STATE STREET CORP Reduces Stake in SJW Group

On July 31, 2023, Boston-based investment firm STATE STREET CORP (Trades, Portfolio) reduced its holdings in SJW Group (NYSE:SJW), a leading water utility services company. The firm sold 1,649,483 shares at a price of $70.46 per share, reducing its total holdings to 1,661,571 shares. This transaction had a minor impact on the firm's portfolio, decreasing its position by 0.01%. Despite the reduction, STATE STREET CORP (Trades, Portfolio) still holds a significant 5.23% stake in SJW Group.

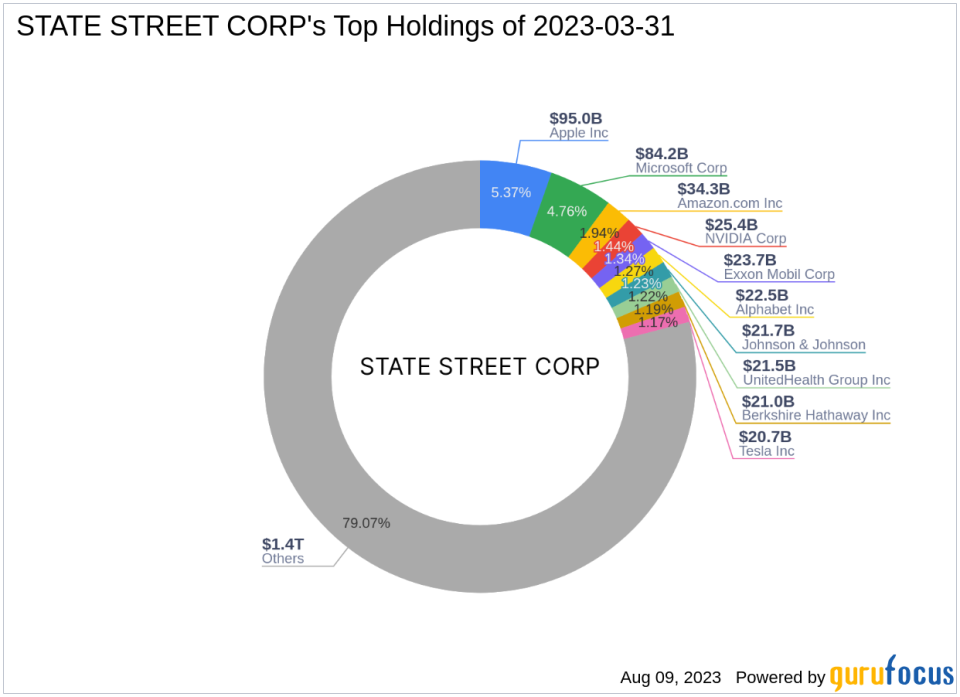

Profile of STATE STREET CORP (Trades, Portfolio)

STATE STREET CORP (Trades, Portfolio), located at ONE LINCOLN STREET, BOSTON, MA, is a renowned investment firm with a diverse portfolio of 4,579 stocks. The firm's top holdings include tech giants like Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Exxon Mobil Corp (NYSE:XOM). The firm's equity stands at a staggering $1,769.19 trillion, with a significant focus on the Technology and Healthcare sectors.

Overview of SJW Group

SJW Group, listed under the symbol SJW, is a U.S.-based water utility services holding company. The company, which went public on June 1, 1972, primarily operates in various California municipalities and has operations in other states. Its business segments include Water Utility Services and Real Estate Services. As of August 10, 2023, the company's market capitalization stands at $2.21 billion.

Performance of SJW Group's Stock

As of the date of this article, SJW Group's stock is trading at $69.55, with a PE percentage of 24.32. According to GuruFocus's valuation, the stock is fairly valued with a GF Value of $71.78. Since its IPO, the stock has seen a massive increase of 4,797.89%. However, the stock has experienced a slight decrease of 1.29% since the transaction and a year-to-date decrease of 15.42%.

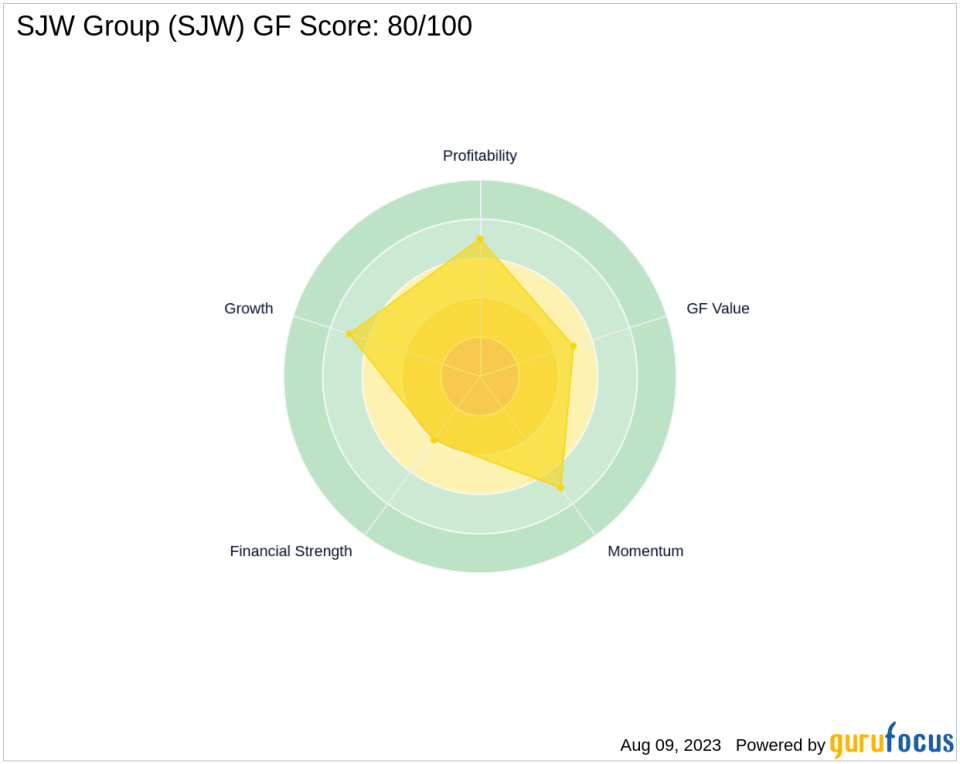

Evaluation of SJW Group's Financial Health

SJW Group has a GF Score of 80/100, indicating good future performance potential. The company's financial strength is rated 4/10, while its profitability rank and growth rank are both 7/10. The company's interest coverage is 2.31, and it has a cash to debt ratio of 0.02. The company's Piotroski F-Score is 7, indicating a healthy financial situation.

Comparison with Other Gurus

Other notable gurus who hold shares in SJW Group include Joel Greenblatt (Trades, Portfolio). However, the largest guru stake in SJW Group is held by GAMCO Investors.

Conclusion

In conclusion, STATE STREET CORP (Trades, Portfolio)'s recent transaction in SJW Group is a strategic move that aligns with its investment philosophy. Despite the reduction, the firm still holds a significant stake in the company. With SJW Group's strong financial health and potential for future performance, this transaction is worth noting for value investors.

This article first appeared on GuruFocus.