-year decline in net sales and earnings, attributing the softer performance to challenges in the aftermarket business and unfavorable weather patterns affecting the Temperature Control segment.

Financial Highlights and Segment Performance

The fourth quarter saw net sales decrease by 5.7% to $290.8 million, with earnings from continuing operations dropping to $7.2 million, or $0.32 per diluted share, compared to $8.5 million, or $0.39 per diluted share in the fourth quarter of 2022. When excluding non-operational gains and losses, earnings from continuing operations were $8.2 million, or $0.37 per diluted share, a significant decrease from $15.1 million, or $0.69 per diluted share in the prior year's quarter.

For the full year, consolidated net sales were $1.36 billion, a slight decrease from $1.37 billion in 2022. The earnings from continuing operations for the year were $63.1 million, or $2.85 per diluted share, down from $73.0 million, or $3.30 per diluted share in the previous year. Adjusted for non-operational items, the full-year earnings from continuing operations were $64.8 million, or $2.92 per diluted share, compared to $79.4 million, or $3.59 per diluted share in 2022.

The Engineered Solutions segment was a bright spot, with sales increasing by 6.7% in the fourth quarter and 4.7% for the year. However, the Vehicle Control segment experienced a 5.9% decline in Q4 sales, and the Temperature Control segment faced a 19.0% decrease in Q4 sales due to weather-related challenges.

Operational and Financial Strategies

Despite the lower sales volumes and the impact on fixed cost leverage, SMP's pricing actions and cost reduction initiatives have begun to offset inflationary pressures. The company also successfully reduced inventory levels and debt, with inventory decreasing to $507.1 million from $528.7 million at the end of 2022, and total debt standing at $156.2 million after paying down $83.6 million during the year.

"Although the economic backdrop and various geopolitical risks may continue to create volatility in 2024, we are confident in the resiliency of our end markets," said Mr. Eric Sills, Standard Motor Products Chairman and Chief Executive Officer. "We are excited about the partial opening of our new distribution center in just a few months and full opening in 2025 that will expand our capacity and provide additional risk avoidance to our overall distribution footprint."

Looking ahead, SMP expects flat to low single-digit sales growth and an Adjusted EBITDA range of 9.0% to 9.5% for 2024. The company also anticipates incurring additional costs related to the expansion of its distribution center and investments in automation capabilities.

Investor Considerations

While SMP's 2023 performance reflects some market softness, the company's strategic initiatives, including debt reduction and inventory management, position it to navigate the expected volatility in 2024. The Engineered Solutions segment's growth and the upcoming distribution center expansion could offer potential for improved operational efficiency and customer service, which are critical factors for value investors considering the long-term prospects of SMP.

For more detailed financial information and to listen to the earnings call, investors can visit SMP's website or dial into the conference call using the provided numbers.

Standard Motor Products' commitment to transparency and strategic planning, despite the challenges faced in 2023, underscores the company's resilience and dedication to delivering value to its shareholders and customers alike.

Explore the complete 8-K earnings release (here) from Standard Motor Products Inc for further details.

This article first appeared on GuruFocus.