STATE STREET CORP Reduces Stake in Nu Skin Enterprises Inc

On July 31, 2023, Boston-based investment firm STATE STREET CORP (Trades, Portfolio) significantly reduced its holdings in Nu Skin Enterprises Inc (NYSE:NUS), a move that has attracted the attention of value investors. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded stock, and the potential implications for the market.

Overview of the Transaction

STATE STREET CORP (Trades, Portfolio), a firm with a portfolio of 4579 stocks and an equity of $1,769.19 trillion, sold 7,244,179 shares of Nu Skin Enterprises Inc at a price of $29.39 per share. This transaction reduced the firm's total holdings in the company to 3,052,556 shares, representing a 70.35% decrease. Despite this significant reduction, Nu Skin Enterprises Inc still accounts for 0.01% of STATE STREET CORP (Trades, Portfolio)'s portfolio and the firm remains a 6.11% shareholder in the company.

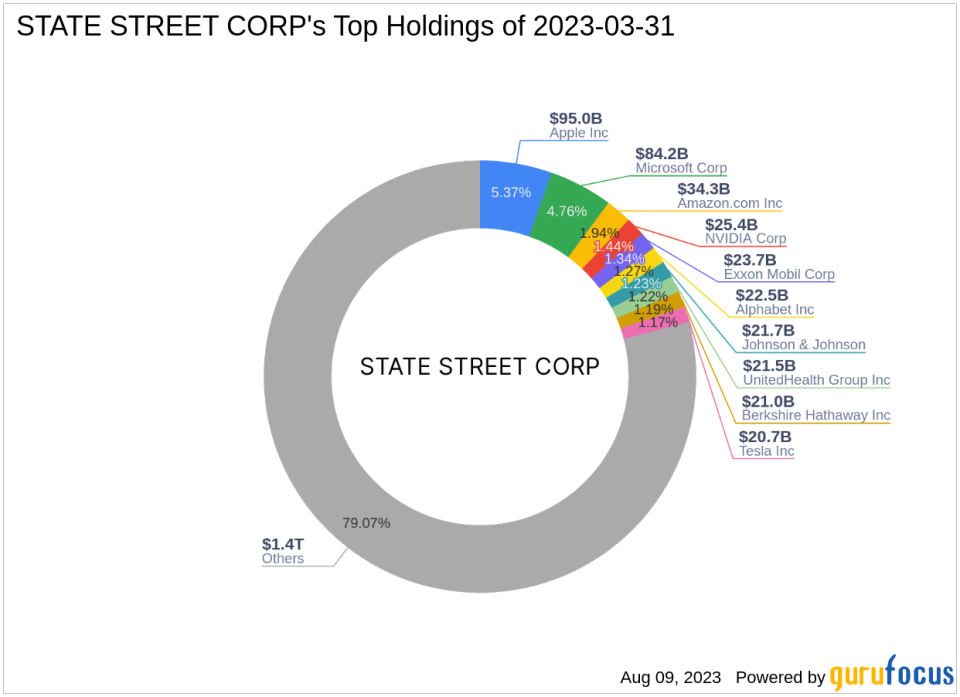

STATE STREET CORP (Trades, Portfolio)'s Investment Philosophy and Portfolio

STATE STREET CORP (Trades, Portfolio) is a renowned investment firm based in Boston, Massachusetts. The firm's top holdings include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Exxon Mobil Corp (NYSE:XOM). The firm's portfolio is heavily concentrated in the Technology and Healthcare sectors.

Detailed Analysis of the Traded Stock: Nu Skin Enterprises Inc

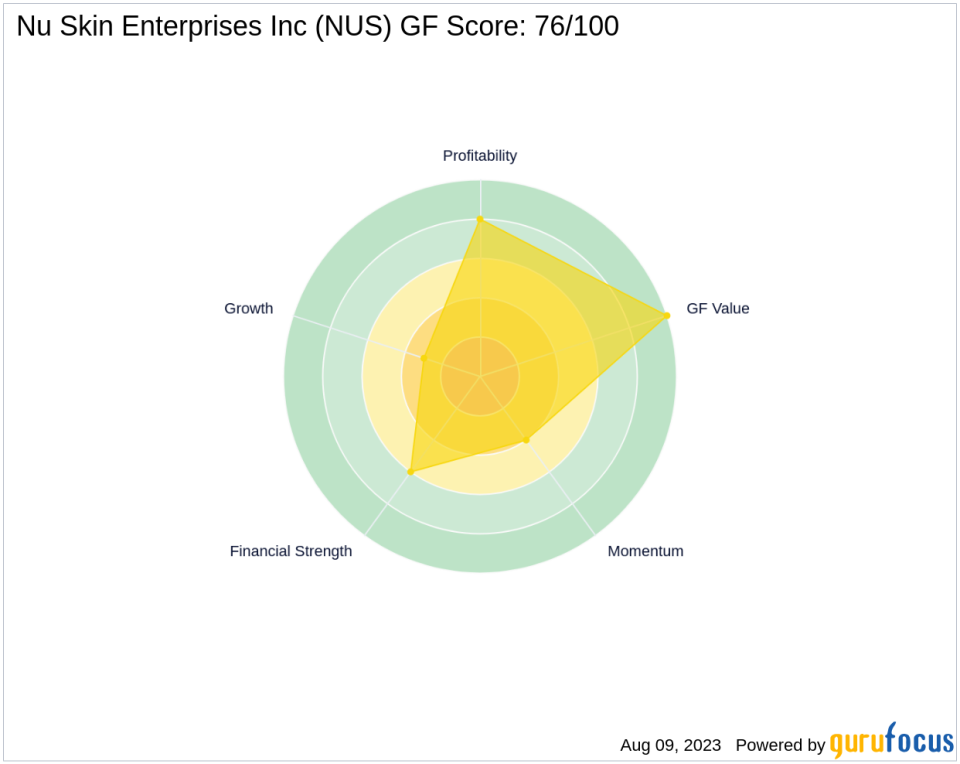

Nu Skin Enterprises Inc, a health and beauty direct-selling company based in the USA, operates in more than 50 countries across the Americas, Europe, and the Asia-Pacific. The company's business segments include Beauty, Other, Wellness, Nu Skin, and Rhyz Investments. As of August 10, 2023, the company has a market cap of $1.26 billion and a stock price of $25.26. The company's GF-Score is 76/100, indicating a good outperformance potential.

The company's Financial Strength is ranked 6/10, with a cash to debt ratio of 0.43. Its Profitability Rank is 8/10, with a return on equity (ROE) of 7.84% and a return on assets (ROA) of 3.81%. However, the company's Growth Rank is only 3/10, indicating a relatively slow growth rate.

Stock's Performance in the Industry

Nu Skin Enterprises Inc operates in the Consumer Packaged Goods industry. The company's gross margin growth is -1.40%, and its operating margin growth is -8.20%. The company's revenue growth over the past three years is 0.60%, while its EBITDA growth over the same period is -9.30%. The company's earnings growth over the past three years is -12.60%.

Other Gurus' Involvement in the Stock

Hotchkis & Wiley Capital Management LLC is the largest guru shareholder of Nu Skin Enterprises Inc. Other gurus who also hold the traded stock include Keeley-Teton Advisors, LLC (Trades, Portfolio), and Jefferies Group (Trades, Portfolio).

Conclusion

In conclusion, STATE STREET CORP (Trades, Portfolio)'s decision to significantly reduce its stake in Nu Skin Enterprises Inc is a notable move that could have implications for the market. While the company has a good profitability rank and a decent GF-Score, its growth rank is relatively low. Therefore, value investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.