STATE STREET CORP Adjusts Position in New Jersey Resources Corp

STATE STREET CORP (Trades, Portfolio), a prominent investment firm, has recently made a significant adjustment to its holdings in New Jersey Resources Corp (NYSE:NJR). On October 31, 2023, the firm reduced its stake in NJR by 3,382,019 shares, resulting in a 39.54% change in its holdings. This transaction had a minor impact of -0.01% on the firm's portfolio, with the trade executed at a price of $40.58 per share. Following the trade, STATE STREET CORP (Trades, Portfolio)'s total share count in NJR stands at 5,170,680, representing a 5.30% position in the company.

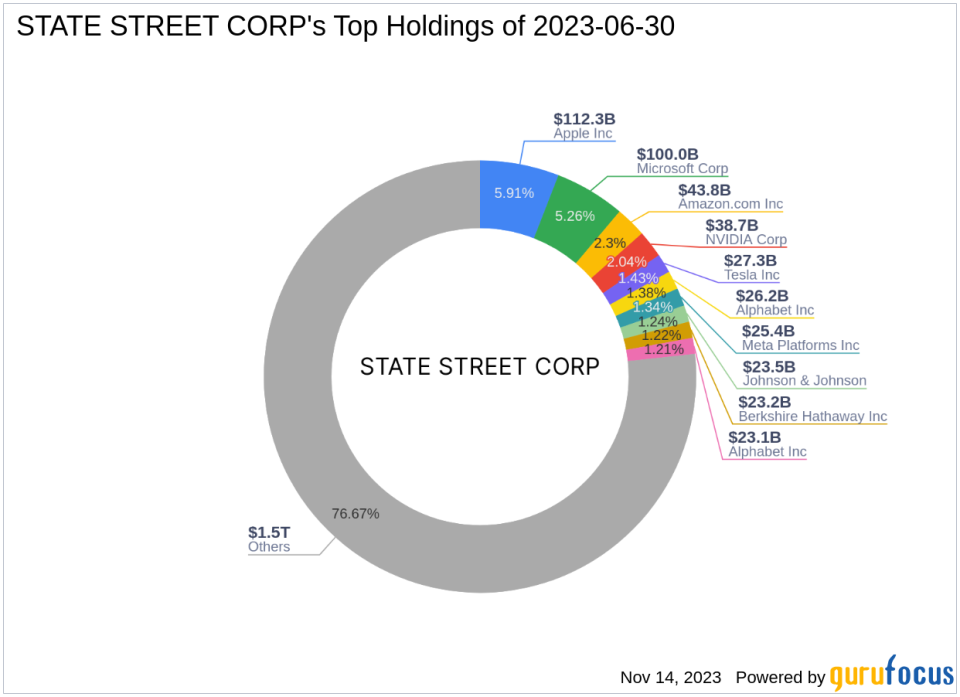

Profile of STATE STREET CORP (Trades, Portfolio)

STATE STREET CORP (Trades, Portfolio), based in Boston, MA, is a well-established investment firm with a focus on delivering long-term value. The firm's investment philosophy emphasizes strategic asset allocation and a disciplined investment approach. With a vast portfolio of 4,478 stocks, STATE STREET CORP (Trades, Portfolio)'s equity amounts to an impressive $1.9 trillion. The firm's top holdings include major players in the technology and healthcare sectors, such as Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA).

Overview of New Jersey Resources Corp

New Jersey Resources Corp, trading under the symbol NJR, is a USA-based energy services holding company with a history dating back to its IPO on July 21, 1982. NJR's business encompasses regulated and nonregulated operations, including its regulated utility, New Jersey Natural Gas, which serves over 570,000 customers. The company's market capitalization stands at $4.18 billion, with a current stock price of $42.89. NJR is considered modestly undervalued with a GF Value of $52.17 and a price to GF Value ratio of 0.82. The stock has experienced a gain of 5.69% since the trade date and has seen a substantial increase of 2,169.31% since its IPO. However, its year-to-date performance reflects a decline of 12.81%.

