State Street Corporation (STT) Reports Mixed Fourth Quarter 2023 Results Amid Market Challenges

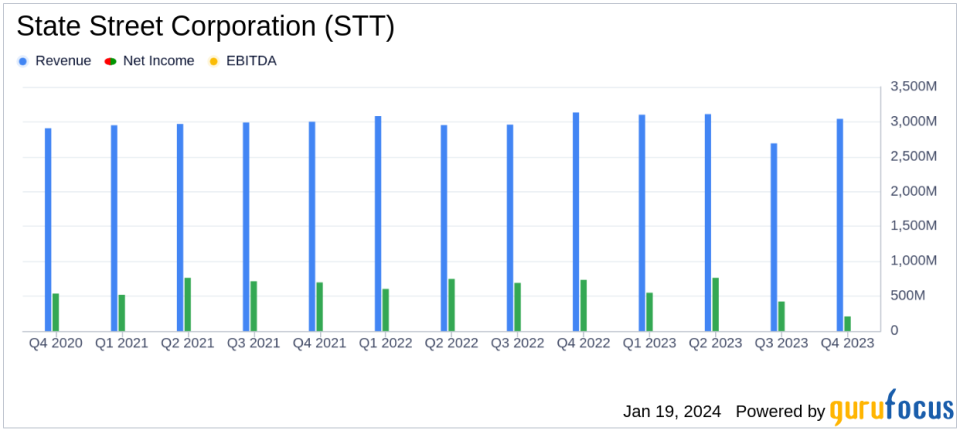

Revenue: Total revenue decreased by 4% YoY to $3.043 billion.

Net Income: Reported net income of $210 million, a 71% decrease YoY.

Earnings Per Share (EPS): Diluted EPS of $0.55, down 71% YoY.

Assets Under Custody and Administration (AUC/A): Increased 14% YoY to $41.8 trillion.

Assets Under Management (AUM): Grew 19% YoY to $4.1 trillion.

Share Repurchase: Announced new authorization to repurchase up to $5 billion of common shares.

On January 19, 2024, State Street Corporation (NYSE:STT) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a leading provider of financial services, including investment servicing, investment management, and investment research and trading, reported a decrease in total revenue and net income compared to the same quarter last year. Despite these challenges, State Street saw a significant increase in assets under custody and administration as well as assets under management, indicating continued business growth in these areas.

Performance and Challenges

State Street's performance in the fourth quarter reflects a mixed financial picture. While the company achieved growth in AUC/A and AUM, total revenue saw a slight decrease, and net income significantly declined year-over-year. The diluted earnings per share also dropped by 71% compared to the fourth quarter of 2022. These results highlight the unpredictable operating environment and the impact of strategic actions taken by the company to transform its operating model and enhance productivity.

Financial Achievements and Industry Impact

The increase in AUC/A and AUM is a notable achievement for State Street, as it demonstrates the company's ability to attract and manage significant new investment mandates, which is crucial in the asset management industry. The record total net inflows in Global Advisors, particularly in ETFs and Cash franchises, underscore the company's strength in these areas. Additionally, the new authorization to repurchase up to $5 billion of common shares reflects confidence in the company's earnings-generating power and commitment to delivering shareholder value.

Financial Highlights and Key Metrics

State Street's financial highlights for the fourth quarter include a 1% increase in servicing fees and a 5% increase in management fees, indicating resilience in core business operations. However, net interest income declined by 14% year-over-year, primarily due to lower average non-interest-bearing deposit balances and a deposit mix shift. The company's return on average common equity (ROE) and pre-tax margin also experienced significant declines, which are important metrics that reflect the company's profitability and operational efficiency.

"Over the course of 2023, we navigated an unpredictable operating environment and continued to execute on our strategy to drive sales growth while taking strategic actions to transform our operating model and further enhance productivity," said Ron O'Hanley, Chairman and Chief Executive Officer of State Street.

Analysis of Company Performance

The fourth quarter results suggest that while State Street is facing challenges in the current financial landscape, the company is also making strategic moves to position itself for future growth. The growth in AUC/A and AUM, along with the strong inflows into Global Advisors, indicate that State Street remains a competitive force in the asset management sector. However, the decline in net income and EPS highlights the need for the company to continue its focus on operational efficiency and cost management.

State Street's performance in the fourth quarter of 2023 presents a complex picture for investors. While there are clear areas of strength, particularly in asset servicing and management, the company must also address the challenges that have impacted its revenue and net income. Value investors and potential GuruFocus.com members should consider both the opportunities and risks presented by State Street's current financial position and strategic initiatives.

For more detailed information and analysis, investors are encouraged to review the full earnings report and consider the company's prospects in the context of the broader financial services industry.

Explore the complete 8-K earnings release (here) from State Street Corporation for further details.

This article first appeared on GuruFocus.