Stanley Black (SWK) Q3 Earnings Surpass Estimate, Sales Lag

Stanley Black & Decker, Inc. SWK has reported mixed results for third-quarter 2020, with earnings surpassing estimates by 8.2%. This marked the company’s seventh consecutive quarter of impressive results. However, sales in the quarter lagged estimates by 1.8%.

Earnings, excluding acquisition-related charges and other one-time impacts, were $2.89 per share in the quarter, surpassing the Zacks Consensus Estimate of $2.67. Also, earnings increased 35.7% from the year-ago quarter’s $2.13 per share on the back of improved sales performance, gains from cost-saving measures and lower taxes.

Revenue Details

In the quarter under review, the company’s net sales were $3,850.2 million, reflecting 6% year-over-year growth. The results benefitted from volume increase of 3%, gains from acquired assets of 2% and price contribution of 1%.

However, the company’s top line lagged the Zacks Consensus Estimate of $3,922 million.

Stanley Black reports revenues under three segments. A brief discussion on the quarterly results is provided below:

Tools & Storage’s revenues totaled $2,804.1 million, representing 72.8% of net revenues in the quarter under review. On a year-over-year basis, the segment’s revenues increased 10.7%, driven by 10% gain from volume and 1% from favorable pricing.

Notably, promotional shipments worth $100-$125 million meant for the third quarter shifted to the fourth quarter.

The Industrial segment generated revenues of $586.6 million, accounting for 15.2% of net revenues in the reported quarter. Revenues decreased 7.3% year over year as a 10% gain from the CAM buyout and a 1% positive impact of foreign currency movements were more than offset by an 18% negative impact of volumes.

The Security segment’s revenues, representing 12% of net revenues, decreased 1.5% year over year to $459.5 million. Favorable impacts of 2% from foreign currency movements and 1% from price realization were more than offset by a 4% negative impact from volume decline.

Margin Profile

In the reported quarter, Stanley Black’s cost of sales (normalized) increased 3.3% year over year to $2,466.9 million. It represented 64.1% of the quarter’s net sales versus 65.7% in the year-ago quarter. Gross profit (normalized) increased 11.1% year over year to $1,383.3 million. Gross margin grew 160 basis points (bps) to 35.9%, driven by favorable impacts of productivity, cost-actions, price and volume. However, the pandemic-related costs and higher currency were spoilsports.

Selling, general and administrative expenses declined 2.2% year over year to $702.9 million. It represented 18.3% of net sales in the reported quarter versus 19.8% in the year-ago quarter. Operating profits (normalized) increased 29.4% year over year to $680.4 million, while margin increased 320 bps to 17.7%.

The company noted that operating margin in the quarter gained from price realized, cost-control measures, volume leverage and other actions.

Adjusted tax rate in the reported quarter was 17.8% compared with the year-ago quarter figure of 21.5%.

Balance Sheet & Cash Flow

Exiting the third quarter of 2020, Stanley Black had cash and cash equivalents of $683 million, declining 20.6% from $859.8 million recorded in the last reported quarter. Long-term debt (net of current portions) at $4,658.5 million was flat sequentially.

In the third quarter, it generated net cash of $677.2 million from operating activities, reflecting an increase from $192.7 million generated in the year-ago quarter. Capital spending totaled $62.1 million versus $96.7 million in the year-ago quarter. Free cash flow in the quarter was $615.1 million, up from $96 million in the year-ago quarter.

During the quarter, Stanley Black paid out cash dividends of $109.6 million, up 7.1% from the year-ago quarter.

Outlook

For 2020, the company refrained from reinstating its financial projections due to the uncertainties related to the coronavirus outbreak. Notably, it suspended its 2020-projections in April this year.

Also, it noted that the safety of its supply-chain partners and workers along with the continuity of businesses remains the top priority. Further, it is progressing well on its cost-reduction program of $1 billion (announced in April 2020). Savings of $500 million — including $175 million achieved in the second quarter and $175 in the third quarter — are expected to be realized from this program in 2020.

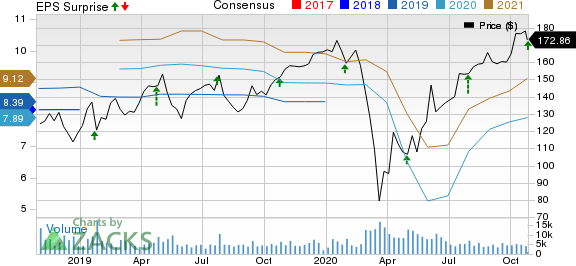

Stanley Black Decker, Inc. Price, Consensus and EPS Surprise

Stanley Black Decker, Inc. price-consensus-eps-surprise-chart | Stanley Black Decker, Inc. Quote

Zacks Rank & Other Stocks to Consider

With a market capitalization of $28.4 billion, Stanley Black currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Zacks Industrial Products sector are EnPro Industries, Inc. NPO, Kaman Corporation KAMN and Kennametal Inc. KMT. While both EnPro Industries and Kaman sport a Zacks Rank #1 (Strong Buy), Kennametal carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for Kaman and Kennametal improved for the current year, while the same has been stable for EnPro. Further, earnings surprise for the last reported quarter was 980.00% for EnPro, 71.43% for Kaman and 25.00% for Kennametal.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stanley Black Decker, Inc. (SWK) : Free Stock Analysis Report

Kaman Corporation (KAMN) : Free Stock Analysis Report

EnPro Industries (NPO) : Free Stock Analysis Report

Kennametal Inc. (KMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.