Financial Health and Market Performance of NJR

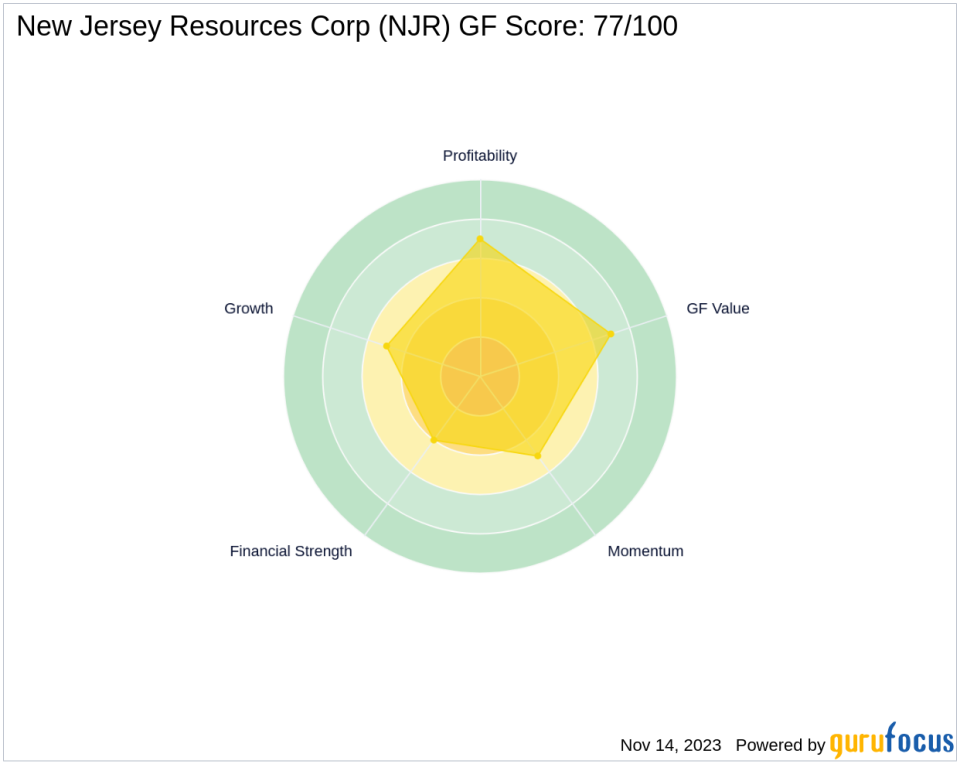

NJR's financial health is reflected in its Financial Strength rank of 4/10 and a Profitability Rank of 7/10. The company's GF Score stands at 77/100, indicating a strong potential for future performance. NJR's industry-specific metrics, such as an interest coverage of 3.66 and a return on equity (ROE) of 14.85%, further demonstrate its solid standing within the Utilities - Regulated industry.

Comparative Historical and Growth Data

Historically, NJR has shown a consistent growth trajectory with a revenue growth over three years of 1.40% and an EBITDA growth of 26.30%. The company's earning growth for the same period stands at 27.30%, underscoring its ability to increase profitability over time.

Technical Analysis and Momentum Indicators

Technical indicators such as the Relative Strength Index (RSI) and Momentum Index provide insights into NJR's stock momentum. The RSI over a 14-day period is 43.58, while the 6-month Momentum Index is -16.33, suggesting a potential shift in market sentiment or trading momentum.

Implications of STATE STREET CORP (Trades, Portfolio)'s Trade Decision

The decision by STATE STREET CORP (Trades, Portfolio) to reduce its position in NJR aligns with its strategic investment approach and may reflect a rebalancing of its portfolio in response to market conditions or internal targets. This trade, while having a minimal impact on the firm's overall portfolio, could signal the firm's evolving perspective on NJR's future growth prospects and its place within the broader market landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.